Blackstone Inc. has reported a 49% increase in net income for the fourth quarter (Q4) of 2025 to cap off a record year for the world’s largest alternative asset manager.

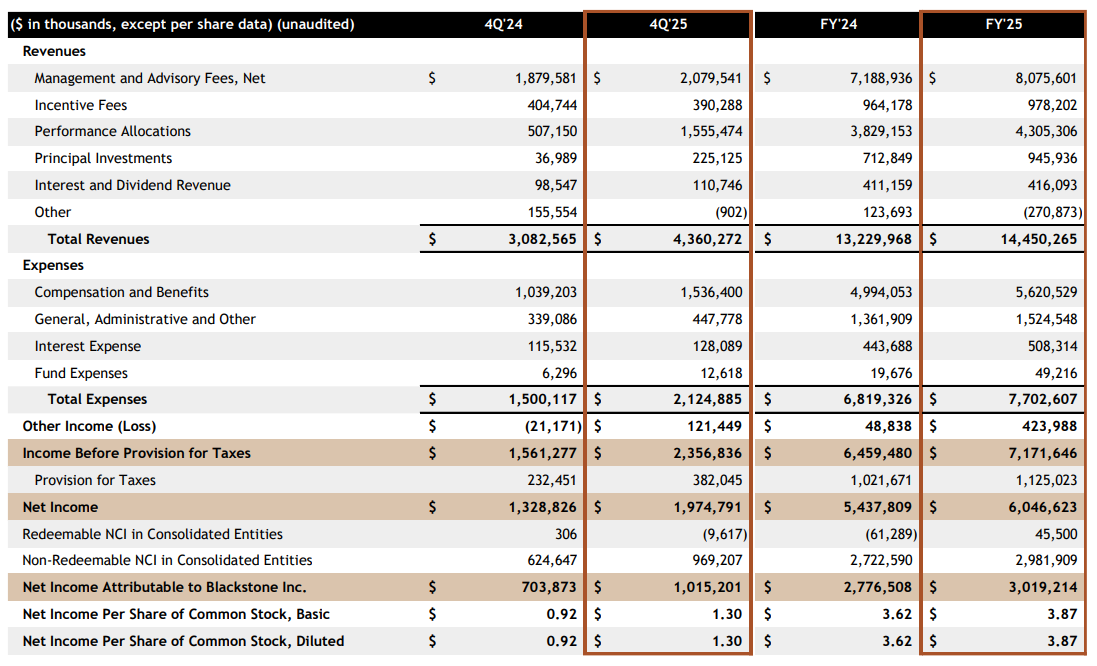

The New York-based firm said net income was US$1.97 billion (A$2.82 billion) in the three months ended 31 December 2025 compared with $1.33 billion in the previous corresponding period (pcp).

Diluted earnings per share (EPS) climbed 41% to $1.30 on revenue, which increased 91% to $4.36 billion over the quarter.

For 2025, net income rose 11% to $6.05 billion and diluted EPS gained 7% to $3.87 as revenue increased 9% to $14.45 billion, which was the best result in the firm’s 40-year history.

Assets under management rose 13% to $1.27 trillion at 31 December.

“Blackstone’s extraordinary fourth-quarter results capped a record year for the firm,” Chairman and Chief Executive Officer Stephen Schwarzman said in a press release.

“Our focus on investing at massive scale in the buildout of digital and energy infrastructure continues to create significant value for our investors.”

He said inflows reached $71 billion in Q4, the highest level in three and a half years, and about $240 billion for the full year, reflecting robust momentum across the institutional wealth and insurance channels.

The firm generated an “outstanding” investment performance for its limited partners in 2025, highlighted by strength in infrastructure, corporate private equity and the multi-asset investing business, BXMA.

“We achieved these results amid the turbulent year for markets which was impacted by tariff uncertainty, geopolitical instability, longest government shutdown in US history,” Schwarzman said on a conference call.

Distributable earnings rose 3% to $2.169 billion in Q4 and 19% to $7.11 billion in 2025, equating to EPS of $1.75 and $5.57, respectively, which surpassed analyst expectations of $1.54 and $5.35.

But Blackstone shares (NYSE: BX) weakened, trading $4.14 (2.82%) lower at $142.65 on Thursday (Friday AEDT), capitalising the company at $430.47 billion, at the time of writing.