Blackstone Inc. has reported a 20% fall in net income for the third quarter of the 2025 financial year (Q3 FY25).

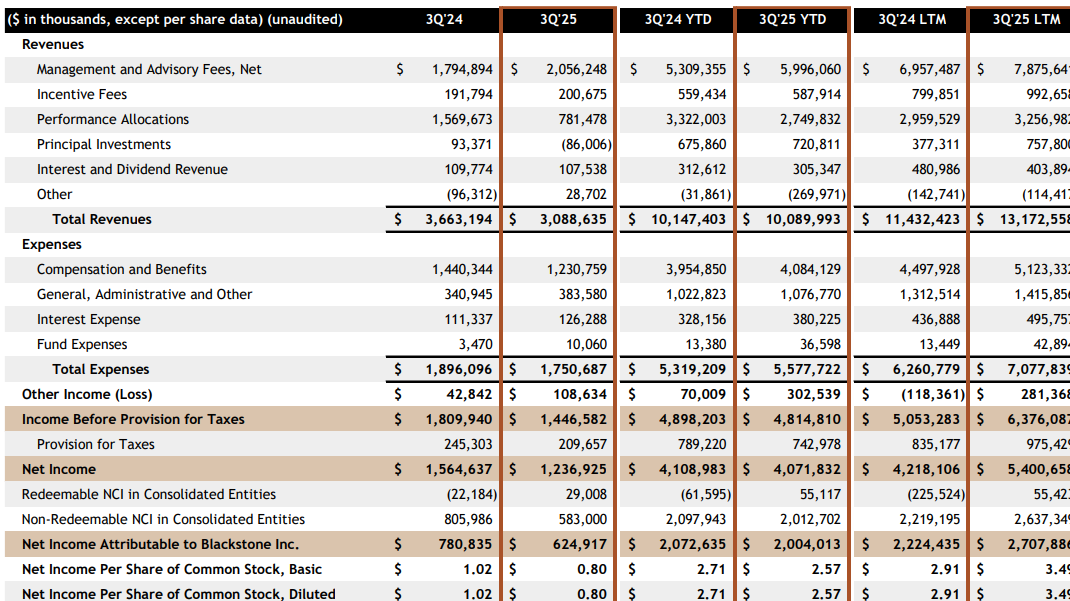

The world’s largest alternative asset manager said net income was US$624.917 million in the three months ended 30 September compared with $780.835 million in the previous corresponding period.

Diluted earnings per share (EPS) fell 22% to 80 cents on revenue, which dropped 16% to $3.088 billion, but distributable earnings, which are available as cash to pay shareholders, surged 42% to $1.889 billion.

In the nine months to 30 September, net income fell 3% to $2.004 billion and EPS dropped 5% to $2.57 on revenue, which was 0.5% down at $10.089 billion, but distributable earnings gained 28% to $4.866 billion.

“Blackstone reported an exceptional third quarter, highlighted by outstanding financial results and robust fund-raising momentum across our three major channels – institutions, insurance and individuals,” Chairman and Chief Executive Officer Stephen A. Schwarzman said in a press release.

Inflows reached $54 billion in the quarter and $225 billion over the last twelve months.

“The leading platforms we’ve established in key growth areas, such as digital and energy infrastructure, are helping power investment performance for our clients and position us extraordinarily well for the future,” he said.

Analysts had expected $1.23 of distributable earnings per share compared with the $1.52 reported, according to estimates compiled by LSEG.

Blackstone shares (NYSE: BX) closed $6.74 (4.17%) lower at $154.98 on Thursday (Friday AEDT), capitalising the company at $183.6 billion, before rising to $155 in after-market trading.