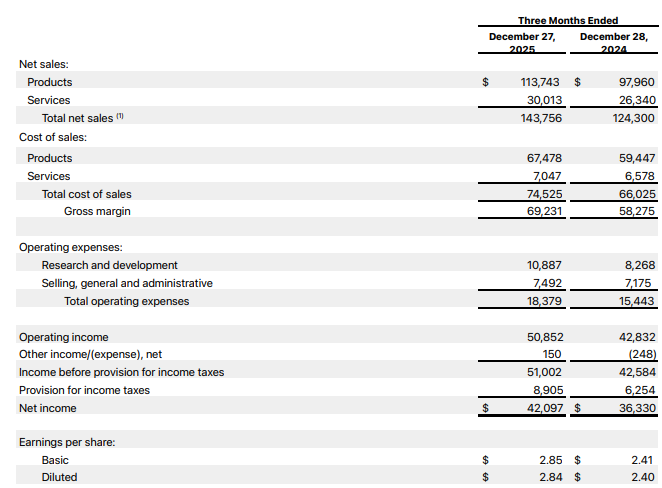

Apple described demand for its iPhone as staggering as it unveiled record profits for the first quarter of the 2026 financial year (Q1 FY26) , which also exceeded market expectations.

The technology giant said net income climbed 16% to $42.097 billion (A$60.2 billion) and diluted earnings per share (EPS) surged 19% to $2.84 on revenue, which grew 5% to $95.4 billion in the three months ended 27 December 2025.

“I’m proud to say we just had a quarter for the record books,” CEO Tim Cook said on a conference call.

“The demand for iPhone was simply staggering, with revenue growing 23% year over year and all-time records across every geographic segment services…”

The company said revenue was well above Apple’s expectations, helped by the iPhone’s best quarter and 14% growth from its Services business, which includes everything except its devices like the iPhone, Mac, iPad, Apple Watch and AirPods.

The company’s installed base was more than 2.5 billion active devices.

“These exceptionally strong results generated nearly $54 billion in operating cash flow, allowing us to return almost $32 billion to shareholders,” Chief Financial Officer Kevan Parekh said in a news release.

Directors declared a cash dividend of 26 cents per share on common stock, payable on 12 February to shareholders on record at the close of business on 9 February.

Quarterly revenue beat analysts' average estimate of $138.48 billion, while EPS was well ahead of the $2.67 consensus estimate.

Before the results, Apple shares (NASDAQ: AAPL) had closed $1.84 (0.72%) higher at $258.28, capitalising the company at $3.80 trillion, before rising 1.2% to $261.49 in after-hours trading following the announcement.