Lendlease Group reported solid first-half results for FY25 on Monday as the company made progress in strategic initiatives amid improved operational efficiency.

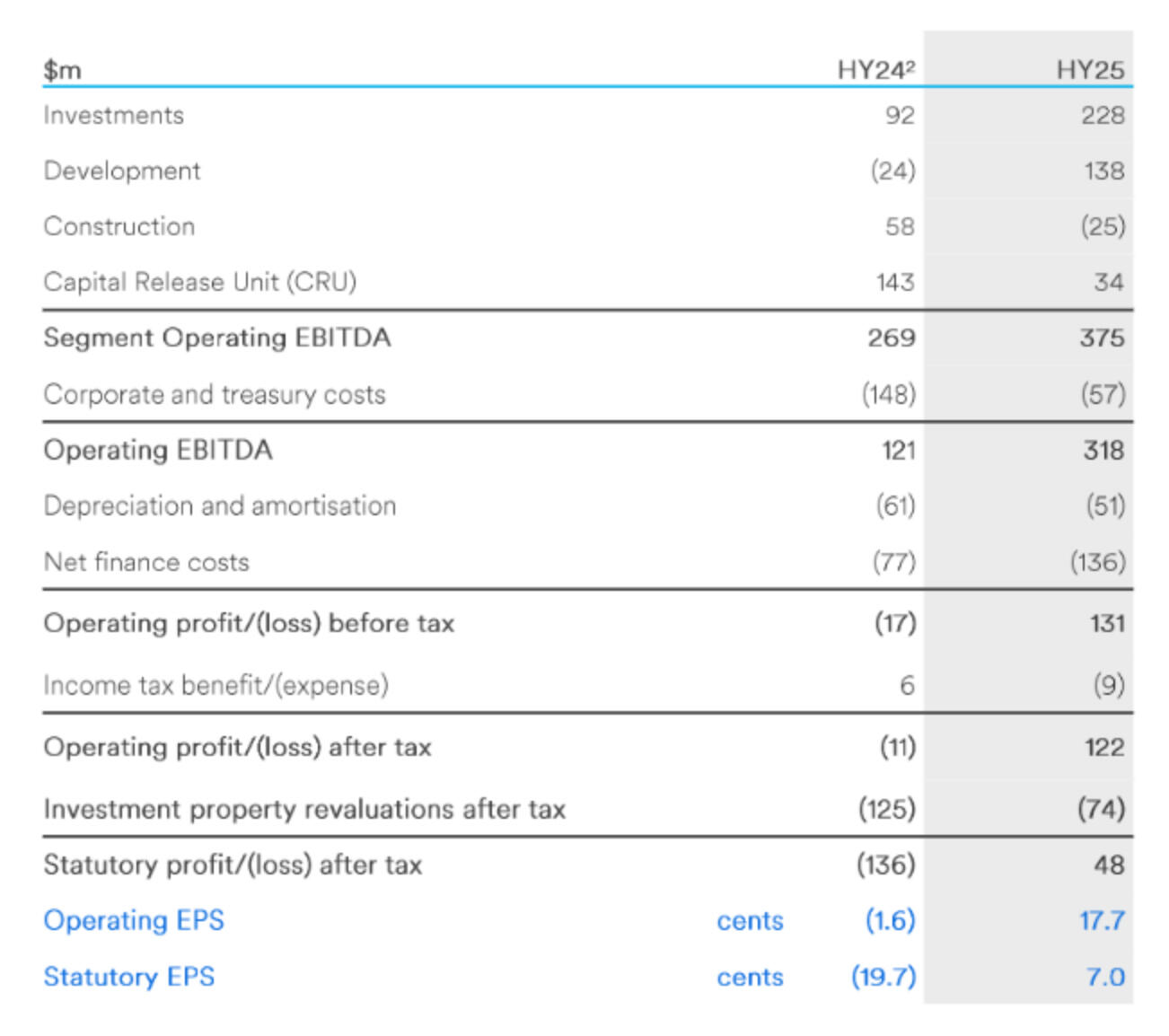

Statutory profit after tax came in at $48 million, reversing a statutory loss of $136 million in the prior corresponding period.

The company reported an Investment, Development, and Construction (IDC) segment EBITDA of $341 million, representing a 171% increase.

Operating profit after tax (OPAT) rose to $122 million, up by $133 million, while operating earnings per security reached 17.7 cents.

In the Investments segment, segment operating EBITDA rose 148% to $228 million, driven by the formation of the Vita Partners Life Sciences joint venture.

Funds under management grew by 3% to $49.6 billion, supported by $0.9 billion in new additions from development projects.

Management EBITDA increased by 7% to $49 million, benefiting from reduced expenses following the removal of regional management structures.

This improvement outweighed the impact of lower fee revenue, driving the management EBITDA margin up to 44.1% from 37.1%.

The Development segment saw a significant turnaround, with operating EBITDA increasing by $162 million to reach $138 million. A key contributor was the successful settlement of Residences Two at One Sydney Harbour.

In the Construction segment, revenues declined from $1.9 billion to $1.5 billion due to the completion of major projects in FY24 and delays in commencing new preferred projects.

Segment operating EBITDA fell by $83 million to negative $25 million, primarily due to losses on two projects affected by construction cost inflation, subcontractor insolvencies, and productivity challenges.

The company is actively pursuing recoveries that have not yet been factored into these results.

Lendlease also noted its progress on strategic initiatives since unveiling its May 2024 strategy.

The company has completed or announced $2.2 billion in capital recycling transactions and remains on track to achieve $2.8 billion in FY25, with additional deals under negotiation.

It has finalised the sale of its U.K. construction business, marking its complete exit from international construction.

The transaction, effective 31 December 2024, accelerates Lendlease’s exit from international construction operations, achieving the milestone well ahead of the 18-month timeline initially announced.

This move aligns with the company’s strategy to simplify its business model and focus on expanding its Australian operations and international Investments platform.

Under the terms of the sale, Lendlease will receive £35 million (A$70 million) in cash consideration, with £10 million ($20 million) deferred until June 2026, subject to completion adjustments.

The transaction follows the recent sale of its U.S. East Coast construction operations and further streamlines the company’s focus on core growth areas.

Chief Executive Officer Tony Lombardo stated: “Our results for 1H25 reflect significant progress in-line with our strategy announced last year, as well as a return to statutory profit. We continue to move at pace to simplify the Group and focus on improving our operational performance.

“Our priorities remain strengthening our balance sheet, returning capital to securityholders and redeploying capital to grow future earnings.”

Looking ahead, Lendlease remains focused on enhancing the performance of its Investments, Development, and Construction segments. The Capital Release Unit (CRU) will continue accelerating capital release initiatives, with earnings per security for FY25 projected to remain in the range of 54 to 62 cents.

This includes approximately 18 cents secured in 1H25 and an anticipated 36 to 44 cents in 2H25.

As part of its capital management strategy, the company plans to announce a securities buyback in line with the guidelines set out in its May 2024 strategy update.

At the time of writing, Lendlease Group (ASX: LLC) stock was trading at A$6.74, up 1.7% from Thursday's close of $6.63. The stock reached a day low of $6.66 and a day high of $6.80. Lendlease Group's market cap stands at $4.61 billion.