Bendigo and Adelaide Bank Limited announced its financial results for the half year ended 31 December 2024.

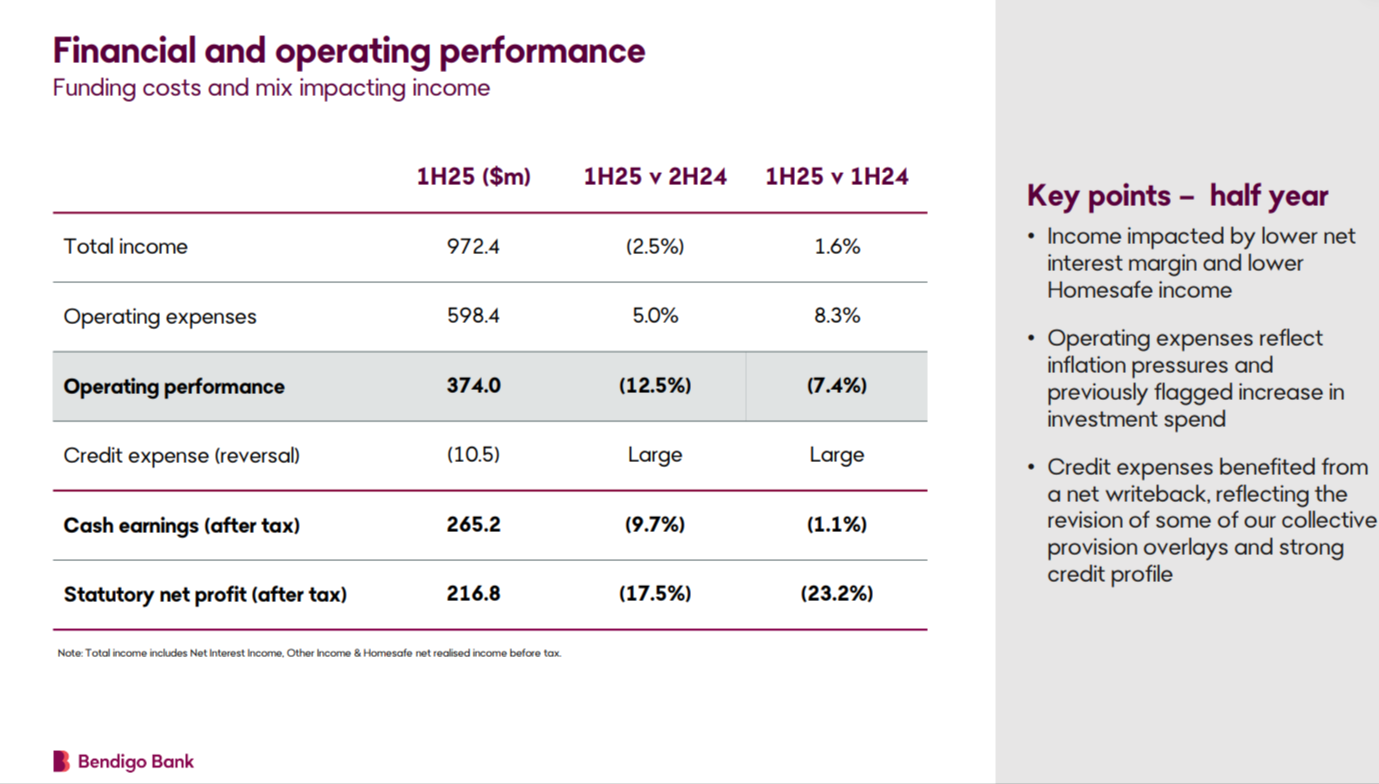

The bank reported cash earnings of $265.2 million and a statutory net profit after tax of $216.8 million.

This represents a decline of 1.1% in cash earnings in comparison to the prior comparative period and a 9.7% decrease compared to the previous half.

Richard Fennell, CEO and Managing Director, noted, "We have experienced significantly increased demand for both lending and deposit products from our customers, which has led to the strongest balance sheet growth we have experienced in some years. However, our earnings have been challenged both on the income and expense lines."

The bank's balance sheet showed strong growth with residential lending increasing by 5.3% to $65.2 billion and customer deposits rising by 5.4% to $72.0 billion.

Despite these positive developments, the bank faced challenges with its net interest margin (NIM) decreasing by 6 basis points to 1.88%, impacted by higher cost deposits and increased wholesale funding costs. The Common Equity Tier 1 ratio remained strong at 11.17%, above the Board-approved target.

Operating expenses increased by 5%, driven by higher investment spending and technology inflationary pressures. The cost to income ratio also rose by 430 basis points to 61.5%.

Fennell highlighted the importance of the bank's transformation program in achieving long-term goals, stating, "We remain committed to disciplined investment as we continue to progress through our multi-year transformation program. This will allow us to achieve the scale necessary to compete effectively and deliver increased value to our shareholders."

Customer growth remained robust, with bank customer numbers increasing by 4.9% to 2.7 million. Bendigo Bank's Net Promoter Score (NPS) of +22.0 was significantly higher than the industry average. Additionally, the bank's digital bank Up reached a milestone of 1 million customers, boasting an exceptional NPS of +58.4. These figures reflect the bank's strong customer satisfaction and continued growth in the digital banking sector.

Despite positive customer and balance sheet growth, the bank faced challenges with impaired loans and increased operating costs.

Gross impaired loans decreased by 6.1% to $127.4 million, while a net write-back of $10.5 million was recorded, primarily in collective provision. Operating expenses increased due to wage inflation, new digital assets, and higher amortisation charges.

However, productivity benefits of $6.2 million were realised, contributing to a 1.1% reduction in cost growth.

The Board declared a stable half-year dividend of 30 cents per share, reflecting a payout ratio of 64% based on cash earnings, balancing strategic investments with shareholder returns.

At the time of writing, Bendigo and Adelaide Bank Limited's (ASX: BEN) share price was $13.42, with a market capitalisation of approximately $7.62 billion.

Related content