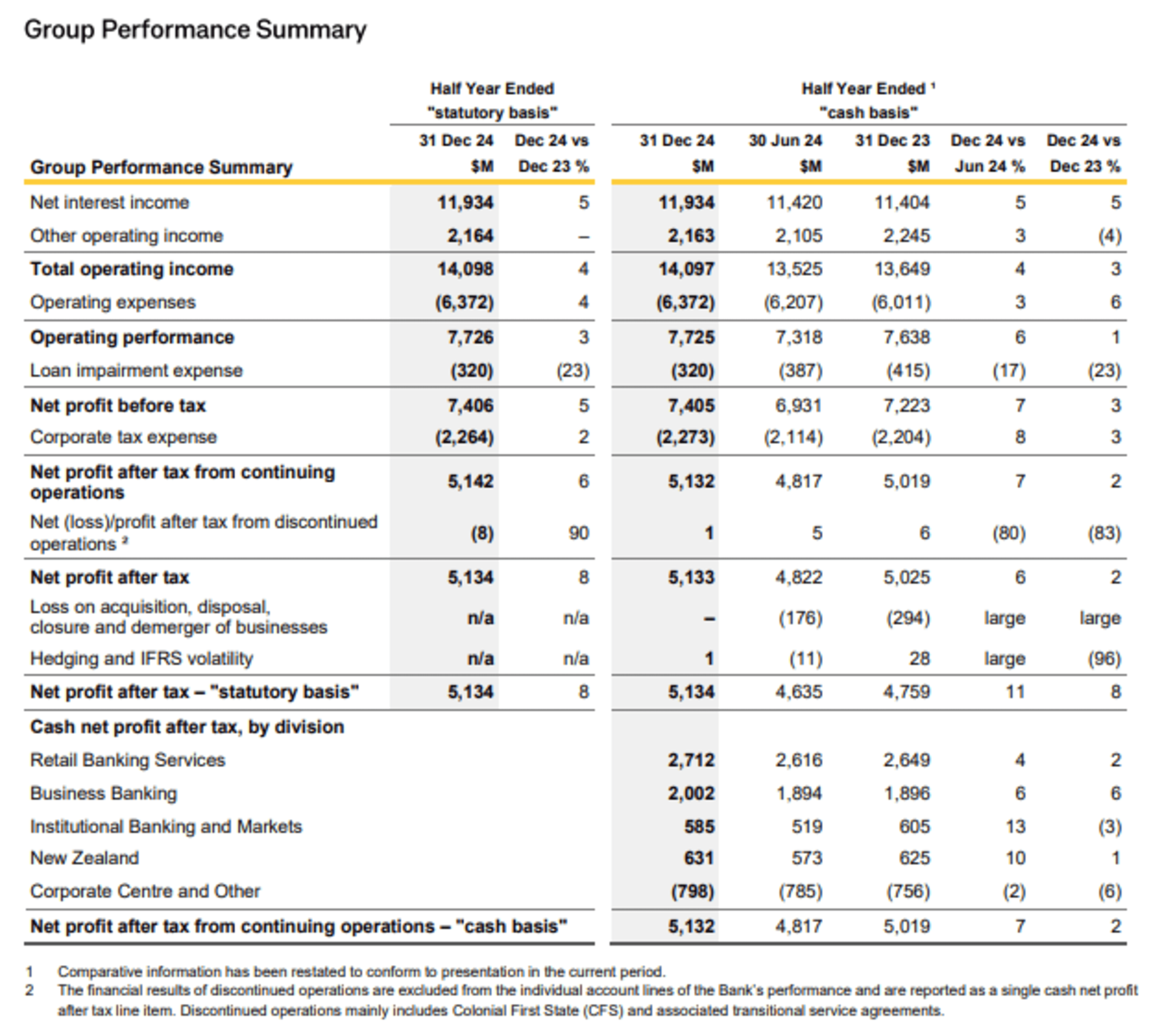

Australia’s largest bank, Commonwealth Bank of Australia (CBA), has reported a 2% increase in half-year cash net profit to A$5.13 billion.

CBA said statutory net profit after tax (NPAT) rose 6% to $5.14 billion on revenue which increased 4% to $14.098 billion in the six months to 31 December 2024.

CBA said NPAT was supported by volume growth in its core businesses and a lower impairment expense, partly offset by higher operating expenses due to continued inflationary pressures and a discretionary increase in franchise investment spending.

The bank declared an interim fully franked dividend of $2.25 per share, up 5% on the previous corresponding period, to be paid on 28 March to shareholders on record on 20 February.

“Through supporting our customers and investing in our franchise we have been able to deliver solid results for our shareholders despite the weaker economic backdrop.” Chief Executive Officer Matt Comyn said in a media release.

“Our consistent financial performance demonstrates our disciplined operational and strategic execution, and the bank's deep customer relationships that help us understand needs and risks and deliver superior digital experiences.”

Net interest margin expanded by two basis points year-on-year on an underlying basis to 2.08% as the effects of competitive pressures on deposits and lending were offset by higher earnings on capital hedges and the replicating portfolio.

Operating expenses rose 6% to $6.372 billion mainly as a result of higher staff expenses due to higher inflation and two additional working days and extra investment, partly offset by productivity initiatives.

Loan impairment expense dropped 23% to $320 million due to disciplined credit origination and underwriting , rising house prices and lower expected losses in consumer finance.

The result beat expectations of a NPAT of $5.056 billion and an interim dividend of $2.22.

CBA (ASX: CBA) shares closed 67 cents (0.41%) lower on Tuesday at $162.16, capitalising the largest of Australia’s Big Four banks at $271.37 billion.