Welcome to our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- BP plc will "fundamentally reset" its strategy as profits dropped sharply in 2024.

- Commonwealth Bank of Australia has reported a 2% increase in half-year cash net profit to A$5.13 billion.

- Suncorp Group Limited has shown an 89% surge in half-year net profit after tax (NPAT) to A$1.1 billion

- Marriott cuts guidance

- Evolution Mining surges to new record financial performance

- Welltower, Humana, AIG, UniCredit post mixed results

_______________________________________________________________________________________

8:40 am (AEDT):

Good morning, Sienna Martyn here to kick us off with today's live earnings blog.

First up we have BP plc (LON: BP) which reported a significant drop in fourth-quarter profit on Tuesday, citing weaker refining margins and increased costs, while also unveiling a US$1.75 billion share buyback and a commitment to "fundamentally" reset its strategy, as reported by finance journalist Oliver Gray.

The British oil major posted an underlying replacement cost profit (RC profit) - a key measure of net income - of $1.169 billion for the quarter, down 48% from $2.99 billion a year earlier and slightly below forecasts.

The oil sector has faced headwinds as crude prices declined following their surge in 2022 after Russia’s invasion of Ukraine. BP has lagged behind its peers, with shares down roughly 9% over the past year, compared to a 6% rise for Shell.

At the time of Oliver's story, BP (LSE: BP) stock was trading at £462.25, easing 0.6% from Monday's close of £465.15. The stock reached a day low of £456 and a day high of £469.85. BP's market cap stands at £74.46 billion.

8:47 am (AEDT):

Next up, we have Kering SA (EPA: KER) with revenue down 12% to €17,194 million, both as reported and on a comparable basis.

As reported, sales from the directly operated retail network decreased 13% on a comparable basis.

François-Henri Pinault, Chairman and Chief Executive Officer said: “In a difficult year, we accelerated the transformation of several of our Houses and moved determinedly to strengthen the health and desirability of our brands for the long term.

Earnings per share amounted to €9.2.

At the time of writing, Kering SA (EPA: KER) had a stock price of €247.40, up €3.2 (1.31%) today. Its market cap was €30.54 billion.

8:59 am (AEDT):

Now we will take a look at Australia’s largest bank, Commonwealth Bank of Australia (ASX: CBA), which has reported a 2% increase in half-year cash net profit to A$5.13 billion.

CBA said statutory net profit after tax (NPAT) rose 6% to $5.14 billion on revenue which increased 4% to $14.098 billion in the six months to 31 December 2024.

NPAT was supported by volume growth in its core businesses and a lower impairment expense, partly offset by higher operating expenses due to continued inflationary pressures and a discretionary increase in franchise investment spending.

“Through supporting our customers and investing in our franchise we have been able to deliver solid results for our shareholders despite the weaker economic backdrop.” Chief Executive Officer Matt Comyn said in a media release.

CBA (ASX: CBA) shares closed 67 cents (0.41%) lower on Tuesday at $162.16, capitalising the largest of Australia’s Big Four banks at $271.37 billion.

To learn more, read the full story by senior business writer Garry West.

9:05 am (AEDT):

Major United States averages closed Tuesday's session (Wednesday AEDT) in a mixed fashion as investors digested Federal Reserve Chair Jerome Powell’s measured stance on interest rates and assessed ongoing trade tensions.

The Dow Jones Industrial Average gained 123.2 points, or 0.3%, finishing at 44,593.7. The S&P 500 inched up just 0.03% to close at 6,068.5, while the Nasdaq Composite slipped 0.4% to 19,643.9.

Big movers include Apple which rose 2.2% after reports suggested the tech giant is partnering with Alibaba to develop artificial intelligence features for iPhone users in China, helping limit broader market losses.

Additionally, Coca-Cola rose 4.7% after surpassing fourth-quarter revenue estimates, driven by higher prices and steady demand for its sodas and juices.

Read Oliver Gray’s full story here.

9:20 am (AEDT):

Next, let's look at the New York stock exchange with Coca-Cola Co. (NYSE: KO) which reported overnight and topped analysts’ expectations, as global demand for its drinks rose.

Earnings per share came in at 55 cents compared to analysts' expectations of 52 cents.

Revenue increased 6% to $11.54 billion compared to an expected $10.68 billion.

Coke’s pricing rose 9% in the quarter, 4% of which came from markets dealing with hyperinflation. The rest came from price hikes and a “favourable mix,” meaning customers purchased more expensive products.

Coke projects organic revenue will grow 5% to 6% in 2025 while the company also expects comparable earnings per share will rise 2% to 3%.

9:30 am (AEDT):

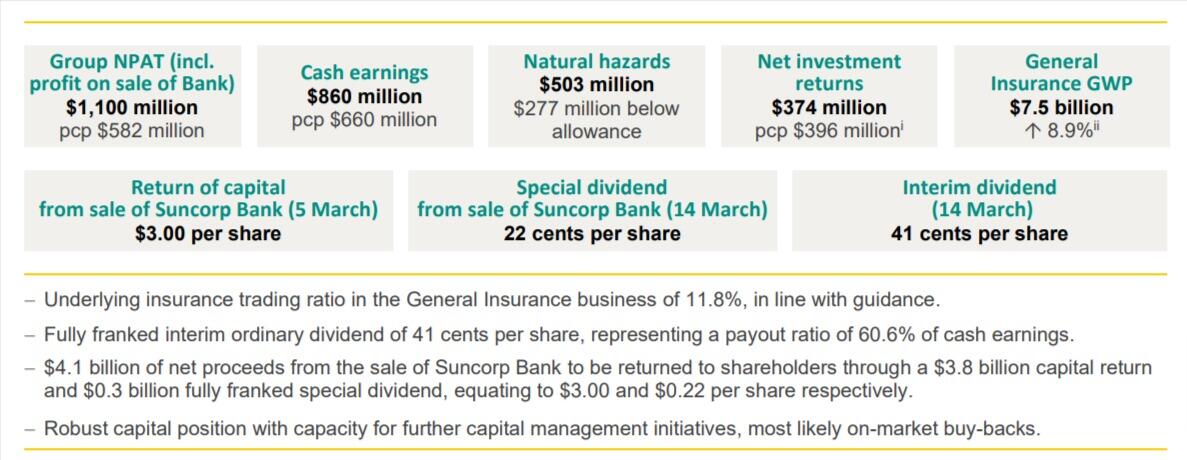

Garry West reports financial services company Suncorp Group Limited (ASX: SUN) has shown an 89% surge in half-year net profit after tax (NPAT) to A$1.1 billion.

The result includes a $252 million one-off gain on the sale of Suncorp Bank for $4.9 billion to ANZ Group Holdings on 31 July 2024.

Suncorp said other factors that supported the result include a favourable natural hazard experience for its insurance business, positive investment returns and the nonrecurrence of prior year reserve strengthening.

CEO Steve Johnston said the results reflected discipline in executing strategic and operational priorities.

“We have delivered to our commitments, we are financially strong and resilient, and we have created future capacity to invest in initiatives to support our customers,” Johnston said in a media statement.

Suncorp shares closed on Tuesday at $20.35, capitalising the company at $20.29 billion

9:45 am (AEDT):

Major eCommerce company Shopify Inc.(NYSE: SHOP) reported better-than-expected sales for the fourth quarter but missed on earnings

Sales in the fourth quarter increased 31% to $2.8 billion, ahead of the $2.73 billion analysts were expecting.

The company earned 44 cents a share on an adjusted diluted basis, also slightly above estimates.

Year-on-year revenue growth rate was up 31%, suggesting the company’s e-commerce software solutions stood out with merchants during the busy holiday quarter.

“We expect the strong merchant momentum from Q4 to carry over into Q1, recognizing that Q1 is consistently our lowest [gross merchandise volume] quarter seasonally,” the company said in its earnings release.

10:05 am (AEDT):

S&P Global Inc (NYSE: SPGI) has reported impressive Q4 results with earnings and revenue outpacing estimates.

Fourth quarter revenue increased 14% to US$14.2 billion, driven by growth in all divisions.

GAAP net income increased 52% to $880 million and GAAP diluted earnings per share increased 56% to $2.85 driven primarily by strong Ratings growth.

Adjusted net income for the fourth quarter increased 18% to $1.163 billion and adjusted diluted earnings per share increased 20% to $3.77.

“I am pleased that S&P Global delivered an outstanding year in 2024…We demonstrated the strength of our businesses and enter 2025 with strong momentum,” said President and CEO Martina Cheung.

S&P stock has gained 6.4% over the past six months, outperforming the 5.4% rally of its industry while underperforming the 14.2% growth of the Zacks S&P 500 Composite.

10:20 am (AEDT):

Gilead Sciences Inc. (NASDAQ: GILD) anticipates 2025 earnings to rise faster than Wall Street expected after reporting a strong Q4 which highlighted continued demand for the company’s top-selling HIV medicines.

The drugmaker forecast profit in the range of $7.70 to $8.10 a share this year.

Gilead is in the process of developing new sources of growth in medicines for cancer and other diseases to supplement its longstanding strength in antiviral products for HIV and hepatitis C among others.

However year-end results showed that the company’s HIV portfolio is still delivering solid returns.

Sales of the blockbuster HIV drug Biktarvy soared 21% to $3.8 billion in the quarter, surpassing analyst estimates of about $3.4 billion.

Growth was said to be driven by a combination of higher demand, pricing and favourable inventory dynamics.

10:50 am (AEDT):

DoorDash Inc. (NASDAQ: DASH) topped analysts revenue and order estimates in Q4.

Revenue rose 25% to $2.87 billion, compared with analysts' average estimate of $2.84 billion, according to data compiled by LSEG.

Total orders rose 19% to 685 million, surpassing the estimate of 673.04 million.

Shares in the company rose nearly 7% after hours trading yesterday, after announcing the decision to buy back shares worth up to $5 billion during fiscal 2025.

DoorDash recorded a profit of $141 million compared with a loss of $154 million in 2023.

Reuters reported that a peak in the holiday season saw customers turn to Doordash’s online platform to buy everything from food and groceries to alcohol.

11:20 am (AEDT):

Let's take a look at U.S. futures now with Oliver Gray.

U.S. stock futures remained little changed on Tuesday evening (Wednesday AEDT) as investors monitored a deluge of corporate earnings results ahead of January’s consumer inflation report, a key data release that could influence the Federal Reserve’s interest rate path.

By 10:25 am AEDT (11:25 pm GMT) Dow Jones Industrial Average futures and S&P 500 futures ticked 0.1% lower, while Nasdaq 100 futures were flat.

Several major stocks saw notable after-hours moves following earnings announcements:

Lyft tumbled 11.1% after issuing weaker-than-expected guidance.

Super Micro Computer fluctuated after the company released preliminary results but failed to file required reports with the SEC.

Upstart Holdings surged 25.4% as it exceeded expectations, reporting fourth-quarter earnings per share (EPS) of $0.26 - well above the forecasted loss of $0.04.

DoorDash climbed 5.8% following strong results (as seen in the previous post).

11:35 am (AEDT):

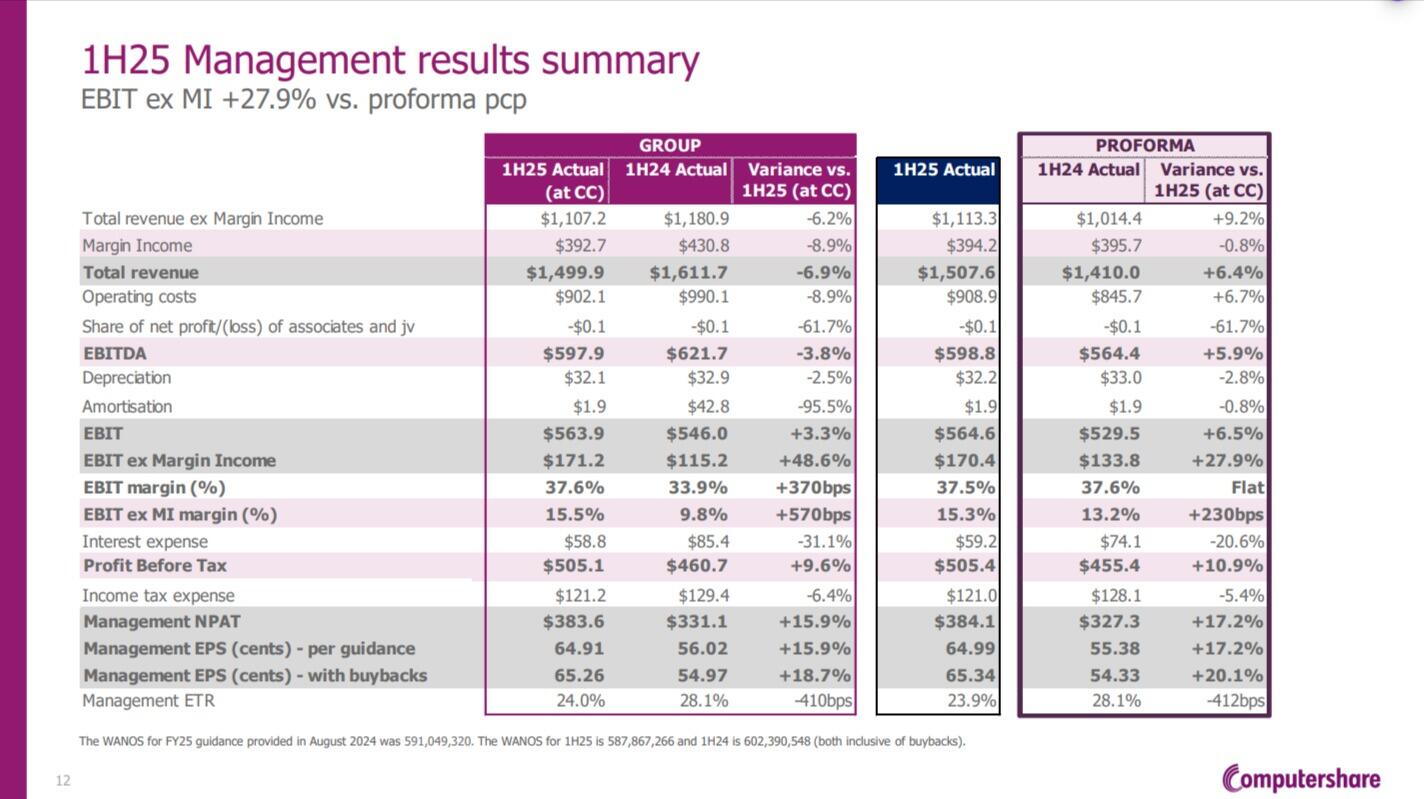

Now Mark Story takes a look at the results from ASX company Computershare.

The company's (ASX: CPU) share price was up over 10% to a record high of $40.02 at the open today after the financial services company reported a stronger-than-expected 1H25 result, with earnings per share above the consensus estimate by 6%.

While operating costs were higher than expected reflecting additional investment for growth, net profit beat forecasts on lower tax rate, revenue across all divisions outperformed expectations.

Read the full story from Mark Story here.

11:54 am (AEDT):

Marriott International Inc. (NASDAQ: MAR) reported weaker-than-expected guidance overnight and as a result, shares fell from their record closing high set yesterday.

The hotelier estimates current-quarter adjusted earnings per share (EPS) in the range of $2.20 to $2.26, and full-year adjusted EPS of $9.83 to $10.19.

Marriott’s current-quarter profit and room-growth outlook were below analysts' forecasts which has offset better-than-anticipated fourth-quarter earnings and revenue.

Q4 revenue increased 5% worldwide with 4.1% growth in the U.S. and Canadian markets and 7.2% growth in other international markets.

At the time of writing this, Marriott stock was trading at US$288.00 down 5.4% from the previous close. The company has a market cap of $80.03 billion.

12:12 pm (AEDT):

Now turning to the Asia Pacific market open with Oliver Gray reporting.

The market opened mixed this Wednesday as Federal Reserve Chair Jerome Powell reiterated that policymakers were in no hurry to lower interest rates.

By 11:40 am AEDT (12:40 am GMT) Japan’s Nikkei 225 gained 0.2% after resuming trade following a holiday, while South Korea's Kospi 200 and Australia’s S&P/ASX 200 hovered around the flatline.

Overnight in the U.S., the major indices closed mixed. The S&P 500 rose 0.03% to 6,068.5, while the Nasdaq Composite fell 0.4% to 19,643.86. The Dow Jones Industrial Average gained 0.3%, closing at 44,593.7.

Powell’s testimony comes amid growing political uncertainty in Washington, where President Donald Trump has expressed support for tariffs on U.S. trading partners.

12:25 pm (AEDT):

U.S. multinational chemical giant, DuPont De Nemours (NYSE: DD) reported fourth-quarter EPS of $1.13, $0.14 better than the analyst estimate of $0.99.

Revenue for Q4 came in at $3.9 billion only just above the consensus estimate of $3.8 billion.

The company reported net Sales of $12.4 billion which increased by 3% along with organic sales increasing by 1%, compared to the prior year

Shares surged to US$81.5, up 6.85% after the chemicals giant topped quarterly forecasts, highlighting strength in electronics and markets.

DuPont's CEO Lori Koch stressed value-creation opportunities as the firm focuses on its high-growth water, health care, and other industrial businesses.

12:41 pm (AEDT):

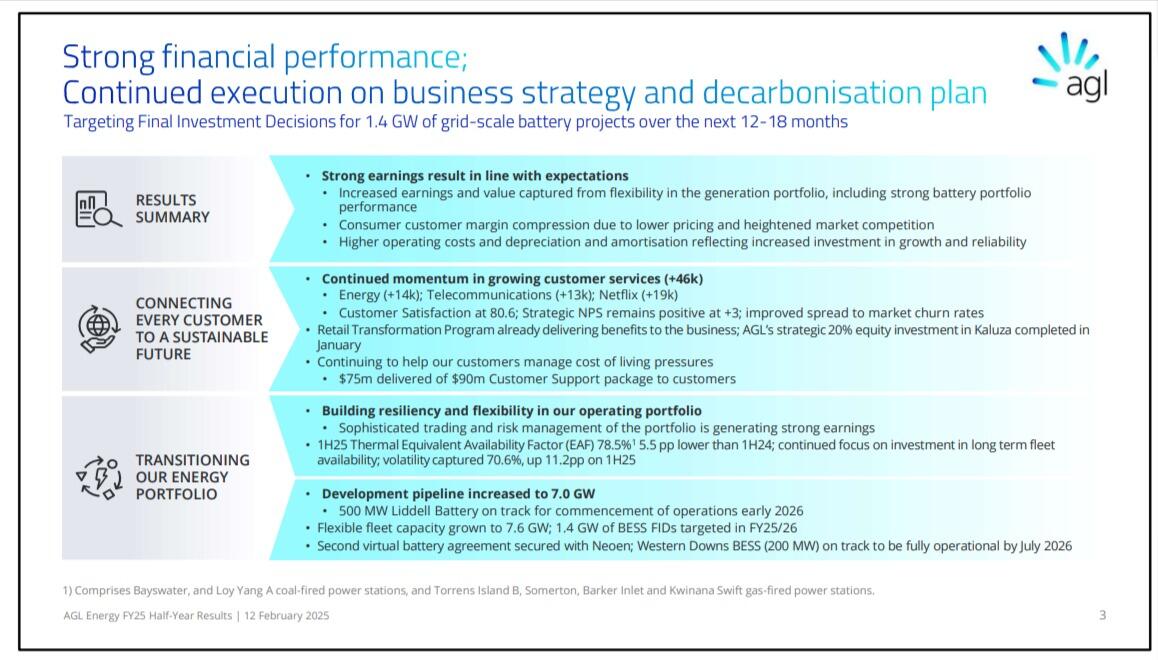

Back to the ASX now where energy generator and supplier AGL Energy (ASX:AGL) has unveiled an 83% plunge in statutory NPAT to A$97 million for the first half of the 2025 financial year (FY25).

AGL said the results were marred by $245 million of significant items including a $165 million increase in onerous contract provisions, $45 million of retail transformation costs, and a $31 million negative movement in the fair value of financial instruments.

The company said underlying EBITDA eased 1% to $1.068 billion and underlying NPAT fell 7% to $373 million on revenue which rose 15.3% to $7.132 billion.

Directors declared a fully franked interim dividend of 23 cents per share, compared with 26 cents in the prior corresponding period, to be paid on 27 March to shareholders registered on 26 February.

AGL also narrowed its FY25 profit guidance to underlying EBITDA of $1.935 billion-$2,135 billion (previously $1,870-$2,170 billion) and underlying NPAT of $580 million-$710 million (previously $530 million-$730 million).

By 12:15 pm AEDT (1.15am GMT) AGL Energy (ASX: AGL) shares had risen 35 cents (2.99%) to $12.06, after ranging between $11.59 and $12.14, capitalising the company at $8.11 billion.

More to come from Garry West.

1:08 pm (AEDT):

That's all from me today folks. Harlan Ockey will be with you for the rest of the afternoon.

Happy Wednesday!

1:27 pm (AEDT):

Hello everyone, Harlan here for the afternoon.

At the NASDAQ, Zillow Group (Z) reported strong revenue across sectors. Its overall Q4 revenue was up 17% year-over-year, reaching US$554 million.

For Sale revenue surged by 15% year-over-year last quarter, while residential revenue was up 11%, rentals revenue was up by 25%, and mortgages revenue was up by 86%. For Sale revenue was the company's largest division by revenue, at US$428 million.

Its adjusted EBITDA was US$112 million. Earnings per share were $0.27, below Zacks Consensus estimates of $0.29.

“The results we reported today demonstrate how well we are executing and seizing our opportunity to transform and digitise residential real estate. With the leading brand in our category and a solid foundation for continued growth, we're excited to serve more buyers, sellers, renters, and real estate professionals this year,” said CEO Jeremy Wacksman.

Zillow's full-year revenue was US$2.2 billion, up 15% year-over-year.

2:11 pm (AEDT):

Returning to the NYSE, Humana (HUM) posted mixed results. Revenue rose 13.5% year-over-year to US$25.73 billion, but GAAP net losses per share were $5.76.

Its full-year earnings per share were US$9.98. Individual Medicare Advantage plan membership is projected to decline by 550,000 in 2025, a decrease of around 10%. U.S. regulators downgraded Humana's Medicare Advantage star rating in October.

Shares fell by US$247.90 following the results.

Humana expects US$15.88 in annual earnings per share under its 2025 guidance. “We are confident in our long-term strategy and 2025 will be a critical step in returning to compelling, normalised margins," said CEO Jim Rechtin.

2:36 pm (AEDT):

At the NYSE, American International Group (AIG) beat estimates, but still declined in several metrics. Revenue fell by 46.1% year-over-year to reach US$6.85 billion, above Zacks estimates of $6.77 billion

Its net earnings per diluted share was US$1.43 last quarter. AIG's full-year net loss per diluted share was $2.17, compared to net earnings of $4.98 in 2023.

General Insurance net present worth in 2024 was US$23.9 billion, decreasing 11% year-over-year due to divestitures.

The company expects a net loss of around US$500 million from January's California wildfires.

“While the early days of 2025 reflect increased global volatility and complexity, AIG has entered a new era, and we are moving forward with strong momentum on behalf of our colleagues, customers, partners and stakeholders. With our focus on disciplined capital management, sustained underwriting excellence and expense management, we are well on track to deliver 10% plus core operating return on equity for full year 2025,” said CEO Peter Zaffino.

3:00 PM (AEDT):

Still at the NYSE, Welltower (WELL) also posted mixed results. The company saw earnings per diluted share of US$0.19, below estimates of $0.41. However, revenue last quarter was $2.25 billion, above analysts' projections of $2.12 billion.

Welltower completed US$2.2 billion in acquisitions last quarter, and invested $233 million into development funding.

Its full-year net income per diluted share was US$1.57, up from $0.66 the previous year.

Resident fees and services was its strongest-performing division across both the year and the quarter, reporting US$1.76 billion in revenue in Q4. This is above Q4 2023's $1.26 billion in revenue.

Welltower's 2025 guidance includes earnings per diluted share from US$1.60 to $1.76.

3:15 pm (AEDT):

At the ASX, Evolution Mining (EVN) said it saw record financial performance last half, with EBITDA up 77% to reach A$1.01 billion. Shares were up around 2% in afternoon trading after the release. Read Mark Story's full review of Evolution's results here.

Earnings per share were A$0.18, rising by 251%. Its statutory net profit increased by 277% to $365 million.

Evolution produced 388,346 ounces of gold last half, up 2% year-over-year. Its copper production was 37,613 tonnes, increasing 36% over FY2024's H1. The company projects it will produce 710,000 to 780,000 ounces of gold and 70,000 to 80,000 tonnes of copper across FY2025.

And still in Australia, NBN Co reported strong results. It saw A$2.9 billion in revenue in the second half of 2024, up 4% year-over-year. EBITDA was $2.1 billion, an increase of $131 million over 2023's second half.

3:55 pm (AEDT):

Moving to Italy's BIT, UniCredit (UCG) saw revenue increase. Revenue last quarter was EU€5.6 billion, up 8.9% year-over-year. Its revenue across FY2024 was €24.2 billion, rising 2% over the previous financial year.

Net profit last quarter was EU€1.6 billion, down 18.4% year-over-year. Its full-year net profit, however, increased by 2% to reach €9.7 billion.

“We will accelerate our growth, aspiring to further widen the gap with our competitors, close our valuation gap, and cementing UniCredit as the bank of Europe’s future and benchmark for banking,” said CEO Andrea Orcel.

This is UniCredit's 16th consecutive quarter of sustainable profitable growth, the company said. UniCredit's 2025 guidance includes net revenue above EU€23 billion, with net profit in line with 2024. It aims to reach €10 billion in net profit by 2027.

4:20 pm (AEDT):

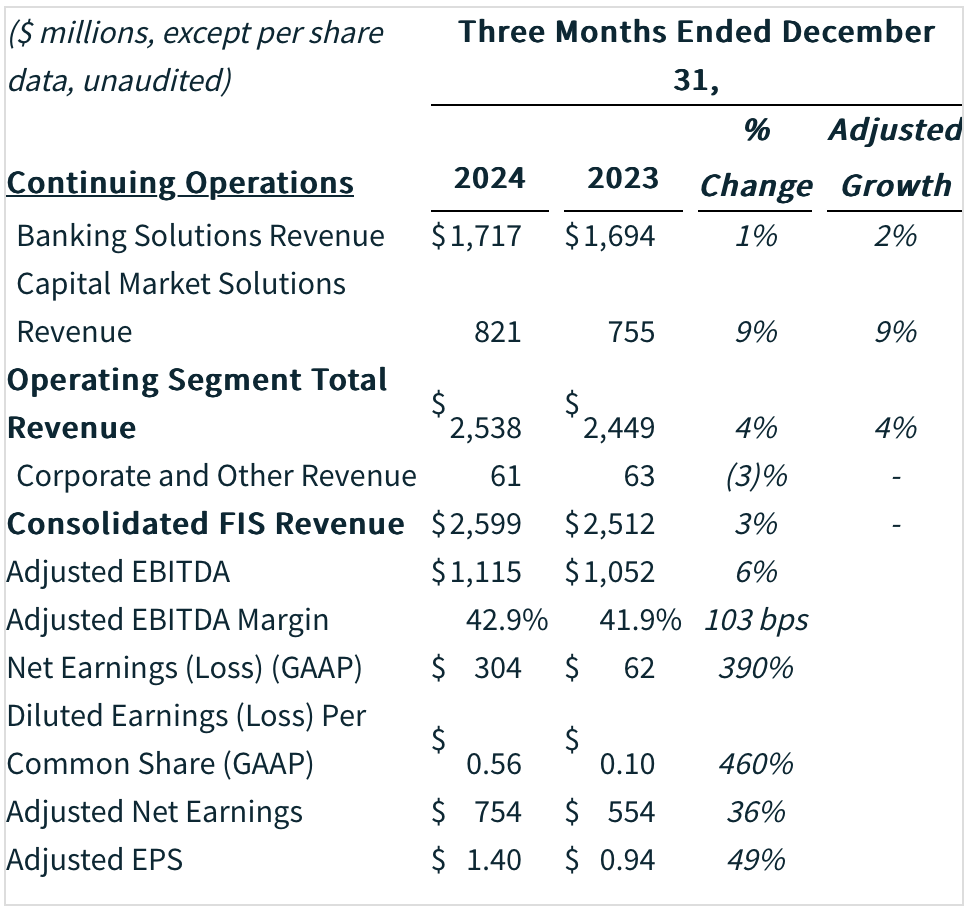

Back at the NYSE, FIS (FIS) fell short of estimates. Its revenue last quarter was US$2.6 billion, up 3% year-over-year, but below LSEG estimates of $2.63 billion.

Adjusted earnings per share were US$1.40, a 49% increase year-over-year. This is above estimates of $1.36.

Its full-year revenue was US$10.1 billion, up 3% over 2023.

FIS' revenue guidance for this quarter is US$2.49 billion to $2.51 billion, below analysts' projection of $2.56 billion. Shares fell by 12% after the release.

“Our 2025 outlook reflects acceleration in the business as we look to further build on the foundations laid in 2024 and drive double-digit total returns," said FIS CEO Stephanie Ferris.

4:31 pm (AEDT):

That's all from me today — thank you for joining us! Tomorrow we'll see earnings from the likes of Cisco, CME Group, and Insurance Australia. We'll see you then!