Few decisions have been as long awaited in Australia as this one and, like the Melbourne Cup, it may stop a nation.

To cut or not to cut, that is the question facing the Reserve Bank of Australia (RBA) Board at its two-day meeting starting today.

The chances that the nine directors of Australia’s central bank will lower the official cash interest rate are rated as high as 90%, according to economists and the ASX RBA Rate Indicator, with 25 basis points (0.25%) rated the most likely size of change.

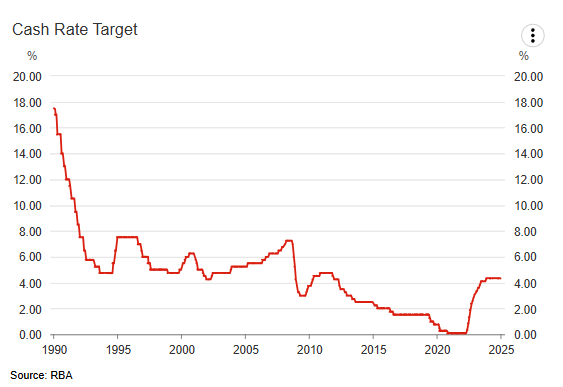

But it is not guaranteed that the cash rate will drop from 4.35%, the level it reached in November 2024 when the RBA increased rates by 25 basis points as part of its four-year battle to control rising inflation.

All eyes on the decision

Financial markets participants will be glued to their screens pending the decision to be communicated via a media release at 2.30pm AEDT (3.30am GMT) on Tuesday when the RBA announces its target cash rate.

This is the rate that banks charge each other to borrow funds overnight on the money market, but it also influences what banks and other lenders charge borrowers for home and other loans.

With Australians battling a cost of living crisis and borrowers struggling to meet debt repayments, this nation of 27 million people is hoping almost like never before that the RBA decides to start easing monetary policy.

This certainly applies to the 3.2 million borrowers (30% of all homes) with more than A$2.3 trillion of home loans outstanding but it extends to all other debt including personal loans and business loans.

But it’s just as critical for the ruling Australian Labor Party which is behind the Liberal/National Party coalition in the opinion polls and needs favourable economic news to lift its stocks ahead of an election due to be held by 17 May 2025.

A Newspoll shows the Coalition has a 51%-49% two-party-preferred lead over Labor, which holds 77 of the 151 seats in the House of Representatives, according to The Australian newspaper.

Official cash rates have been lifted 13 times since they bottomed at 0.1% in November 2020 at the height of the COVID-19 pandemic, according to the RBA website.

Falling CPI provides hope

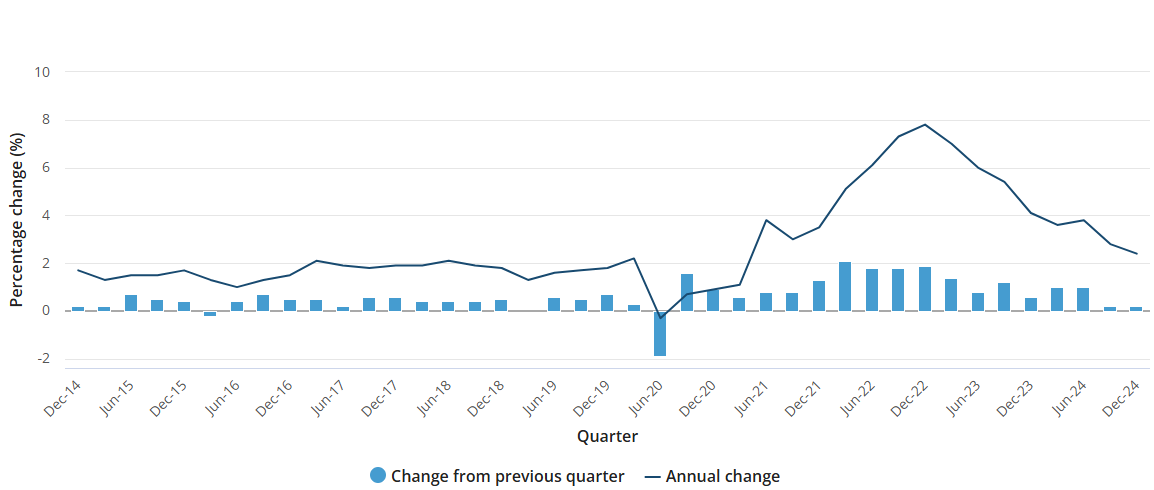

What has given the RBA Board the opportunity to consider cutting rates is a fall in inflation rates whose sharp rise had prompted the central bank to tighten monetary policy so much.

The consumer price index (CPI), which measures the cost of living, surged from an annual rate of 1.1% in early 2020 to 7.8% at the end of 2022 but has since eased to 2.4% in the December quarter of 2024, according to an Australian Bureau of Statistics media release.

Underlying (or core) inflation, which is the measure the central bank monitors most and excludes volatile components like food and petrol, fell to 3.2% in the December quarter from a high of 6.1% midway through 2022.

Mitigating against that is a stronger than expected labour market with seasonally-adjusted unemployment dropping from 7.5% in July 2020 to 4% in December 2024, according to an ABS media release, not far above the 10-year low of 3.4% in October 2023.

The RBA said on 10 December when it left the cash rate unchanged that although inflation had fallen substantially since the peak in 2022, underlying inflation of about 3.5% was “still some way” from the 2.5% midpoint of its inflation target.

The most recent forecasts published in the November Statement on Monetary Policy (SMP) did not see inflation returning sustainably to the target midpoint until 2026.

“The Board is gaining some confidence that inflationary pressures are declining in line with these recent forecasts, but risks remain,” the RBA said in a media release.

“While headline inflation has declined substantially and will remain lower for a time, underlying inflation is more indicative of inflation momentum, and it remains too high.

“The Board will continue to rely upon the data and the evolving assessment of risks to guide its decisions. In doing so, it will pay close attention to developments in the global economy and financial markets, trends in domestic demand, and the outlook for inflation and the labour market.”

View from the market

Most economists, including those working for the Big Four banks, expect a 25 basis point (0.25%) reduction with Goldman Sachs forecasting cuts totalling 50 basis points (0.5%) in February and April.

“We expect the RBA to cut in February and signal data dependence, with subsequent data on GDP, wages and monthly inflation pushing the new RBA Board (starting in March) to cut again in April,” the investment bank said in a research document.

It said timely measures of core inflation were now tracking within the RBA's 2-3% target band, including the Australian Bureau of Statistics’ monthly trimmed-mean CPI (2.7%) and the Melbourne Institute trimmed-mean gauge (2.1%).

Goldman Sachs noted, as had other economists, that in its December statement the RBA Board left out previous language that it was “vigilant to upside risks to inflation” and "not ruling anything in or out."

CommSec said Commonwealth Bank economists had pencilled in 25 basis point cuts in each of the four quarters of 2025, bringing the cash rate down to 3.35%.

National Australia Bank (NAB) said it expected the RBA to gradually cut the cash rate to 3.1% by February 2026 as inflation had moderated faster than the RBA expected.

“While the labour market remains strong, we do not see current conditions as inflationary. However, the RBA’s growing confidence will need to come in part from a reassessment of tightness in the labour market,” NAB said in its Monetary Policy Update.

Westpac Chief Economist Luci Ellis said the better-than-expected inflation data in December tilted the balance of probabilities back in favour of a rate cut in February.

“We have just enough evidence to conclude that disinflation has proceeded faster than the RBA expected, so the Board will have the required confidence to start the rate-cutting phase in February," Ellis said in a note.