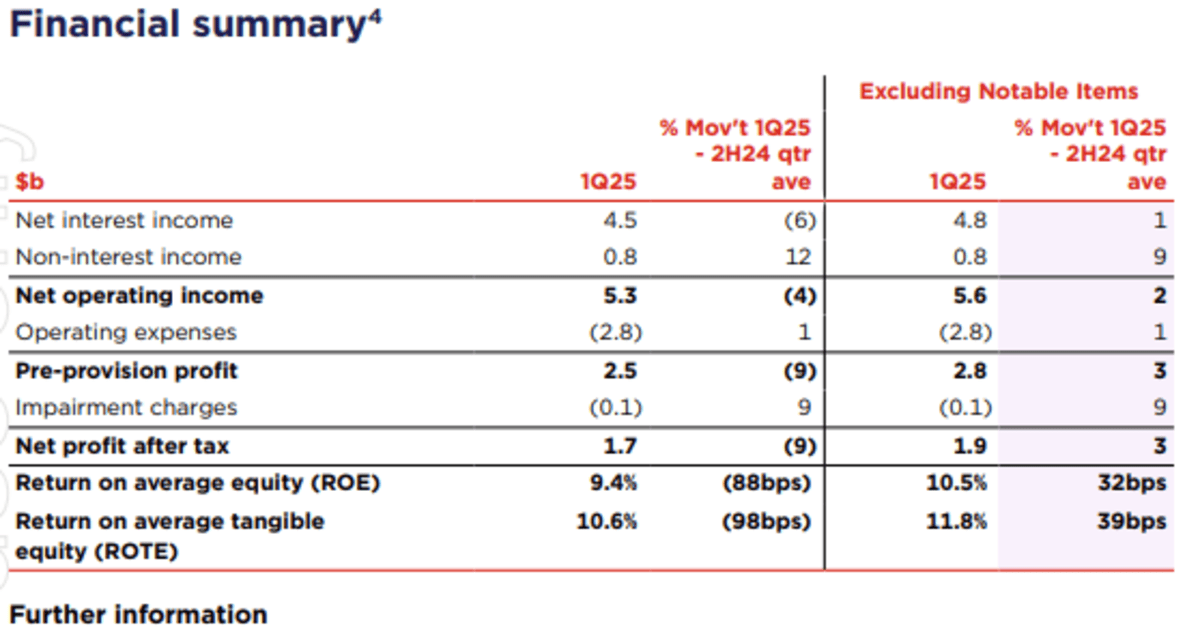

Westpac Banking Corporation said unaudited net profit fell 9% to A$1.7 billion in the first quarter of the 2025 financial year (Q1 FY25).

Westpac, Australia’s second largest bank by assets and market capitalisation, said the result was drive by notable items related solely to hedge accounting which would reverse over time.

The 208-year-old bank said unaudited net profit increased 3% to $1.9 billion when notable items were excluded.

“This has been a solid first quarter performance, reflecting our strong financial position, balance sheet growth and service excellence,” Chief Executive Officer Anthony Miller said in an ASX release.

Pre-provision profit grew 3% with revenue increasing 2% and expenses rising 1%.

Core net interest margin narrowed by two basis points to 1.81% due partly to a provision release in 2H24 but the decline was modest as a result of prudent management of mortgage competition and a shift towards lower spread savings and term deposits.

Net interest income fell 6% but, if excluding notable items, it increased 1% with higher average interest earning assets offsetting a modest decline in net interest margin, while non-interest income rose 12%, or 9% if excluding notable items, due to higher financial markets revenue.

Miller said cost of living pressures and high interest rates remained challenging for some customers while many businesses faced cost pressures and lower demand.

He said the easing inflation could see the Reserve Bank of Australia reduce the official cash interest rate tomorrow, providing relief to households and supporting business activity.

“We continue to prioritise financial strength with capital, funding and liquidity remaining comfortably above regulatory minimums,” Miller said.

Westpac (ASX: WBC) shares had closed at $34.71, up six cents (0.17%), on Friday, capitalising the bank at $119.09 billion.