Due to a perfect calm of attractive yields, a resilient Australian economy and evolving market infrastructure, Australian dollar-denominated bonds from international issuers - aka kangaroo bonds – are playing an increasingly important role in global fixed income.

Demand for kangaroo bonds traditionally comes from investors in Australia and the Asia Pacific.

However, the local market is increasingly attracting global attention as the world looks to diversify away from United States dollar assets, while growing investor participation is also improving A$ liquidity.

While full-fledged de-dollarisation appears unlikely, the U.S. dollar will likely be weaker and more volatile.

As a result, investors who work in treasuries or asset liability management roles are looking to manage risk by spreading their investments well beyond U.S. dollar assets.

While this has led to increased interest in a basket of different currencies, including the euro and Japanese yen, it’s the Australian dollar that’s emerged as a particularly attractive alternative to the U.S. dollar.

Goldilocks moment

Buoyed by three rate cuts by the Reserve Bank of Australia (RBA) this year, the local yield curve remains steep, and this has positively impacted the ability of bank treasuries, particularly those in Asia, to enjoy a favourable cost-of-carry - the total cost of holding an investment or asset over a period of time.

With the markets expecting rates to go lower while fiscal challenges continue, Oliver Holt, head of debt syndicate and IG origination (Asia ex-Japan) at Nomura, believes the Australian bond market is experiencing a Goldilocks moment.

Conditions are “just right”, adds Holt, with front-end rates in Australia lower, global yields higher, and investors seeking to diversify away from U.S. treasuries and dollars.

The Australian dollar market also offers compelling yields compared to other major currencies.

While the five-year U.S. dollar swap rate stands at approximately 3.38%, the Australian dollar equivalent is 3.71%.

This compares favourably to other alternatives such as the euro (2.38%), Singapore dollar (1.53%), and Japanese yen (1.16%).

“The Australian economy remains resilient, with a relatively low debt-to-GDP ratio at 40-50%, so its high yields are attractive compared to markets where fiscal concerns are more prominent,” Holt noted.

A$ liquidity and deeper investor base

The evolution of the Australian market since the pandemic is also making local conditions more favourable for domestic and offshore investors alike.

For starters, as rates went lower, Australia’s active fund management industry started to witness major growth.

In a more recent development, Australian regulators announced the phasing out of bank hybrid bonds.

While popular among retail investors for yield enhancement, hybrids were deemed ineffective at absorbing losses in the event of a crisis, and the regulator finally concluded that issuers understated the underlying risks to retail investors.

Given that there is now no additional supply, these hybrid bonds are being redeemed, which means sizable amounts of money are now sloshing around in the market looking for a home.

According to Holt, this partly explains the record order books on the kangaroo bonds Nomura has been underwriting in the subordinated bank market.

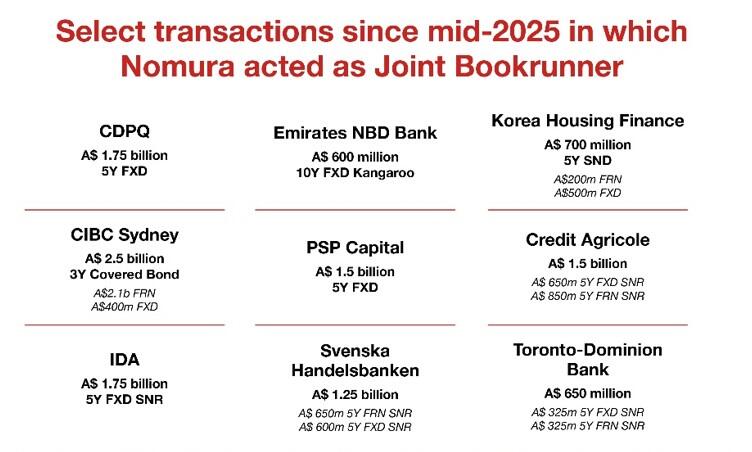

“[We] are seeing strong traction lately, with our DCM and A$ syndicate teams having an active year advising notable issuances from across Canada, Europe, the Middle East and Korea, with many of these transactions netting record order books,” says Holt.

“As a Tokyo-headquartered institution, we also see and have access to some unique flows from Japan into the Australian dollar market especially into the semi-government bonds.”

Evolving A$ market

While it’s not yet as deep as U.S. dollar or euro liquidity levels, the Australian dollar market has a robust developed markets (DM) trading infrastructure across government bonds, semi-government bonds, and credit products.

The evolution of the Australian dollar market has been mirrored by superior liquidity compared to other Asian currencies. For large transactions, such as billion-dollar interest rate swaps, execution has become more efficient and cost-effective.

Given the country’s favourable dynamics, Holt expects the Australian dollar bond market to continue playing an increasingly important role in global fixed income portfolios, especially for investors seeking yield and diversification in the Asian time zone.

He expects recent landmark transactions and larger deal sizes to create a virtuous cycle, attracting more investors globally.

Bond Opportunities

New Issues

Leading integrated transport fuels company in Australia and NZ, Ampol (ASX: ALD), has announced its intention to launch its 6th hybrid issuance.

The issue is expected to have a call date of 8.25 years and a rating of BBB.

The anticipated issue size is at least $500 million, aimed at replacing the upcoming hybrid call in 2026.

There is expected to be a fixed and/or floating rate tranche.

The expectation is that the bond will come to market with indications of interest close to 6%.

Bondadviser has a fair value estimated at SQ ASW / 3mBBSW +205bps (c.5.55%) based on comparisons with similar corporate hybrids so it should launch somewhere in between.

High Yield

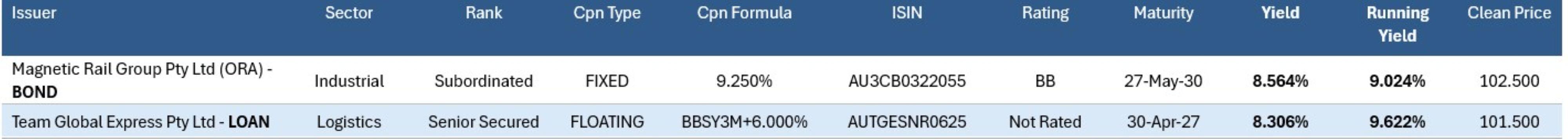

Indications of some high-yield opportunities can be found below:

Magnetic Rail Group is an Australian rail freight company specialising in bulk coal haulage across New South Wales and Queensland, and Team Global Express is a major logistics and transportation company operating across Australia and New Zealand, offering multimodal freight services by road, rail, air, and sea.

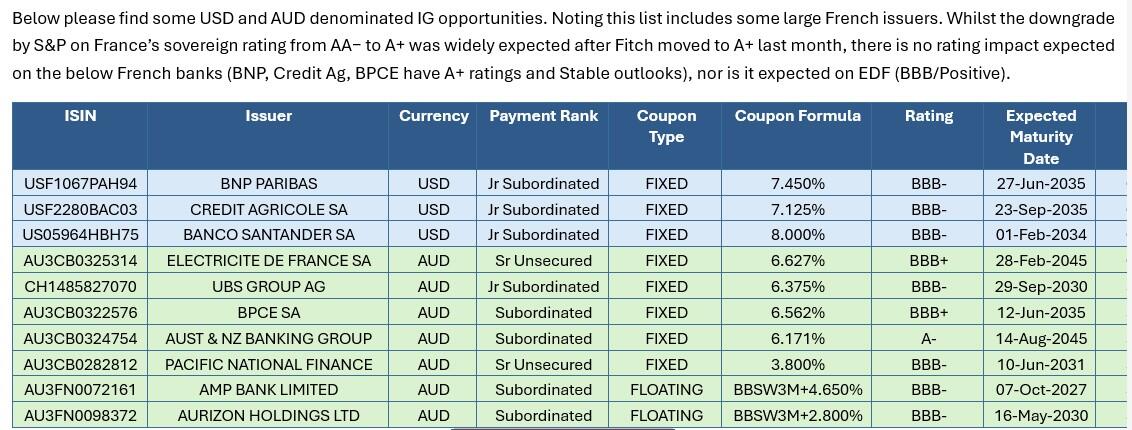

Investment Grade

Below, please find some USD and AUD-denominated IG opportunities.