With six to twelve-month term deposits from the big four banks now only averaging around 3% as the market braces for further rate cuts, there’s growing investor appetite for Australian dollar-denominated, investment-grade credit, which has shifted from yielding over 6% a few months ago, to currently offering 5%-6%.

With this in mind, issuers are capitalising on growing local investor demand by continuing to bring new offerings to market.

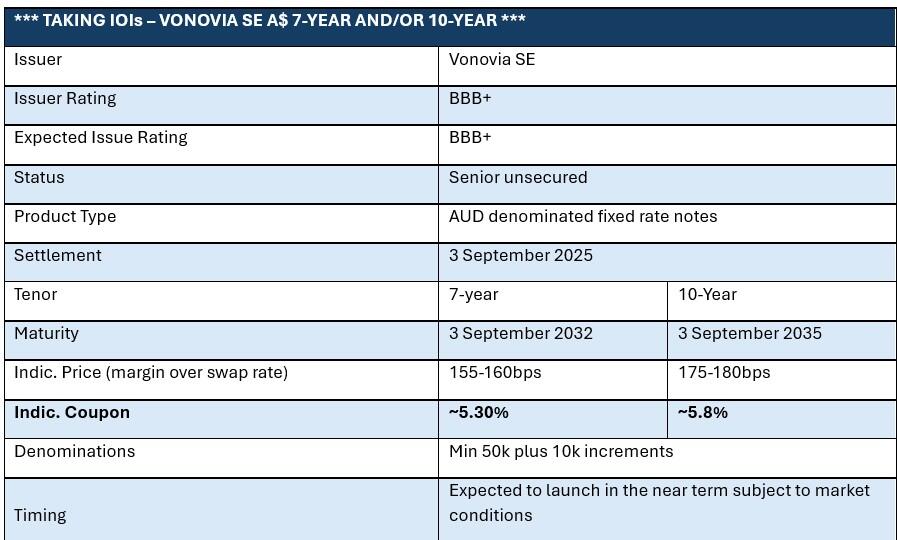

A BBB+ rated bond is preparing to launch with two tranches, a 7-year and a 10-year, with fixed coupons of around 5.3% and around 5.8% respectively.

Securing an income from a quality issuer of over 5.5% should serve investors well in current market conditions, especially with these returns becoming increasingly difficult to achieve as rates continue falling.

For this reason, the 10 year tranche is expected to be the most popular.

The issuer is DAX-listed Vonovia SE - Europe’s largest private residential real estate company, headquartered in Bochum, Germany – which owns and manages a vast portfolio of over 565,000 residential units across Germany, Sweden, and Austria, with a total property value of approximately €97.8 billion (A$174.7 billion).

This will be their first A$-denominated bond issuance, marking its official debut in the A$ market.

Prior to this, Vonovia SE has issued bonds in EUR, SEK, GBP, and other currencies.

Revolution AM launches new PC product on ASX

Meanwhile, in other interesting fixed-income news, Revolution Asset Management is set to launch a new private credit product on the ASX.

Targeting to raise $400 million, Revolution Private Credit Income Trust, under ASX code REV, will debut on September 22 and has already attracted bids of over $1 billion.

"The launch of the trust reflects our commitment to making private credit more accessible through a structure that is transparent, liquid and aligned with investor interests,” said Revolution co-founder and chief investment officer Bob Sahota.

As confidence in private credit continues to grow as a crucial component of diversified portfolios, this trust offers investors a compelling solution.”

Investors can apply for $2 for one unit to raise a minimum of $150 million, with a maximum of $400 million.

Proceeds of the offer will be invested in the $2.8 billion Revolution Private Debt Fund II, which predominantly holds Australian and NZ senior secured corporate loans, asset-backed securities, commercial real estate loans, plus bonds and cash.

Excluding property development and small business lending, the portfolio includes corporate debt such as senior secured loans to entities like Colonial First State, Arnott's and Lumus Imaging.

At the end of June, the Private Debt Fund II had 54 loans with an average expected life of the portfolio being 1.1 years.

The portfolio yield to maturity was 9.1%, with a credit spread of the portfolio above the Bank Bill Swap Rates (BBSW) benchmark rate of 536 basis points, while the average credit rating of the portfolio is BB+.

REV targets a return of RBA cash rate + 4% p.a. net of fees and charges a 0.95% management fee and no performance fees.

Equity Trustees acts as the responsible entity.

"The trust represents the natural evolution of our strategy and a significant milestone in our growth as a specialist private credit manager. We're encouraged by the strong interest we have received to date," Sahota said.

Revolution has $3.4 billion in assets under management.

AirTrunk raises A$16 billion in sustainability-linked loans

Meanwhile, leading hyperscale data centre specialist, AirTrunk, has raised A$16 billion in sustainability-linked loans with multi-transaction financing covering key greenfield and operational assets across Australia, Hong Kong, Malaysia and Singapore.

The landmark A$16 billion financing takes the company’s total financing platform to over $18 billion, including Japan, cementing its position as one of the largest issuers of sustainable finance in the global data centre industry.

Based on AirTrunk’s commitments to hit net zero emissions by 2030, the debt syndicate comprising over 60 banks and financiers backed the financing, including Westpac (ASX: WBC), National Australia Bank (ASX:NAB), and Commonwealth Bank (ASX: CBA).

The refinancing is comprised of four individual transactions, which are each sustainability-linked, structured as either green loans or sustainability-linked loans (SLLs).

In Singapore, the S$2.25 billion (A$2.68 billion) green loan will support the development of AirTrunk SGP2 in Loyang and is Singapore’s largest loan and green loan for a data centre.

In Melbourne, the green loan is the largest in the Asia Pacific and Japan region and the first globally to feature margin adjustments linked to a social impact program – a mechanism traditionally used in sustainability-linked loans.

“By linking all A$18 billion of our financing to sustainability, we demonstrate our long-term commitment to scale responsibly, building essential digital infrastructure to power the digital economy, while delivering lasting positive environmental and social impact,” said AirTrunk Founder & Chief Executive Officer, Robin Khuda.