As was widely expected, the Reserve Bank of Australia (RBA) cut the official cash interest rate by 25 basis points on Tuesday to 3.60%.

This marks the third rate cut of 2025 and the lowest level since April 2023.

While the cut was by no means unexpected, what took the market by complete surprise was the tough-love narrative dished out by the central bank’s Governor Michele Bullock.

In what was tantamount to the classic kiss-kick manoeuvre, Bullock followed up on the welcomed cut with a grim warning Australians to prepare for chronically lower growth in their living standards.

The RBA Board has taken a scalpel to its productivity growth assumptions and is expecting annual productivity growth of a paltry 0.7% in 2028 and beyond.

The RBA is also pointing to a downgrade for GDP, business investment and household income if poor productivity performance doesn’t improve.

Key reasons behind Tuesday’s cut:

Inflation Cooling: Headline inflation dropped to 2.1% in the June quarter, near a four-year low and at the bottom of the RBA’s target range.

Core inflation (trimmed mean - excludes volatile price movements, which is especially useful as a measure when headline figures are distorted by temporary shocks like fuel or food price swing) also slowed to 2.7%, the lowest since December 2021.

Labour Market Softening: Unemployment ticked up to 4.3%, the highest in 3.5 years, signalling easing pressure on wages and demand.

Economic Outlook: The RBA expects modest growth ahead, with inflation remaining within the 2–3% target range, although global uncertainty remains high.

Bullock emphasised the board’s cautious approach amid global uncertainty, but noted that recent inflation data strongly supported the rate cut.

Bond Opportunities

Here are some bond opportunities to consider in the wake of Tuesday’s cut.

New Issue Update

ANZ (ASX: ANZ) has launched the first 20-year fixed bullet bond in Australia (there is no call date, just a legal maturity date).

An A- rated bond paying a fixed coupon of 6.171% for 20 years, it was well supported by clients and looks even more attractive now following this rate cut.

Since this move by the RBA was expected, there has been little reaction from the market, however, with this bond’s attractive fixed coupon, it should perform well from a capital perspective if interest rates continue to travel downwards as expected.

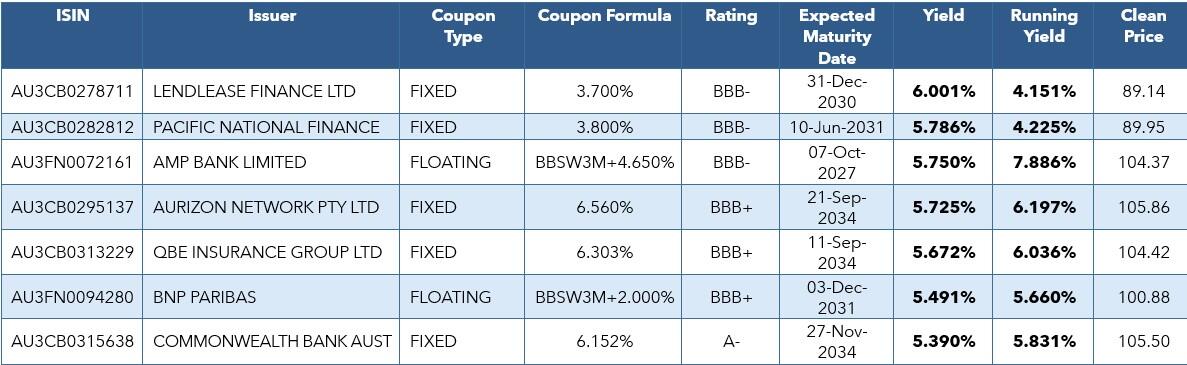

From a relative value perspective, securing a yield over 6%+ is a rare occurrence in the current investment-grade market, which is indicated in the table of bonds below, highlighting the opportunity presented with this new issue.

High Yield

Meanwhile, there is understood to be a small amount left of a new three-year senior secured loan transaction in the leisure and experiential sector.

The transaction offers investors access to a senior secured term loan with an attractive yield (BBSY + 9.25% p.a), robust downside protection, and strong sponsor alignment. The business is supported by exclusive technology rights, strong operational performance, and high barriers to entry.

The $40 million senior facility supports a recapitalisation and growth strategy, including the refinance of existing debt and working capital runway with institutional equity sponsors committing $35 million in new preference equity, signalling long-term confidence and alignment.

Investment Grade

Below are some IG bonds offering value at yields of 5.5%+.

This article does not constitute financial or product advice. You should consider independent advice before making financial decisions.