While superannuation is typically the vehicle of choice when it comes to growing wealth, it makes for a lousy structure through which retirees gift assets or property to family members after their death - aka making a bequest.

But while the tax on a super death benefit can be onerous – as much as 17% on taxed elements and 32% on untaxed elements – this doesn’t seem to stop retirees falling into this trap.

According to research by life insurer and pioneer of investment bonds in Australia, Generation Life, 34% of Australians use super as a vehicle through which they leave their legacy for loved ones.

Whether they were simply unaware of this outcome or failed to act on it before they died, allowing the state to become a co-beneficiary along with loved ones is not something anyone, no matter how wealthy, should be comfortable with.

Research by Generation Life also reveals that while one in five Australians want to pass their legacy to their grandchildren, it isn't necessarily about simply wanting to give the younger generation a financial head start.

Guardrails around contestability

According to a director at Generation Life Araujo Felipe, retirees can be equally concerned about possible relationship breakdowns among their adult children, or they may be considering the impact of a blended family.

What Felipe is alluding to is the intention of many retirees to put guardrails around their legacies in the face of contestability.

When it comes to estate planning, the white picket fence picture of a nuclear family is less common than it was 40 years ago.

Then there are couples without children who now have to contend with the greater probability of relatives coming out of the woodwork.

“Our research shows that 80% of high-net-worth Australians want to leave something… but only 14% actually have a plan to do so,” says Felipe, who urges retirees to seek professional advice when it comes to estate planning.

Half of today’s wills are contested

According to the University of NSW Law Journal, 50% of wills are being contested in courts, while 74% of stated estate claims were successful - a figure that rose to 100% of stated claims for estates with over 3 million in assets.

The journal also warns that the distribution of assets after death is not a purely financial or legal exercise.

Unknown to many retirees, their will can present a very public realignment of relationships and financial hierarchies within a family.

As a result, wills can end up creating or even reigniting smouldering family disharmony and can become a focal point for new ones.

The role of investment bonds

Given that they sit outside the will and are not subject to probate, investment bonds can play an important role in ensuring money goes to the specific people a retiree intended it for.

If you’ve heard of insurance bonds, here’s an insight into how they work.

Given that investment bonds sit outside probate, it’s also possible to bequeath wealth without a public record of where it’s going.

Funds placed within an investment bond do not form part of the estate where a beneficiary or future transfer has been nominated.

In other words, they are paid directly to beneficiaries who do not need to be dependents; they can be non-family members or even a favourite charity.

As a tax-paid asset, investment bonds pass on your wealth without incurring any tax by the beneficiary once the bond has been held for 10 years, or tax-free as a death benefit, any time.

The other beauty of investment bonds is that they let you make special rules around how and when they can be accessed by beneficiaries.

As a result, investment bonds may be appropriate for beneficiaries with special needs or those with insufficient experience to make large investment decisions.

A new breed of investment bonds

While estate planning in the past may have been the preserve of those with reasonable wealth, Felipe reminds all Australians that anyone on the marginal tax rate above 30% in the dollar can benefit from investment bonds.

While investment bonds are by no means new to Australia, new features ensure greater control, not just around who inherits wealth, but how beneficiaries are able to access that wealth.

As a case in point, Generation Life’s investment bonds include Future Event Transfer options.

What these bonds do is provide the flexibility to nominate the date of a future event – like beneficiaries reaching a certain age – at which point the proceeds can be accessed.

Then there’s the option for the bequestor to stipulate that a beneficiary receive an income stream and can also specify how long an income stream remains in place before capital is accessed.

Here’s an example of how that flexibility can be put into practise.

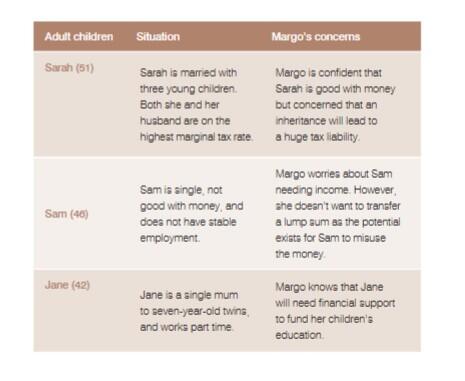

Margo (77) is a homeowner with three non-dependent children. The table below describes each child's situation and the concerns Margo has about leaving an inheritance for each of them.

Other investment bond providers

When searching for the best investment bond providers in Australia, it's important to read the small print.

Some of the leading investment bond providers in Australia include:

- Australian Unity: Offers a range of diversified portfolios for long-term investors.

- Centuria Life: Provides a flexible and tax-effective investment bond solution.

- Generation Life: Known for its strong investment options and wealth management solutions.

- Foresters Financial: Offers tax-efficient investment bonds suitable for various financial goals.

Before choosing an investment bond, it's also important to assess your financial objectives and compare the fees, investment choices and additional benefits each provider offers to ensure you select an investment that aligns with your investment objectives and risk tolerance.