Gold prices steadied around the key US$4,000 mark on Friday, consolidating weekly losses as investors assessed a stronger United States dollar and waning expectations for a December rate cut.

By 4 pm AEDT (5 am GMT), spot gold was down 0.5% at US$4,004.98 per ounce. For the week, gold has lost 2.7%, retracing part of its earlier rally, but remains set for its third consecutive monthly gain.

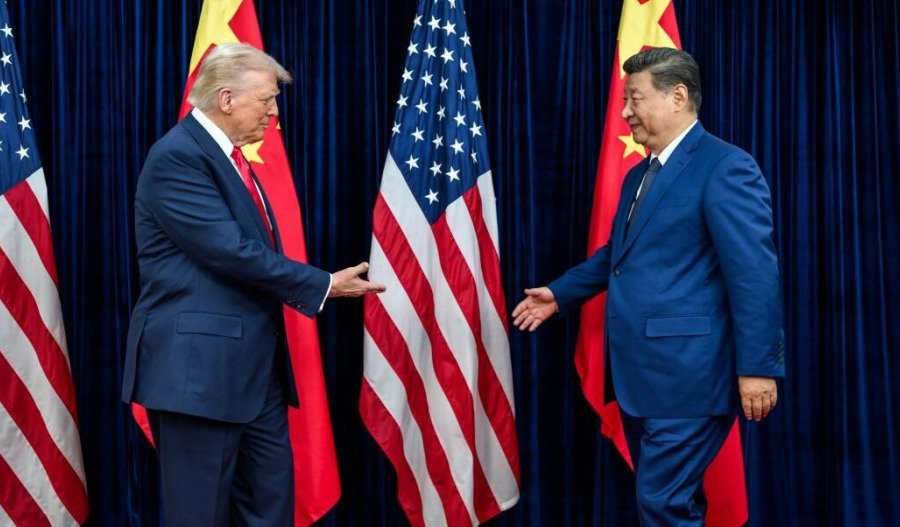

Markets appeared to take profits after a strong correction in gold prices, prompted by optimism over a potential U.S.-China trade deal and a more cautious tone from the Federal Reserve.

The Fed on Wednesday delivered an expected 25 basis-point rate cut, though Chair Jerome Powell suggested policymakers may become “more cautious” if doing so limits their ability to assess further economic data on jobs and inflation.

According to the CME Group FedWatch Tool, traders are now pricing in a 71% chance of another 25 bps rate cut in December, down from 91.1% a week ago.

The shift in expectations has bolstered the U.S. dollar, which is hovering at two-month highs against major peers, weighing on gold’s near-term momentum.

Gold’s recovery earlier in the week was supported by a report from the World Gold Council, which stated that “total gold demand grew 3% y/y to 1,313t, the highest quarterly total in our data series.

"Yet this was eclipsed by the value measure of demand, which jumped 44% y/y to a record of US$146bn.”

Traders are watching closely to see if the metal can break higher amid a mixed backdrop of risk sentiment, strong U.S. dollar performance, and global demand resilience.