Oil prices eased during Friday's Asian trade, poised to record a third straight monthly decline, as the United States dollar strengthened and soft Chinese data weighed on sentiment.

Rising output from major producers also offset the impact of Western sanctions targeting Russian exports.

By 3:30 pm AEDT (4:30 am GMT), Brent crude futures slipped 38 cents, or 0.6%, to US$64.62 per barrel, while U.S. West Texas Intermediate crude was 41 cents, or 0.7%, lower at US$60.16.

ANZ analysts commented in a note to clients, "In the short term, we expect imports by India and China to fall, as refiners take stock of these latest measures. This will delay the expected inventory build in the current quarter and see increasing pressure on OPEC to fill gaps."

"Indian refiners have paused purchases of Russian crude following the U.S. move to sanction Russian oil companies Rosneft and Lukoil. However, there has been no indication on the Chinese side as to whether they will stop buying.

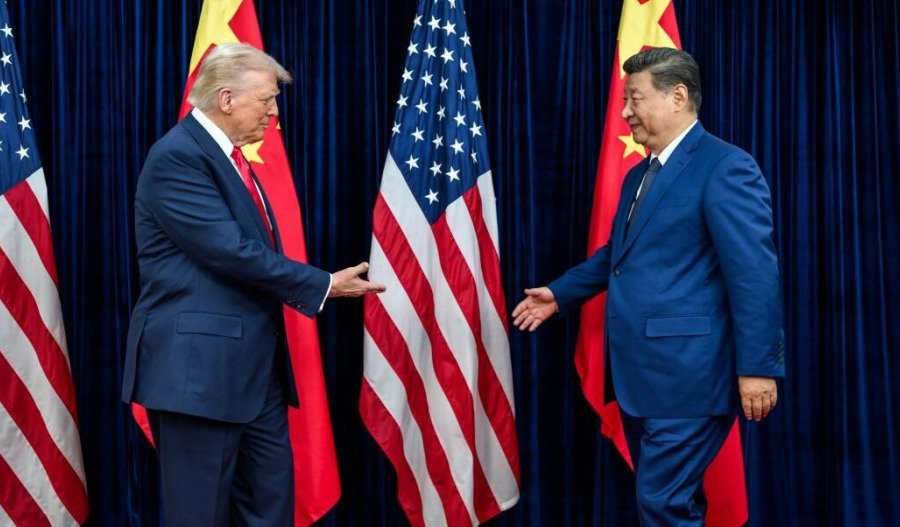

"There was also hope that China would agree to purchases of U.S. oil & gas as part of a broader U.S.-China deal.

"The market is now watching this weekend’s OPEC+ meeting and discussions of its output policy."

The greenback strengthened overnight after Federal Reserve Chair Jerome Powell said a December rate cut was “not guaranteed”, fuelling expectations that U.S. rates could remain higher for longer.

Oil prices also dipped following an official survey showing that China’s factory activity contracted for a seventh consecutive month in October.

Both Brent and WTI are on track to fall around 3% in October, as supply growth continues to outpace demand.

The Organization of the Petroleum Exporting Countries and other major non-OPEC producers have ramped up output to gain market share, further pressuring prices.

Additional supply is also expected to mitigate the impact of Western sanctions on Russian crude flows to key buyers China and India.

Ahead of Sunday’s meeting, sources familiar with OPEC+ discussions told Reuters that the group is leaning toward a modest output boost in December.

In total, OPEC+ members have raised production targets by more than 2.7 million barrels per day - roughly 2.5% of global supply - through a series of monthly increases this year.