Gold prices slipped from all-time highs during Asian trade on Thursday, trading back below the US$4,800 level as easing geopolitical tensions reduced demand for safe-haven assets.

By 3:45 pm AEDT (4:45 am GMT), spot gold was down 0.7% at $4,796.25 an ounce.

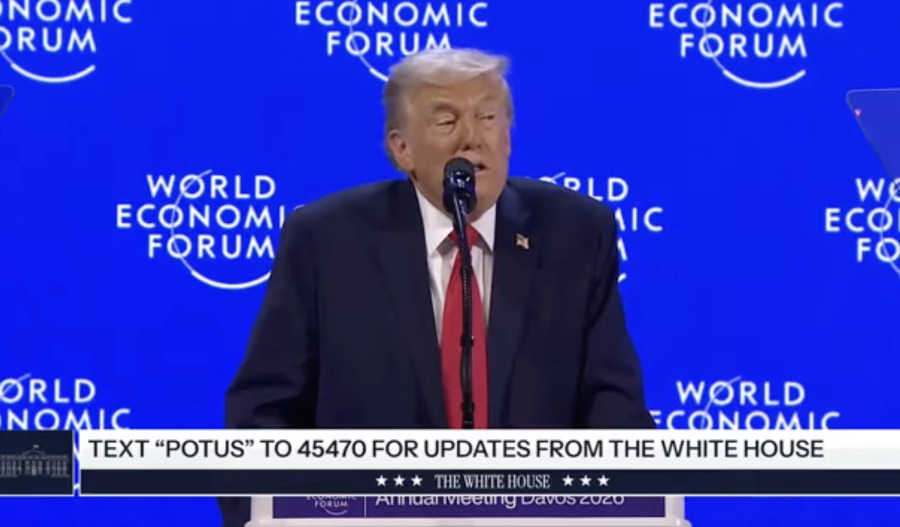

The pullback followed comments from United States President Donald Trump, who said he would step back from imposing tariffs on European nations that had opposed his push to take control of Greenland.

Trump added that the United States and the North Atlantic Treaty Organization had “formed the framework of a future deal with respect to Greenland”.

Optimism that a resolution to the dispute could be reached without escalating tariffs has weighed on traditional safe-haven assets such as gold in the near term.

However, Trump did not provide details on the parameters of the so-called “framework”, leaving uncertainty over what any agreement would entail.

Germany’s finance minister, Lars Klingbeil, warned against premature optimism following Trump’s decision to ease tariff threats, noting that renewed tensions between the United States and the European Union could still emerge.

Any signs of escalation would likely restore support for gold prices.

Separately, Goldman Sachs lifted its end-2026 gold price forecast to $5,400 an ounce from $4,900 previously, citing continued diversification into gold by private investors and emerging market central banks.

“We assume private sector diversification buyers, whose purchases hedge global policy risks and have driven the upside surprise to our price forecast, don't liquidate their gold holdings in 2026, effectively lifting the starting point of our price forecast,” the bank said in a note on Wednesday.

Investors are now looking ahead to a batch of U.S. economic data due later on Thursday, including the final reading of third-quarter gross domestic product, weekly initial jobless claims and the personal consumption expenditures price index.

Weaker-than-expected figures could weigh on the U.S. dollar and provide fresh support for the dollar-denominated precious metal.