Minutes from the Federal Reserve’s December policy meeting showed officials were sharply divided over the decision to cut interest rates amid lingering inflation concerns and uncertainty over the economic outlook.

The minutes, released on Tuesday (Wednesday AEDT), detailed discussions from the Federal Open Market Committee’s 9-10 December meeting, which ended with a 9–3 vote to lower the federal funds rate by 25 basis points to a range of 3.5%–3.75%.

It marked the most dissents since 2019 and highlighted deep divisions within the committee.

“Most participants judged that further downward adjustments to the target range for the federal funds rate would likely be appropriate if inflation declined over time as expected,” the document said.

However, policymakers differed over how quickly and how far rates should fall: “With respect to the extent and timing of additional adjustments to the target range for the federal funds rate, some participants suggested that, under their economic outlooks, it would likely be appropriate to keep the target range unchanged for some time after a lowering of the range at this meeting,” the minutes said.

The minutes also revealed that several officials viewed the decision as a close call. “A few of those who supported lowering the policy rate at this meeting indicated that the decision was finely balanced or that they could have supported keeping the target range unchanged,” the document noted.

Officials broadly agreed the United States economy was continuing to expand at a “moderate” pace, but they saw downside risks to employment alongside upside risks to inflation.

Disagreement centred on the relative strength of those forces, with indications that the vote could easily have gone the other way.

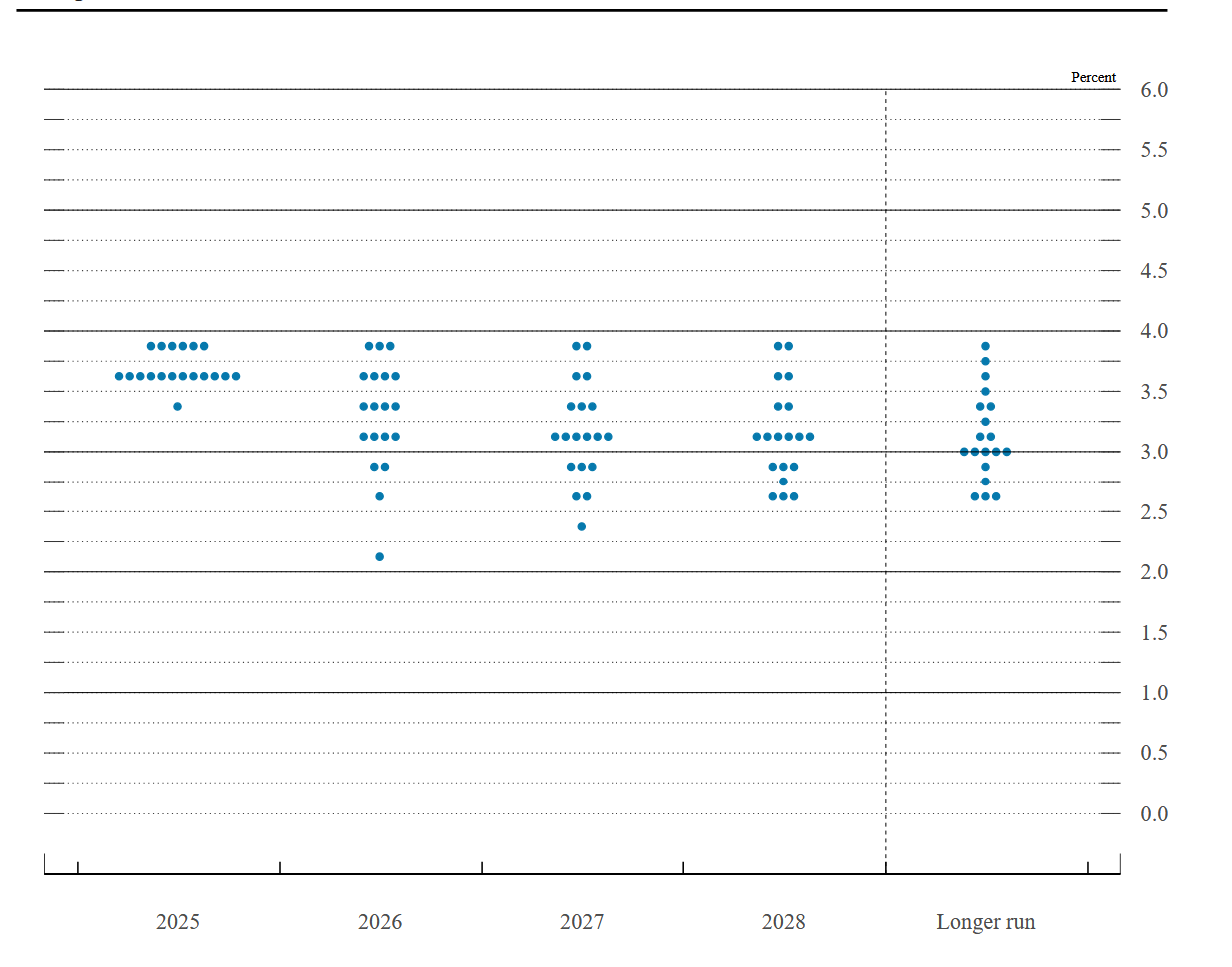

The meeting coincided with the release of the Fed’s quarterly Summary of Economic Projections, including the closely watched dot plot.

The projections pointed to another rate cut in 2026 followed by one more in 2027, which would bring the policy rate to around 3%, a level officials regard as neutral for economic growth.

Those opposing further easing “expressed concern that progress toward the Committee’s 2 percent inflation objective had stalled in 2025 or indicated that they needed to have more confidence that inflation was being brought down sustainably to the Committee’s objective.”

Officials also discussed the impact of President Donald Trump’s tariffs, agreeing they were contributing to inflation but largely expecting the effect to be temporary and to fade into 2026.

The minutes highlighted market volatility linked to artificial intelligence investment, noting that “developments regarding artificial intelligence (AI) also contributed to the volatility of the stock prices of the largest technology companies,” as capital spending accelerated and firms increasingly relied on debt to finance AI-related infrastructure.

Since the meeting, data has shown a labour market with slow hiring but limited layoffs, while inflation has eased gradually but remains above the Fed’s 2% target.

Economic growth has remained strong, with third-quarter gross domestic product (GDP) rising at a 4.3% annualised pace, exceeding expectations.

Even so, policymakers cautioned that some data remains incomplete due to lingering effects from a government shutdown, leading markets to expect the Fed to hold rates steady in the near term as officials assess incoming information.

The committee’s voting lineup is also set to change, with new regional presidents rotating into voting roles, potentially altering the balance of views.

At the same meeting, the Fed voted to resume bond purchases, acquiring about US$40 billion (A$59.7 billion) a month in short-term Treasury bills to stabilise funding markets and maintain ample reserves in the banking system.