SpaceX is reportedly weighing a share market debut that could redraw the power map of corporate America. The mechanism would issue two types of shares: One carrying standard voting rights, the other carrying “super votes”, typically 10 or 20 votes per share.

The effect is simple. Founders can sell economic ownership while retaining control of decisions.

CEO Elon Musk has argued publicly that meaningful influence requires around 25% of voting power - not necessarily ownership, but votes.

At Tesla, where he holds about 11% of shares, he has floated the idea of a similar structure to safeguard his long-term strategy in artificial intelligence and robotics.

The SpaceX proposal mirrors models used by Meta Platforms and Alphabet Inc.

Supporters of this model suggest such frameworks protect long-term innovation from short-term market pressure.

However, critics counter that unequal voting rights weaken accountability because public investors can own most of the stock yet hold limited say.

SpaceX is understood to be targeting a listing that could value the business north of US$1.5 trillion and raise as much as $50 billion.

If achieved, that would eclipse the 2019 float of Saudi Aramco, which raised $29 billion and still ranks as the world’s largest IPO.

This is not just a capital raising. It is a restructuring.

SpaceX has absorbed Musk’s artificial intelligence venture, xAI, broadening its remit beyond rockets and satellites.

The merger creates a combined valuation estimated at around US$1.25 trillion, but it also brings debt.

Musk accumulated roughly US$18 billion in borrowings tied to his takeover of Twitter — now X — and the build-out of xAI.

Investment banks, including Morgan Stanley, are understood to be examining refinancing options to tidy the balance sheet ahead of any listing.

Debt restructuring, in plain terms, means renegotiating loans to ease repayments or extend maturities. For IPO investors, it reduces uncertainty.

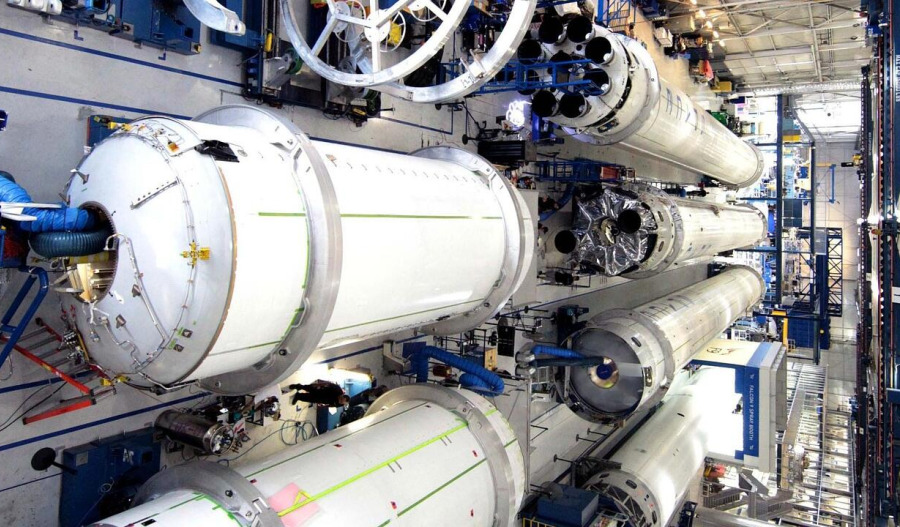

Operationally, SpaceX enters the public arena from a position of strength.

Revenue for 2025 is projected between $15 billion and $16 billion, with earnings before interest, tax, depreciation and amortisation near $8 billion.

Roughly nine million users now subscribe to the Starlink satellite broadband network, and the company completed 165 launch missions last year, which is more than half of global orbital launches.

By contrast, xAI remains in heavy investment mode, generating modest revenue while burning cash on data centres and advanced chips.

SpaceX has committed $2 billion to support the AI arm, underscoring the strategic pivot toward what some analysts call “orbital AI”, which places computing infrastructure in low Earth orbit to process data in space.

Folding a capital-intensive AI start-up into a profitable launch business complicates the story for investors who previously backed a pure-play space infrastructure leader.

Market reaction to the merger has been mixed, with some minority shareholders questioning the logic.

SpaceX is also expanding its board to guide the IPO process and oversee governance.

That step is standard practice before listing, particularly when dual-class shares are involved.

While a prospectus is yet to be filed, market conditions, regulatory approvals and debt negotiations could reshape the timetable.

Musk wants public capital without surrendering strategic command.

A dual-class structure would give him that buffer and create a corporate moat against activist investors seeking to redirect cash flow or curb ambition.

Whether investors accept limited voting power in exchange for exposure to Musk’s space-AI vision will determine if this becomes the largest listing in history.

Join our community of decision-makers. No card required

Join now