Walt Disney Company shares plunged after it reported a fall in operating income for the first quarter of the 2026 financial year (Q1 FY26), including a drop in earnings at its Entertainment division, and warned of “headwinds” for its United States theme parks.

The media and entertainment giant said net income fell 6% to US$2.402 billion (A$3.45 billion) in the quarter ended 27 December 2025 from $2.554 billion in the previous corresponding period (pcp).

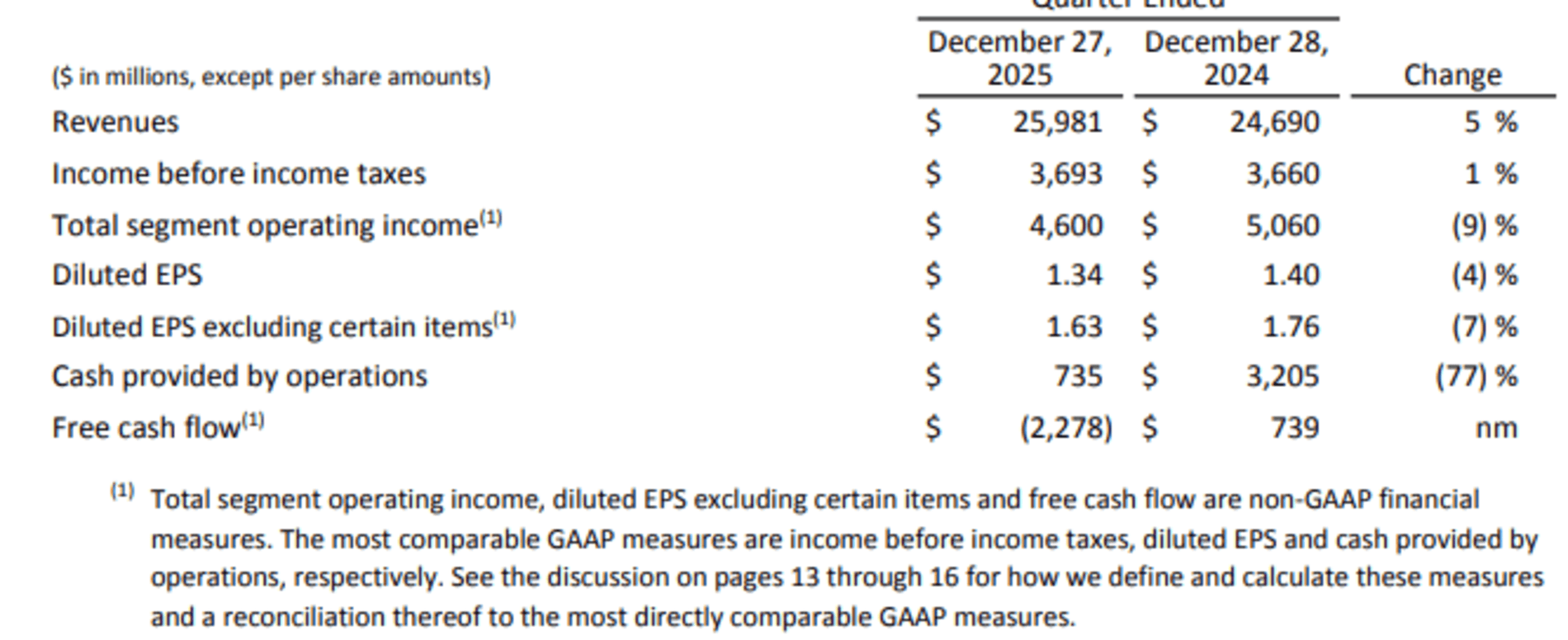

Diluted earnings per share (EPS) excluding certain items eased 7% to $1.63 while revenue rose 5% to $25.981 billion.

Markets were expecting EPS of $1.57 on revenues of $25.7 billion.

“We are pleased with the start to our fiscal year, and our achievements reflect the tremendous progress we’ve made,” Chief Executive Officer Robert Iger said in an earnings report.

He said Disney delivered a strong box office performance in calendar year 2025 with billion-dollar hits like Zootopia 2 and Avatar: Fire and Ash franchises that generated value across many of its businesses.

But Disney's entertainment unit, which includes its film studios, television networks and streaming services, reported a 35% drop in operating profit due to the cost of marketing these movies.

The company also said it expected modest operating income growth from its Experiences segment in FY26 due to factors including international visitation headwinds at its domestic theme parks, pre-launch costs for the Disney Adventure at Disney Cruise Line and pre-opening costs for World of Frozen at Disneyland Paris.

"The share price drop is very much to do with the parks business," Quilter Cheviot Head of Technology Research Ben Barringer was quoted in a Reuters story as saying.

"Its size means it ultimately matters more and thus will move the market.”

Disney’s board is reportedly meeting this week to appoint a successor to Iger, who was CEO from 2005 to 2020 and returned to the role in 2022.

Revenue beat the consensus forecast of $25.7 billion, while adjusted EPS of $1.63, which was down 7% from the pcp, was better than analysts' estimates of $1.57 per share.

But Disney shares (NYSE: DIS) closed $8.35 (7.40%) lower at US$ 104.45, capitalising the company at $185.23 billion, before rising to $104.58 in after-hours trading.