Walt Disney Company has doubled its operating income in the third quarter of the 2025 financial year (Q3 FY25) and increased its annual profit forecast.

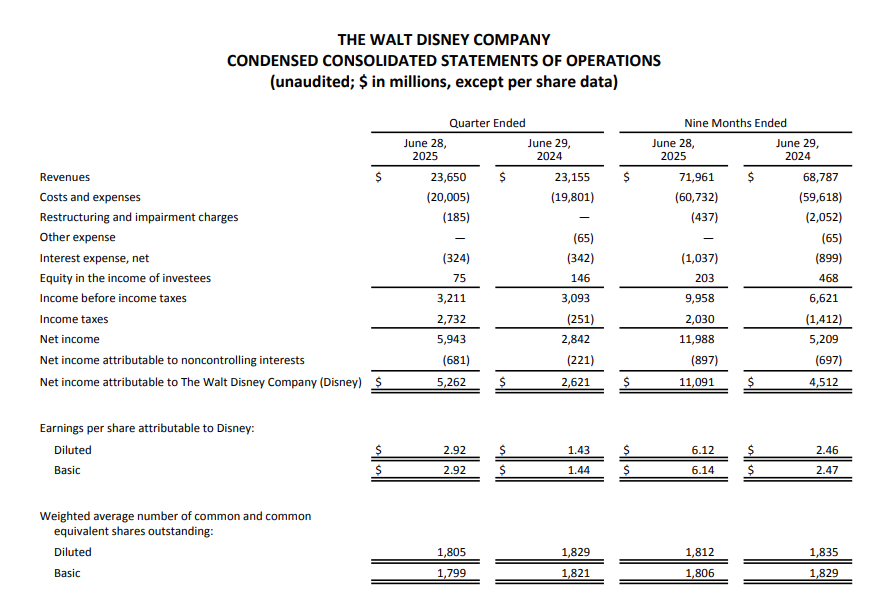

The Entertainment giant said net income increased to US$5.262 billion (A$8.13 billion) in the three months to 28 June 2025 from $2.621 billion in the previous corresponding period, on revenue which rose 2% to $23.7 billion.

The latest quarter included a $3.3 billion non-cash tax benefit recognised upon the change in the United States income tax classification of its Hulu streaming service.

The profit improvements were more modest but still strong before the impact of the tax benefit, with income before taxes rising 4% to $3.2 billion, segment operating income gaining 8% to $4.6 billion and adjusted earnings per share (EPS) increasing 16% to $1.61.

“We are pleased with our creative success and financial performance in Q3 as we continue to execute across our strategic priorities,” Chief Executive Officer Robert Iger said in a press release.

He said Disney was taking major steps forward in streaming with the upcoming launch of ESPN’s direct-to-consumer service, plans announced on Tuesday with the National Football League and the integration of Hulu into Disney.

“And we have more expansions underway around the world in our parks and experiences than at any other time in our history. With ambitious plans ahead for all our businesses, we’re not done building, and we are excited for Disney’s future,” Iger said.

In the first nine months of FY25, net income soared 145% to $11.091 billion and adjusted EPS rose 26% to $4.82 on revenue which rose 5% to $71.961 billion.

The company also forecast an 18% lift in adjusted EPS to $5.85 for FY25, powered by segment operating income growth in the double-digit percentages from its Entertainment business, 18% from its Sports business and 8% from Experiences.

Although adjusted EPS of $1.61 was higher than consensus forecasts of between $1.45 and $1.47, revenue of $23.7 billion was slightly below the top estimate of $23.75 billion.

Disney shares (NYSE: DIS) closed $3.15 (2.66%) lower at $115.17 on Wednesday (Thursday AEST), capitalising the company at $207.05 billion, before rising in after-hours trading to $115.23.