Walt Disney Company shares dived after it posted a 12% increase in operating income for the 2025 financial year (FY25) despite a drop in fourth quarter earnings and revealed it could not estimate the length and cost of its dispute with YouTube.

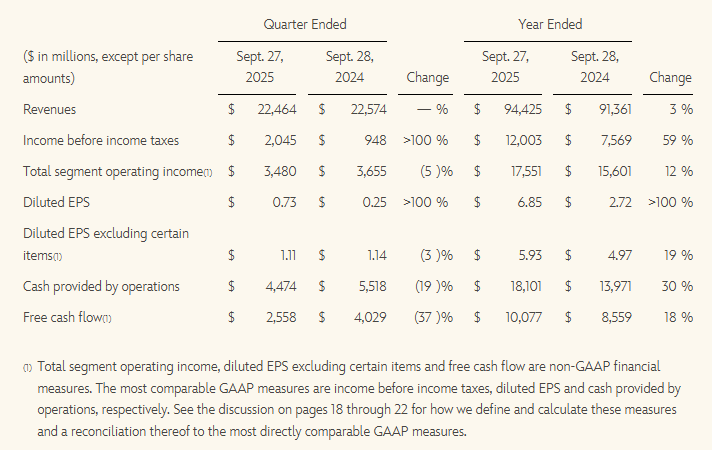

The global entertainment giant said segment operating income increased to US$17.56 billion (A$26.69 billion) in the 12 months to 27 September 2025 from $15.601 billion in the previous corresponding period on revenue which rose 3% to $94.43 billion.

Diluted earnings per share (EPS) more than doubled to $6.85.

But in the fourth quarter, operating income fell 5% to $3.48 billion, and diluted EPS excluding certain items dropped 3% to $1.11 on flat revenue of $22.46 billion.

Disney said full-year segment operating income increased 19% to $4.7 billion for entertainment, fell 2% to $911 million for sports and rose 8% to a record $10.0 billion for experiences.

“This was another year of great progress as we strengthened the company by leveraging the value of our creative and brand assets and continued to make meaningful progress in our direct-to-consumer businesses,” Chief Executive Officer Robert Iger said in a news release.

Disney forecast double-digit adjusted EPS growth in FY27 compared to fiscal 2026 and flagged that it was preparing for a potentially long fight with Alphabet (NASDAQ: GOOG) subsidiary YouTube TV over distribution of its television networks.

“On October 30, 2025, the Company’s channels were removed from YouTube TV following the expiration of the parties’ distribution contract without agreement on renewal terms, and the Company cannot predict how long this service blackout will last or reasonably estimate the adverse impact on our results of operations,” Disney said on its Form 10-K.

The company missed quarterly revenue expectations as the cable weakness overshadowed strong growth in the company's streaming and parks businesses central to its growth.

The company, which opened its Disneyland theme park in California in 1955, also owns film studios, television networks, resorts and streaming services.

Walt Disney (NYSE: DIS) closed $9.04 (7.75%) lower at $107.61 on Thursday (Friday AEDT), capitalising the company at $193.748 billion.