Australia’s second largest retailer Coles lifted its interim dividend despite net profit easing in the first half of the 2025 financial year (H1 FY25) as it benefitted from strikes at a competitor.

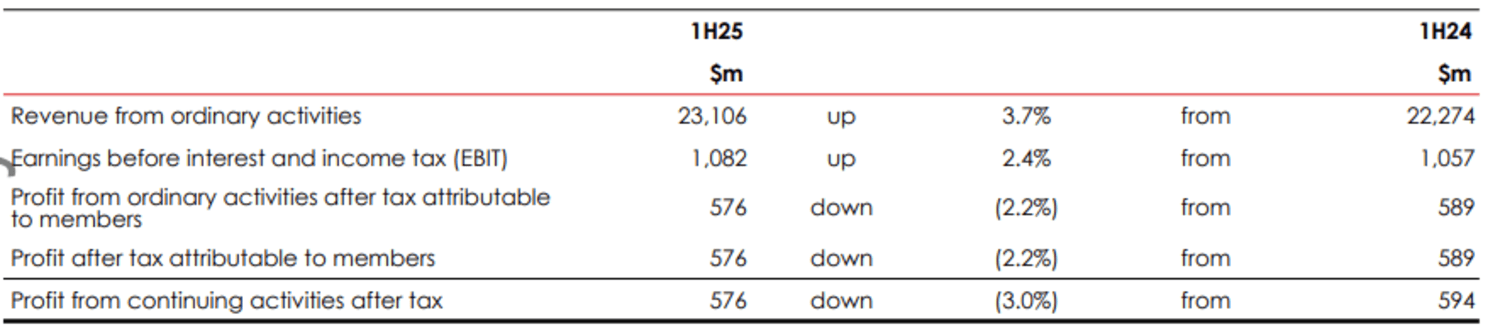

Coles, which operates about 800 supermarkets in Australia, said net profit after tax dropped 2.2% to A$576 million (US$363 million) in the period 1 July 2024 to 5 January 2025 although revenue increased by 3.7% to $23.106 million.

Australia’s second largest retailer after Woolworths (ASX: WOW) said earnings before interest and tax (EBIT) rose just 2.4% to $1.082 billion.

Coles said it “responded at pace” to a competitor’s supply chain disruption which delivered about $120 million in supermarket sales and $20 million in EBIT, referring to a strike which affected Woolworths in the same period.

Chair James Graham said it was particularly pleasing to see the benefits of capital investments in automation, data and technology, which allowed Coles to respond to demand spikes experienced during the half.

The Board declared a fully franked interim dividend of 37 cents per share to be paid on 27 March 2025 to shareholders registered on 6 March, up from 36 cents a year earlier.

Group CEO Leah Weckert said Coles had a strong focus on value, fresh quality and availability which supported volume-led supermarket growth.

“Pleasingly, we saw improving customer experience metrics during the period, reinforcing the importance of delivering affordability and a great shopping experience whilst customers continue to face cost of living pressures,” she said in an ASX announcement.

Coles announced that Graham would retire as Chair on 30 April to be replaced by director Peter Allen.

Coles shares (ASX: COL) closed on Wednesday at $19.69, down three cents (0.15%), capitalising the company at $26.39 billion.

Coles was floated on the ASX in 2018 at $12.75 per share after being demerged from Wesfarmers (ASX: WES), which acquired it in 2007.