Welcome to our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Salesforce revenue grows on strength of AI and cloud offerings

- Qantas revenue, customers up

- Nvidia, Heico reach new revenue highs

- AB InBev surges past sales estimates despite low volumes

- Aston Martin profits fall by 9%

- Lowe's, Synopsys beat estimates amid revenue slump

____________________________________________________________________________________

8:52 am (AEDT):

Good morning! Harlan Ockey here to walk you through today's earnings. We'll be hearing from the likes of Nvidia, Qantas, Coles, and Medibank.

Starting off with the NYSE, Salesforce (CRM) posted revenue growth, particularly in its artificial intelligence division. Revenue rose to US$10 billion last quarter, up 8% year-over-year, but missed estimates of $10.04 billion.

Overall revenue across its fiscal year was US$37.9 billion, a 9% increase over the previous year. Its full-year Data Cloud & AI revenue was $900 million, rising 120%. Almost half of the Fortune 100 use Salesforce's Data Cloud & AI services, the company said.

Adjusted earnings per share were US$2.78, above estimates of $2.61.

The company's guidance for the first quarter of its FY2026 includes revenue from US$9.71-9.76 billion.

“No company is better positioned than Salesforce to lead customers through the digital labour revolution. With our deeply unified platform, seamlessly integrating our Customer 360 apps, Data Cloud and Agentforce, we’re already delivering unprecedented levels of productivity, efficiency and cost savings for thousands of companies," CEO Marc Benioff said.

9:03 am (AEDT):

Turning to the ASX, Qantas (QAN) has ended a six year dividend holiday after increasing profit in the first half of the 2025 financial year (FY25).

Australia’s flag carrier said statutory profit after tax rose 6.2% to A$923 million (US$581 million) and underlying profit before tax jumped 11.2% to $1.385 billion on revenue which increased 9% to $12.129 billion in the six months to 31 December.

The Board announced an interim dividend of 16.5 cents per share and a special dividend of 9.9 cents per share, both fully franked and to be paid on 16 April 2025 to shareholders on record on 12 March 2025, representing the first payouts since FY19.

“The performance was driven by the strength of the Group’s dual brand strategy with demand for travel remaining strong across all customer segments,” Qantas said in an ASX announcement.

The airline said Qantas and Jetstar’s domestic and international businesses delivered increased profitability and carried almost 10% more customers.

Premium and corporate travel remained strong for Qantas while Jetstar carried a record number of customers in a high cost of living environment, with about one in three flying for less than $100.

“While customer satisfaction improved for all segments, there is more progress to be made,” it said.

Qantas said it expected strong travel demand across the portfolio heading into the second half with domestic unit revenue expected to rise 3-5% in the second half, international unit revenue expected to be flat, and net freight revenue expected to be $10-30 million higher, all compared with the second half of FY24.

Qantas shares had closed on Wednesday at $8.89, down 21 cents (2.31%), capitalising the company at $13.45 billion, having touched a record high of $9.64 earlier this month. Privatised in 1995 when the by the Australian Government sold its remaining 75% stake, the shares have risen more than 600% since then from the issue price of $1.25.

(Thank you to Garry West for the write-up! Read his full report here.)

9:09 am (AEDT):

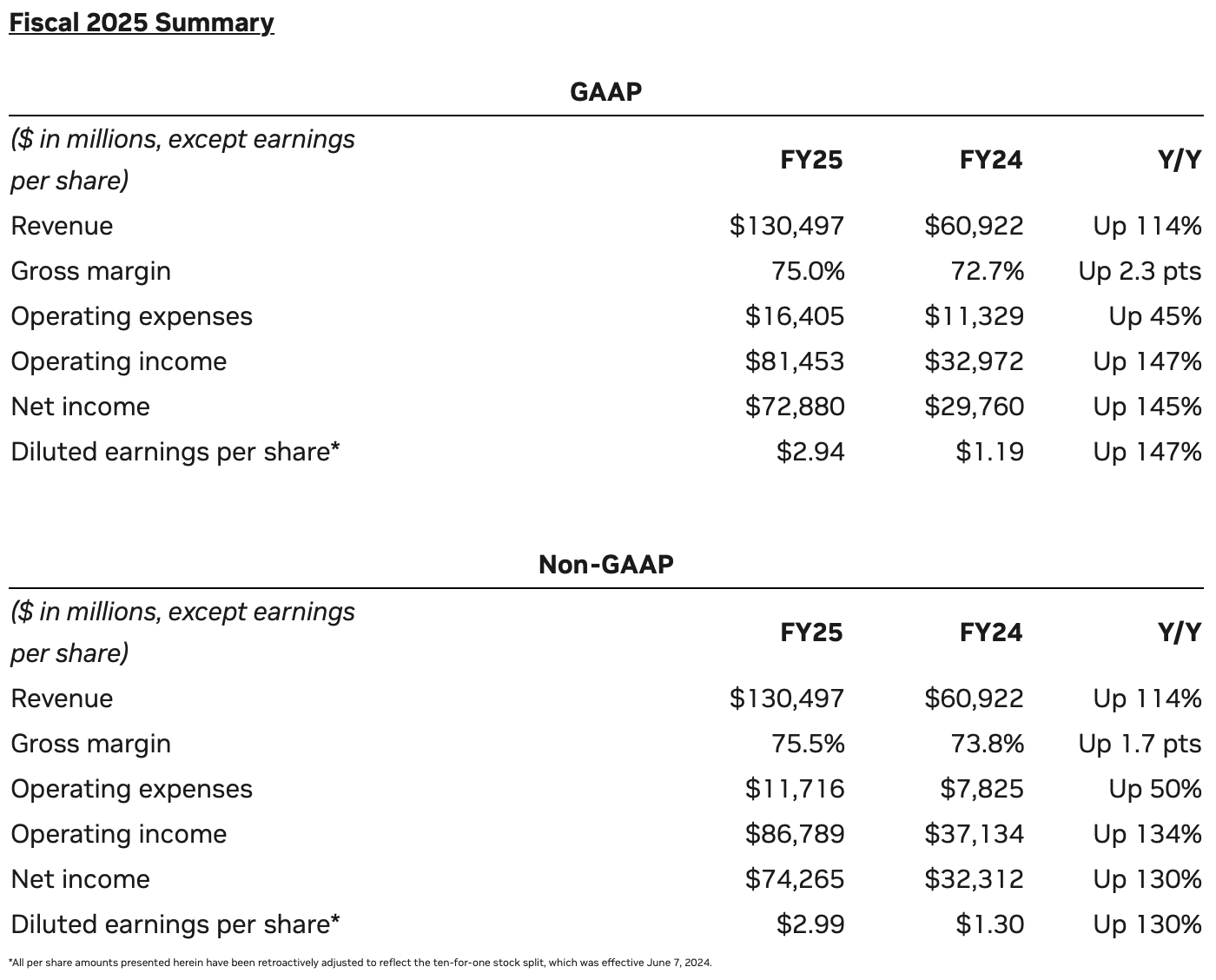

At the NASDAQ, Nvidia (NVDA) reported record quarterly revenue of approximately US$39.3 billion (A$62.5 billion), up 12% from the previous quarter and 78% from the same period last year.

Its data centre division reached a new all-time high of US$35.6 billion, growing 93% year-over-year.

Revenue across the fiscal year was US$230.5 billion, also a new record.

GAAP-adjusted net income was US$72.88 billion across the fiscal year, up 145%. GAAP diluted earnings per share were $2.94, rising 147%.

Guidance for the first quarter of FY2026 includes revenue of US$43 billion, plus or minus 2%.

Andrew Banks has the full story.

9:13 am (AEDT):

In a U.S. trading update, the Dow Jones Industrial Average fell by 0.4%. The Nasdaq Composite was up by 0.3% and the S&P 500 closed flat, with both ending four-day losing streaks.

Read Oliver Gray's full report here.

9:29 am (AEDT):

At the NASDAQ, eBay (EBAY) saw revenue grow by 1% year-on-year last quarter, in line with estimates. Its Q4 revenue was US$2.58 billion, with full-year revenue rising 2% to reach $10.3 billion.

Non-GAAP net income was US$607 billion last quarter, up 8%. Earnings per diluted share were $1.25, rising 16% and beating estimates of $1.20.

Gross merchandise volume was US$19.3 billion in Q4, up 4% year-over-year.

Its guidance for Q1 2025 includes revenue of US$2.52-2.56 billion, under LSEG analyst estimates of $2.59 billion. Its projected gross merchandise volume is $18.3-18.6 billion, below estimates of $18.8 billion.

“eBay achieved three consecutive quarters of GMV growth to end 2024, and we took significant steps toward our vision of reinventing the future of ecommerce for enthusiasts," said CEO Jamie Iannone. “We created a solid foundation to build upon in 2025, and our outlook reflects our confidence in eBay’s ability to drive sustainable, long-term growth.”

9:47 am (AEDT):

In Brussels, AB InBev (ABI) beat sales estimates, with revenue last quarter growing by 3.4% year-over-year to US$14.84 billion. LSEG estimates were $14.05 billion.

The company's underlying profit was US$1.77 billion last quarter, compared with $1.66 billion in Q4 2023. Underlying earnings per share were $0.88, rising from $0.82 year-over-year.

Volumes fell by 1.9% last quarter, however. The decline in volume was led by the Asia Pacific and its Global Export and Holding Companies, which posted drops of 12.7% and 23.4% respectively. In China, volumes declined by 19% last quarter due to inventory issues and a soft industry, with revenue falling in the country by 13.7%.

AB InBev's share price closed 8.56% higher after the results were released, reaching EU€56.80.

9:52 am (AEDT):

Returning to the ASX, Coles (COL) lifted its interim dividend despite profits easing in the first half of the 2025 financial year (H1 FY25).

Coles, which operates about 800 supermarkets in Australia, said net profit after tax dropped 2.2% to A$576 million (US$363 million) in the period 1 July 2024 to 5 January 2025 although revenue increased by 3.7% to $23.106 million.

Australia’s second largest retailer said earnings before interest and tax (EBIT) rose 2.4% to $1.082 billion.

Coles said it “responded at pace” to a competitor’s supply chain disruption which delivered about $120 million in supermarkets sales and $20 million in EBIT, referring to a strike which affected Woolworths in the same period.

Chair James Graham said it was particularly pleasing to see the benefits of capital investments in automation, data and technology which allowed Coles to respond to the spikes in demand experienced during the half.

The Board declared a fully franked interim dividend of 37 cents per share to be on 27 March 2025 to shareholders registered on 6 March, up from 36 cents a year earlier.

Group CEO Leah Weckert said Coles had a strong focus on value, fresh quality and availability which supported volume-led growth in supermarkets. “Pleasingly, we saw improving customer experience metrics during the period, reinforcing the importance of delivering affordability and a great shopping experience whilst customers continue to face cost of living pressures,” she said in an ASX announcement.

Coles announced that Graham would retire as Chair on 30 April to be replaced by director Peter Allen.

Coles shares closed on Wednesday at $19.69, down three cents (0.15%), capitalising the company at $26.39 billion. Coles was floated on the ASX in 2018 at $12.75 per share after being demerged from Wesfarmers (ASX: WES), which had acquired it in 2007.

(Thank you to Garry West for the write-up. Read Garry's full report here.)

10:12 am (AEDT):

ASX update: the poor run of luck for investors seeking capital appreciation is set to continue on the Australian Securities Exchange on Thursday with future trading pointing to a dip on the opening of the second last day of the reporting season.

At 9:40 am AEDT the S&P/ASX 200 March share price index (SPI) contract was trading 10 points (0.12%) lower than the previous settlement at 8,214.

The Australian market index had closed down 0.1% on Wednesday at 8,240.7 points, dropping to a six-week low and continuing an eight day losing streak.

(Thank you to Garry West for the write-up. Read his full story here.)

10:37 am (AEDT):

Still at the ASX, Ramsay Health Care (RHC) is expected to meet mixed sentiment at the open after the private hospital operator declared a significant full year net loss in one breath but then announced plans to sell its underperforming European business in the next.

Overall, while underlying profit was up 10.7% to $158.9 million — reflecting activity and revenue growth in all regions — the net loss came in at A$104.9 million once one-off costs of $263.8 million were included.

One off costs relate to the group’s underperforming Elysium Healthcare mental healthcare business in the UK which contributed $291 million towards the writedowns, plus $34 million in non-cash provisions.

Despite the mixed result, the dividend was steady at 40c.

Shareholders can take some solace from management’s decision to appoint Goldman Sachs to explore and advise on strategic options associated with offloading Ramsay’s 52.8% shareholding in underperforming Ramsay Santé which employs 38,000 people across five countries.

While there is no certainty any transaction will eventuate, Ramsay noted that it “will remain disciplined and give consideration to the current operating performance of Ramsay Santé, market conditions and execution certainty, which will influence the decision to undertake, and timing of, any strategic activity.”

(Thank you to Mark Story for the write-up. Read his full story here.)

11:24 am (AEDT):

U.S. futures update: By 11:10 am AEDT (12:10 am GMT), Dow Jones Industrial Average futures slipped 0.2% while S&P 500 futures and Nasdaq 100 futures added 0.1%.

In extended deals, Nvidia eased 0.5% after reporting its financial results. Salesforce and eBay shares fell by 5.3% and 8.9% respectively after missing revenue guidance expectations.

Oliver Gray has the full story.

11:41 am (AEDT):

Over at the NASDAQ: Synopsys (SNPS) saw revenue and earnings per share sink last quarter, but still beat analyst estimates.

Revenue was US$1.455 billion, down from $1.511 billion year-over-year.

Earnings per diluted share were US$3.03 in the first quarter of its FY2025, exceeding guidance and surpassing Zacks estimates of $2.81. Its earnings per share at the same time in FY2024 were $3.56, however.

Net income was US$473.2 million, falling from $525.5 million year-over-year.

"We delivered a solid start to the year, with non-GAAP earnings above guidance, and revenue in the upper end of our guided range," said CFO Shelagh Glaser. “These results are a product of our resilient business model, strong operational execution, and leading technology that is mission-critical to customers. We are reaffirming our full-year guidance including expectations for double-digit revenue growth.”

Synopsys' US$35 billion acquisition of software company Ansys was approved by the European Commission last month.

12:10 pm (AEDT):

At the LSE, Aston Martin (AML) reported declines in revenue and profit across 2024.

Revenue was UK£1.58 billion, falling 3% year-over-year. In Q4, revenue was £589.3 million, a 1% drop.

Its gross profit in 2024 was UK£583.9 million, down 9%. Total wholesale volumes also fell by 9% to reach 6,030.

“After a period of intense product launches, coupled with industry-wide and Company challenges, our focus now shifts to operational execution and delivering financial sustainability. I see great potential in Aston Martin, and our goal is to transition from a high-potential business to a high-performing one, better equipped to navigate future opportunities and uncertainties," said CEO Adrian Hallmark.

The company said it will dismiss 5% of its workforce, with the goal of saving UK£25 million.

Aston Martin's new plug-in hybrid vehicle Valhalla is due later in 2025. The launch of its first fully electric vehicle has again been delayed, after being pushed back to 2026 last year.

12:24 pm (AEDT):

Back at the ASX, Medibank (MPL) saw net profits rise by 13.8% to A$299 million last half, exceeding estimates by 5%.

Revenue grew by 6.1% to $4.27 billion. Underlying earnings per share were $0.108, up 13.8%.

Customer growth in the Australian market rose 0.9%. A total of $3.3 billion in claims was paid over the half.

Mark Story has the full report.

Chloe Jaenicke will take over for the next hour. See you later this afternoon!

12:53 pm (AEDT):

Good afternoon everyone, it’s Chloe Jaenicke here to take you through the next hour.

Media conglomerate Southern Cross Media Group (ASX: SXL) reported that 1H FY25 revenue was up 5.3% to A$209.7 million and EBITDA was up 24.6% to $24.1 million.

Momentum from strong 2H FY24 has driven improved 1H FY25 results in continuing operations.

The company said the increased financial performance was due to its continuing dominance of 25-54 audiences across regional and metro radio markets, improvements in advertising, disciplined cost management and strong digital audio revenue growth.

Southern Cross Media is expecting continued growth throughout the financial year, especially with LiSTNR which is predicted to have double-digit revenue growth in FY25 and FY26.

“Despite continued challenging advertising market conditions, our focus on executing our key commitments, including a focus on revenue growth, LiSTNR profitability, cost and capital discipline has translated to improved financial performance, with Audio EBITDA up 47%, on the back of 5% Audio revenue growth,” chief executive John Kelly said.

1:09 pm (AEDT):

Brazilian energy company, Petrobras Brasileiro’s (NYSE: PBR) financial debt reached its lowest level since 2008, sitting at around US23.2 billion at the end of 2024.

The company also reported a net profit of $7.5 billion for the year.

Petrobras CFO and investor relations director, Fernando Melgarejo said the results were greatly impacted by exclusive events. Without these events, the net profit would have been $19.4 billion for the year

“These are financial transactions between companies in the same group, which generate opposite effects that ultimately balance each other out economically,” Melgarejo said.

“This is because the exchange rate variation in these transactions enters the holding company’s net result in Brazil and negatively impacted the 2024 profit.”

Other contributing factors include the company’s adherence to a tax litigation notice in June 2024 alongside other external factors like the variation in the price of Brent and 40% reduction of the diesel crackspread.

For the Q4 2024, their net profit was $2.8 billion.

1:29 pm (AEDT):

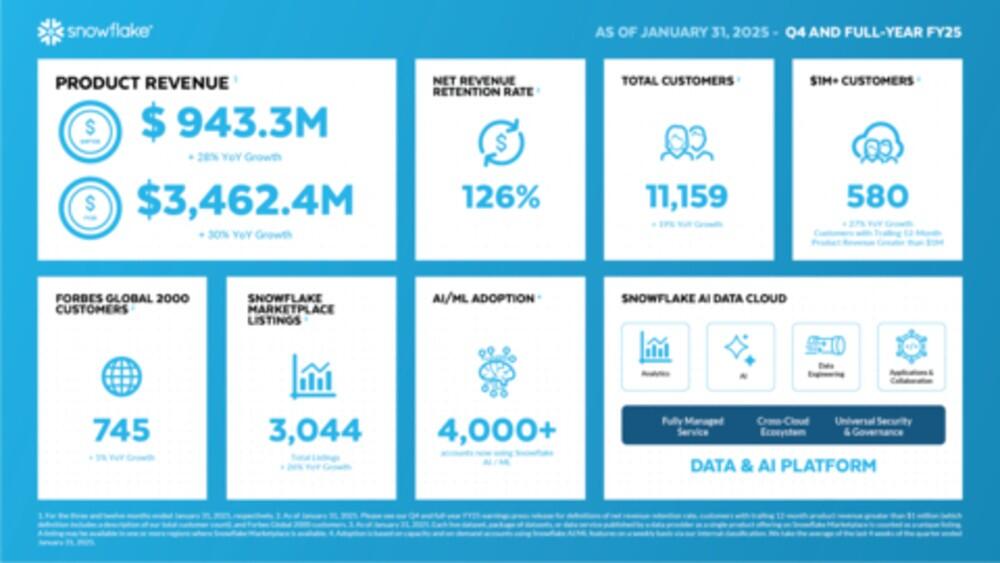

Revenue for cloud data storage company Snowflake (NYSE: SNOW) for the fourth quarter of 2024 grew 27% year-over-year to $986.8 million.

The majority of this was made up of the company's product revenue which rose 28% year-over-year to $943.3 million.

Product revenue was also strong for the fiscal year increasing 30% from the year before to $3.5 billion.

“We see tremendous opportunities ahead to support our customers throughout their end-to-end data lifecycle, and we are laser-focused on delivering on this vision,” Snowflake CEO, Sridhar Ramaswamy said.

1:43 pm (AEDT):

It's Harlan Ockey again, back to take you through the end of the day.

In an Asia-Pacific trading update, the region's markets have been mixed today. Australia’s S&P 200 gained 0.5%, and Japan’s Nikkei 225 rose by 0.2%. South Korea’s Kospi fell by 0.7%

The Shanghai Composite climbed 1% to 3,380.2, while the CSI 300 grew by 0.9%. Hong Kong’s Hang Seng Index jumped 3.3% to 23,787.9.

Read Oliver Gray's full story here.

2:24 pm (AEDT):

At the NYSE, Lowe's (LOW) exceeded estimates last quarter, though revenue fell year-over-year.

Revenue was US$18.55 billion, down from $18.6 billion the previous year, but above estimates of $18.3 billion.

Its adjusted earnings per share were US$1.93, compared with estimates of $1.84.

"Our results this quarter were once again better-than-expected, as we continue to gain traction with our Total Home strategic initiatives," said CEO Marvin R. Ellison. “We remain confident in the long-term strength of the home improvement industry, and we are equally confident in our strategy to capitalize on the expected recovery.”

The company's full FY2025 guidance includes revenue of US$83.5-84.5 billion, with diluted earnings per share at $12.15 to $12.40.

2:32 pm (AEDT):

ASX update: Wisetech Global's (WTC) share price has fallen by more than 2% after the news that ASIC is investigating the company, which has been beset by a boardroom revolt and allegations of inappropriate behaviour by founder Richard White.

White was reappointed executive chairman this week after four of the six WiseTech directors resigned due to irreconcilable differences over his ongoing role in the company. He had stepped down as CEO in October 2024 amid allegations of inappropriate behaviour, including intimidation, bullying, and paying for a multimillion-dollar house for an employee, and he transitioned into a consulting role.

At 1:45 pm AEDT (2:45 am GMT), WiseTech shares were trading at $94.38, down $2.12 or 2.20% on the day and about 20% over the last month.

(Thank you to Garry West for the write-up.)

3:05 pm (AEDT):

At the NYSE, Agilent Technologies (A) reported year-over-year revenue growth of 1.4% last quarter, beating estimates.

Revenue was US$1.68 billion, above Zacks estimates by 0.86%.

Non-GAAP earnings per share were US$1.31, rising 2% year-over-year and surpassing estimates of $1.27.

“The Agilent team delivered better than our expectations in Q1. As a result of a solid start to the year, we’re maintaining our core growth and EPS expectations for the year," said CEO Padraig McDonnell.

Its Life Sciences & Diagnostics and CrossLab Group divisions, the company's largest, saw revenue increase to US$647 million and $696 million, respectively. This represents year-over-year growth of 4% and 1%.

The company's full-year outlook projects revenue of US$6.68-6.76 billion, with $1.61-1.65 billion expected this quarter.

3:50 pm (AEDT):

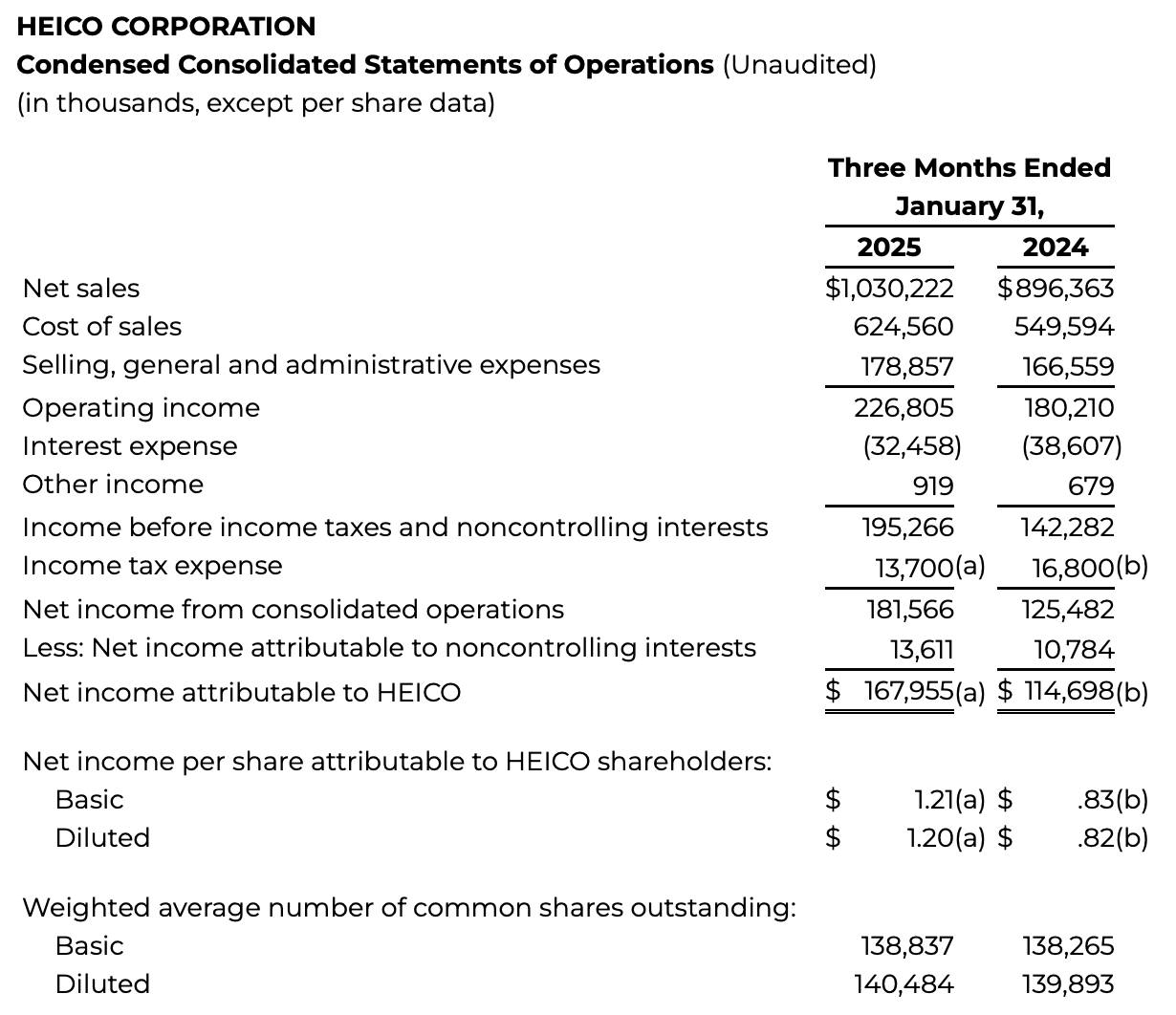

Still at the NYSE, Heico (HEI) posted a 46% year-over-year increase in net income last quarter, reaching US$168 million.

Revenue climbed by 15% to US$1.03 billion. This surpassed Zacks estimates of $971.3 million, and is a new high for the company.

Its Flight Support division reported its eighteenth consecutive quarter of revenue growth, increasing by 15% to a record US$713.2 million last quarter.

The Electronic Technologies division saw revenue rise by 16% year-over-year to US$330 million.

“We are thrilled to announce all-time record quarterly net income, operating income and net sales, principally driven by double-digit organic growth within both the Flight Support Group and Electronic Technologies Group, as well as the contributions from our fiscal 2024 and 2025 acquisitions. The strong organic growth reflects increased demand across all of the Flight Support Group's product lines and for the Electronic Technologies Group's defense, space and aerospace products,” said CEO Laurans Mendelson.

4:33 pm (AEDT):

And at the NYSE again, TJX (TJX) beat expectations on earnings per share and revenue last quarter. TJX is the parent company of TJ Maxx and TK Maxx.

Revenue last quarter was US$16.35 billion, flat from the previous year and above LSEG estimates of $16.2 billion.

Earnings per diluted share were US$1.23, up 1% year-over-year and exceeding estimates of $1.16. Its full-year earnings per diluted share were $4.26.

"We delivered outstanding top-and bottom-line results that exceeded our guidance for the year. We surpassed $56 billion in annual sales, drove a 4% comparable store sales increase, significantly increased profitability, and opened our 5,000th store during the year," said CEO Ernie Herrman.

TJX's comparable in-store sales rose across its divisions last quarter, with TJX Canada boasting the largest growth at 10%. Overall store sales grew by 5% last quarter, and 4% across its full fiscal year.

Its Marmaxx division, which includes the U.S.' TJ Maxx operations and is the company's largest, saw revenue of US$9.97 billion. This is a 1% decrease year-over-year, though TJX noted the equivalent quarter in FY2024 was one week longer.

The company's full-year FY2026 guidance includes overall store sales growth of 2-3%. Its projected earnings per diluted share is US$4.34-4.43, which would be an increase of 2-4% over FY2025.

During FY2025, the company opened 131 new stores to reach 5,085 retail locations. TJX acquired a 35% stake in Emirati retailer Brands for Less in August, and plans to open its first stores in Spain in early 2026.

That's all from me today. Tomorrow, we'll see earnings from companies like Dell, HP, Warner Bros. Discovery, TPG Telecom, and PEXA. Till next time!