Qantas Airways has ended a six-year dividend holiday after increasing profit in the first half of the 2025 financial year (FY25).

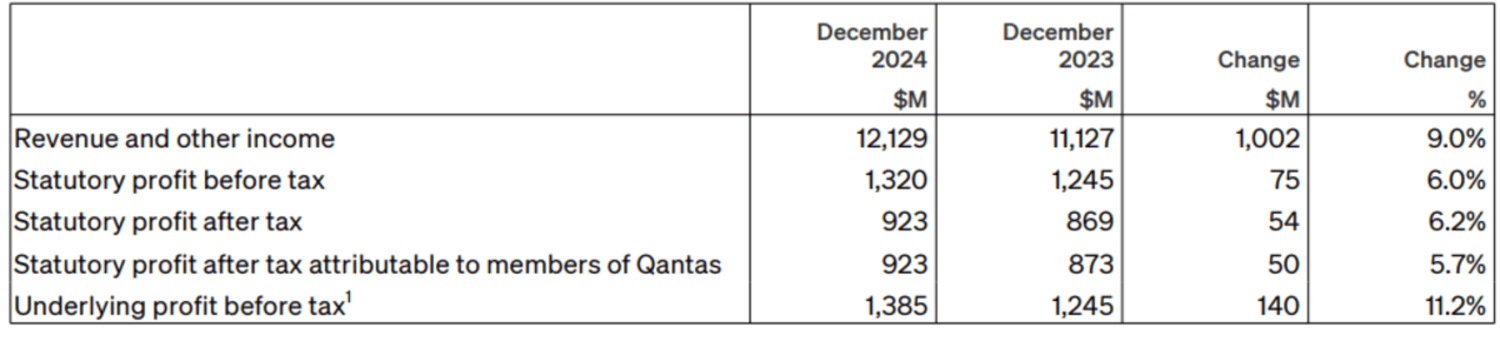

Australia’s flag carrier said statutory profit after tax rose 6.2% to A$923 million (US$581 million) and underlying profit before tax jumped 11.2% to $1.385 billion on revenue which increased 9% to $12.129 billion in the six months to 31 December.

The Board announced an interim dividend of 16.5 cents per share and a special dividend of 9.9 cents per share, both fully franked and to be paid on 16 April 2025 to shareholders on record on 12 March 2025, representing the first payouts since FY19.

“The performance was driven by the strength of the Group’s dual brand strategy with demand for travel remaining strong across all customer segments,” Qantas said in an ASX announcement.

The airline said Qantas and Jetstar’s domestic and international businesses delivered increased profitability and carried almost 10% more customers.

Premium and corporate travel remained strong for Qantas while Jetstar carried a record number of customers in a high cost of living environment, with about one in three flying for less than $100.

“While customer satisfaction improved for all segments, there is more progress to be made,” it said.

Qantas said it expected strong travel demand across the portfolio heading into the second half with domestic unit revenue expected to rise 3-5% in the second half, international unit revenue expected to be flat, and net freight revenue expected to be $10-30 million higher, all compared with the second half of FY24.

Qantas (ASX: QAN) shares had closed on Wednesday at $8.89, down 21 cents (2.31%), capitalising the company at $13.45 billion, having touched a record high of $9.64 earlier this month.

Privatised in 1995 when the by the Australian Government sold its remaining 75% stake, the shares have risen more than 600% since then from the issue price of $1.25.