Nvidia has announced its financial results for the fourth quarter and fiscal year 2025. The company reported record quarterly revenue of approximately A$62.5 billion (US$39.3 billion), up 12% from the previous quarter and 78% from the same period last year.

The data centre segment also saw record revenue of around A$56.6 billion, up 16% from the previous quarter and 93% year-on-year.

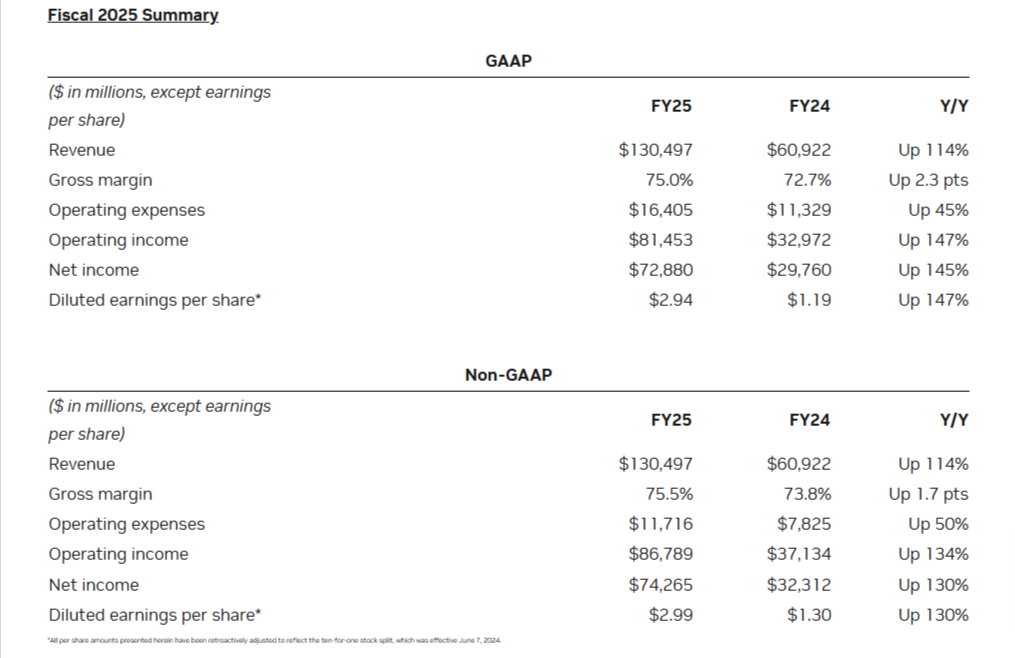

For the full fiscal year, Nvidia achieved a record revenue of A$207.5 billion (US$130.5 billion), up 114% from the previous year. GAAP earnings per diluted share for the quarter were $1.41, up 14% from the previous quarter and 82% year-over-year, while non-GAAP earnings per diluted share were $1.41, up 10% from the previous quarter and 71% year-over-year.

The key pros of the report include impressive revenue growth driven by strong demand for Nvidia's Blackwell AI supercomputers and data centre GPUs.

The company's leadership in the AI chip market has positioned it well to capitalise on the growing demand for AI infrastructure. Additionally, Nvidia's successful ramp-up of massive-scale production of Blackwell AI supercomputers has resulted in billions of dollars in sales in its first quarter.

However, there are some cons to consider. Concerns over supply chain issues for Blackwell chips and potential restrictions on exports to China due to national security concerns could impact future growth. Investors are also wary of AI infrastructure growth sustainability, given the recent slowdown in capital expenditures by key customers.

Looking ahead, Nvidia's outlook remains positive, with the company anticipating continued strong demand for its AI chips.

For the first quarter of fiscal 2026, Nvidia has set its revenue guidance at approximately A$68.4 billion, plus or minus 2%. GAAP and non-GAAP gross margins are expected to be around 70.6% and 71.0%, respectively, plus or minus 50 basis points. GAAP and non-GAAP operating expenses are projected to be approximately A$8.3 billion and A$5.7 billion, respectively. GAAP and non-GAAP other income and expense are forecasted to be income of approximately A$636 million, excluding gains and losses from non-marketable and publicly-held equity securities. GAAP and non-GAAP tax rates are expected to be around 17.0%, plus or minus 1%, excluding discrete items.

In terms of meeting analysts' expectations, Nvidia's fourth-quarter results exceeded expectations. Analysts projected revenue of around A$60.6 billion, and Nvidia delivered A$62.5 billion. The company's strong performance and positive outlook have reinforced its position as a leader in the AI chip market. Investors remain bullish about its future prospects. Despite some challenges, Nvidia's impressive growth and continued innovation in AI technology make it a company to watch in the coming years.

Nvidia's founder and CEO, Jensen Huang, highlighted the strong demand for Blackwell AI supercomputers. Huang also noted that reasoning AI adds another scaling law, making models smarter with increased compute for training and long thinking.

“Demand for Blackwell is amazing as reasoning AI adds another scaling law — increasing compute for training makes models smarter and increasing compute for long thinking makes the answer smarter,” said Huang.

“We’ve successfully ramped up the massive-scale production of Blackwell AI supercomputers, achieving billions of dollars in sales in its first quarter. AI is advancing at light speed as agentic AI and physical AI set the stage for the next wave of AI to revolutionise the largest industries.”

Nvidia will pay its next quarterly cash dividend of A$0.02 per share on April 2, 2025, to all shareholders of record on 12 March, 2025. This dividend reflects the company's commitment to returning value to its shareholders while continuing to invest in growth and innovation.

Overall, Nvidia's strong financial performance and positive outlook make it a compelling investment opportunity for global investors.

At the time of writing, Nvidia's (NASDAQ: NVDA) stock price was US$131.28, with a market cap of approximately US$3.22 trillion.

Related content