Quantum computing stocks have plummeted after Nvidia CEO Jensen Huang said the technology would not be widely usable for at least 15 years.

Stocks like Rigetti Computing fell 40% after Huang’s comments, while IonQ and Quantum Computing Inc both dropped by 37%.

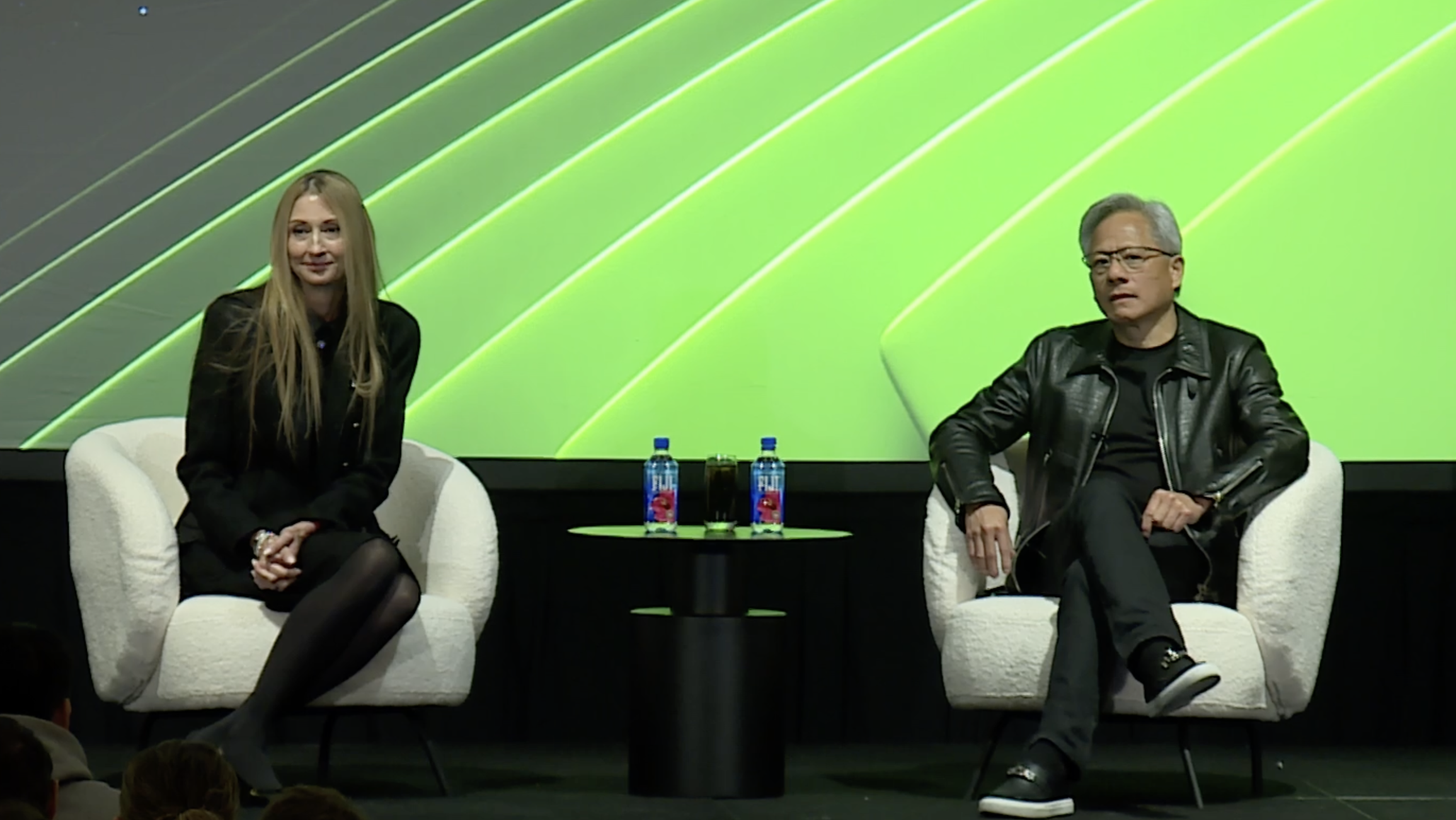

“If you kind of said 15 years for very useful quantum computers, that would probably be on the early side. If you said 30, it’s probably on the late side,” Huang said at a Consumer Electronics Show (CES) financial analyst question-and-answer session. “But if you picked 20, I think a whole bunch of us would believe it.”

Rigetti is valued at around US$4.4 billion, and IonQ is valued at $10 billion.

Quantum computing stocks soared after Google announced its Willow quantum chip in December. Willow can perform calculations in under five minutes that would take a standard supercomputer 10 septillion years.

Both governments and the private sector have invested heavily in quantum computing. Because quantum computing bits can represent different values simultaneously, scientists and investors hope it can be used to rapidly calculate possible solutions in a variety of fields.

Nvidia’s own quantum computing endeavours include CUDA-Q, a development platform for quantum computing applications.

The company also said at CES that it would release its own AI supercomputer, known as Project Digits, and a platform to develop physical AI systems.

Nvidia’s (NASDAQ: NVDA) share price closed at US$140.11, down slightly from its previous close at $140.14. Its market capitalisation is $3.4 trillion.

Related content