Asia-Pacific markets rebounded on Thursday as risk appetite returned, tracking gains on Wall Street after United States President Donald Trump walked back his threats to impose tariffs on European countries over Greenland.

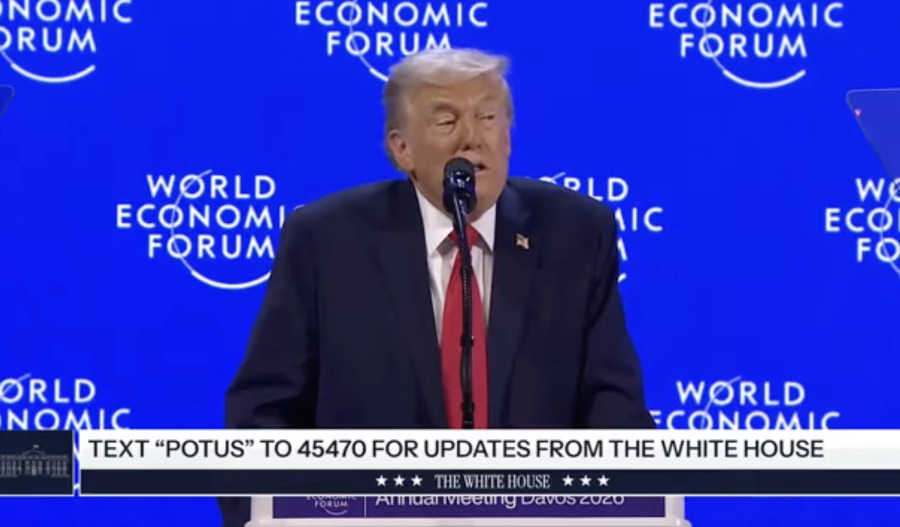

Investor sentiment improved further after Trump said at the World Economic Forum in Davos that he would not use force to acquire the Arctic island, easing fears of a potential escalation in geopolitical tensions.

Trump also said via a post on Truth Social that he had “formed the framework of a future deal with respect to Greenland and, in fact, the entire Arctic Region”.

By 11:40 am AEDT (12:40 am GMT), Australia’s S&P/ASX 200 was up 0.8%, Japan’s Nikkei 225 had gained 1.1%, and South Korea’s KOSPI 200 was 1.5% higher.

On the data front, South Korea’s economic growth slowed in the December quarter as a sharp slump in construction investment and weaker exports outweighed modest gains in household consumption. The economy expanded 1.5% year on year in the October–December period, according to central bank advance estimates, missing expectations of 1.9% and down from 1.8% growth in the prior quarter.

In Japan, export growth in December undershot forecasts, rising 5.1% year on year, as shipments to the U.S. recorded a double-digit decline.

Economists had expected exports to grow 6.1%, unchanged from November.

Japanese exports were largely pressured through much of 2025 by tariff uncertainty, before rebounding later in the year following a U.S. trade deal that cut duties to 15%.

In Australia, fresh labour force data from the Australian Bureau of Statistics (ABS) showed the economy added 65,000 jobs in December, with the unemployment rate falling to a seasonally adjusted 4.1%.

Markets were expecting an increase of 30,000 jobs and for the unemployment rate to tick up to 4.4% from 4.3% in the previous month.

Overnight in the U.S., major benchmarks rebounded, with the Dow Jones Industrial Average, S&P 500 and Nasdaq Composite each closing 1.2% higher.

Commodity prices were also firmer, with Brent crude oil rising 0.5% to settle at US$65.24 a barrel. Spot gold jumped 1.4% to close at a fresh record high of US$4,831.38 an ounce.

In China, the Shanghai Composite edged up 0.1% to 4,116.9, while the CSI 300 also added 0.1% to 4,723.1.

Hong Kong’s Hang Seng Index rose 0.4% to 26,585.1, while India’s BSE Sensex fell 0.3% to a fresh 14-week low of 81,909.6.

European markets finished mixed on Wednesday. The UK’s FTSE 100 inched up 0.1% to 10,138.1, Germany’s DAX slipped 0.6% to 24,561.0, and France’s CAC 40 added 0.1% to 8,069.2.