CEO Lisa Su cites "insatiable" AI demand and key partnerships with OpenAI, Meta, and Oracle as drivers for a massive data centre expansion, as analysts raise price targets.

Shares for Advanced Micro Devices (NASDAQ: AMD) swung during Tuesday's session, ultimately closing down 2.32% to US$238.31, in a potential "sell-the-news" reaction to its highly anticipated Financial Analyst Day.

The movement came as CEO Lisa Su laid out an aggressive financial forecast, projecting that AMD's overall revenue would expand by ~35% per year to 2030.

AMD's ambitious growth is to be driven by what she described as an "insatiable" demand for artificial intelligence chips.

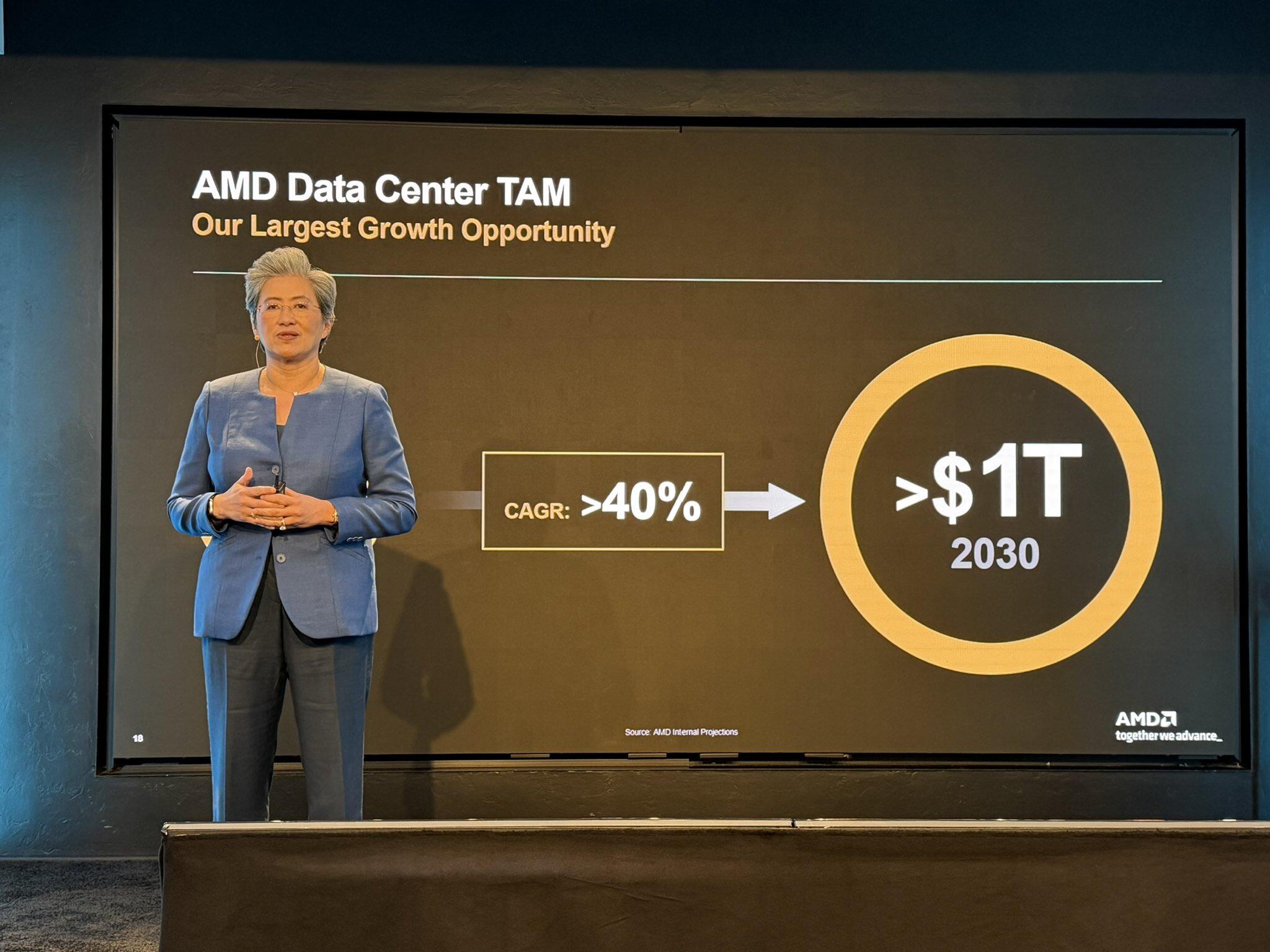

The primary engine for this expansion is the company’s AI data centre business, which Su expects to grow at a staggering 80% per year over the same time period.

This trajectory puts the business on track to hit "tens of billions of dollars" in sales by 2027.

Ultimately, Su said AMD is positioned to achieve a "double-digit" share in the highly competitive data centre AI chip market within the next five years.

This is a direct challenge to the market's current leader, Nvidia, which holds an estimated 90%-plus market share.

That dominance has given Nvidia a market capitalisation of over $4.6 trillion, which dwarfs AMD’s valuation of roughly $387 billion.

To counter this, AMD's plan involves more than just selling individual chips.

Roadmap rolled out

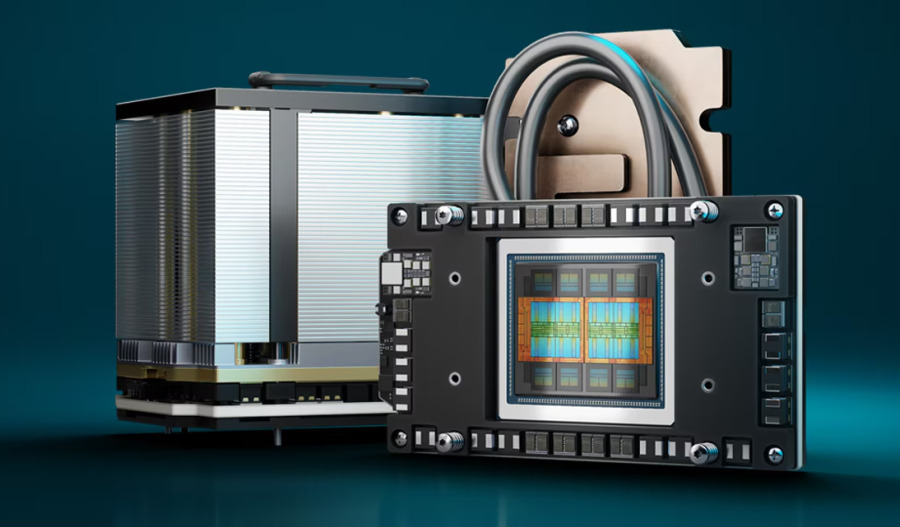

The company unveiled a new product roadmap focused on delivering complete, rack-scale AI systems.

A centrepiece of this strategy is "Helios", AMD's first full server rack solution, set to be deployed in the third quarter of 2026 as a direct competitor to Nvidia's GB200 systems.

The Helios racks will be powered by AMD's newly announced "Zen 6" CPU architecture, codenamed "Venice", which will be built on TSMC's 2nm process and feature enhanced AI pipelines.

These new CPUs will work alongside the company's next-generation MI400 and MI500 series AI accelerators, with traction already materialising into major deals.

In October, AMD announced a multi-billion dollar partnership with OpenAI to sell its Instinct AI chips over multiple years, starting with enough chips in 2026 to power a 1-gigawatt facility.

Significantly, as part of the deal, the AI startup could end up taking a 10% stake in the chipmaker.

Big deals and chip expectations

Su also highlighted long-term deals with other tech giants, including Oracle and Meta, cementing AMD's role as a critical partner in the AI build-out.

Wall Street analysts reacted positively to the ambitious targets, with firms like Rosenblatt, Benchmark, Evercore ISI, Stifel, and UBS issuing "Buy" or "Outperform" ratings.

Price targets were also raised, with Rosenblatt setting a $300 target, Wedbush at $290, and JP Morgan at $270.

However, analysts also pointed to significant risks.

Some, like Wedbush's Matt Bryson, noted that the "largest x-factor is not TAM, but rather quality and delivery timing" of the new chips.

Bank of America's Vivek Arya highlighted that AMD is attempting to execute its first rack-scale solution, while its rival Nvidia is already preparing to launch its third-generation product.

Analysts also remain focused on AMD's software stack, ROCm, with feedback still described as "mixed" compared to Nvidia's dominant and deeply entrenched CUDA platform.

Despite the day's share price dip, investors have taken note of the company's aggressive pivot to AI, with AMD shares having nearly doubled in value so far in 2025.