Woolworths shares tanked 11% at Wednesday's open as the company cut its dividend after posting a 19.1% fall in net profit after tax (NPAT) for the 2025 financial year (FY25), but forecast an improvement in the current year.

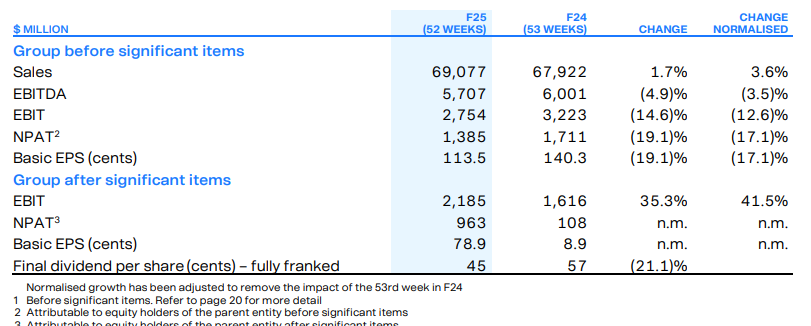

Australia’s largest retailer said NPAT dived to A$1.385 billion (US$900 million) in the 52 weeks ended 29 June 2025, compared with $1.711 billion in the previous corresponding period (pcp) as revenue grew by just 1.7% to $69.077 billion.

Directors declared a fully franked 45 cents per share final dividend to be paid on 26 September to shareholders registered on 3 September, down from 57 cents a year earlier, bringing the full year payment to 84 cents, well down on $1.44 in the pcp.

The 14.6% drop in earnings before interest and tax (EBIT) to $2,754 billion was driven by its Australian Food and BIG W businesses.

Excluding tobacco, average prices fell year on year for the sixth consecutive quarter, while value for money continued to improve and a focus on availability and elevating retail execution was also contributing to momentum in customer scores.

Woolworths reported “more stability” in Australian Food, but second half (H2) and current trading was below its ambition, while key customer metrics were improving in H2 through lower prices and focus on retail execution.

Group CEO Amanda Bardwell said Woolworths had taken action to reposition the group for long-term sustainable growth after a highly disrupted first half.

“While there is more to do and current trading remains below our ambition, we have seen some early positive signs with improving customer scores,” she said in an ASX announcement.

Three focus areas for 2025 were “getting it right for our customers”, lowering shelf prices, increasing specials, absorbing cost price increases on everyday items and making pricing clearer and easier to understand.

Bardwell said Woolworths expected an improved financial performance in FY26, driven by Australian Food, a continued recovery in New Zealand Food and a return to profitability in BIG W.

She said the medium-term ambition was to deliver sustainable mid to high single-digit EBIT growth through consistent growth from Woolworths Retail, improved profits from New Zealand Food and BIG W and incremental growth from its complementary businesses and services.

“Together, this will support our double-digit total shareholder return aspiration,” Bardwell said.

Woolworths shares (ASX: WOW) were trading $3.53 or 11% lower at $29.86 on Wednesday, capitalising the company at $39.67 billion.