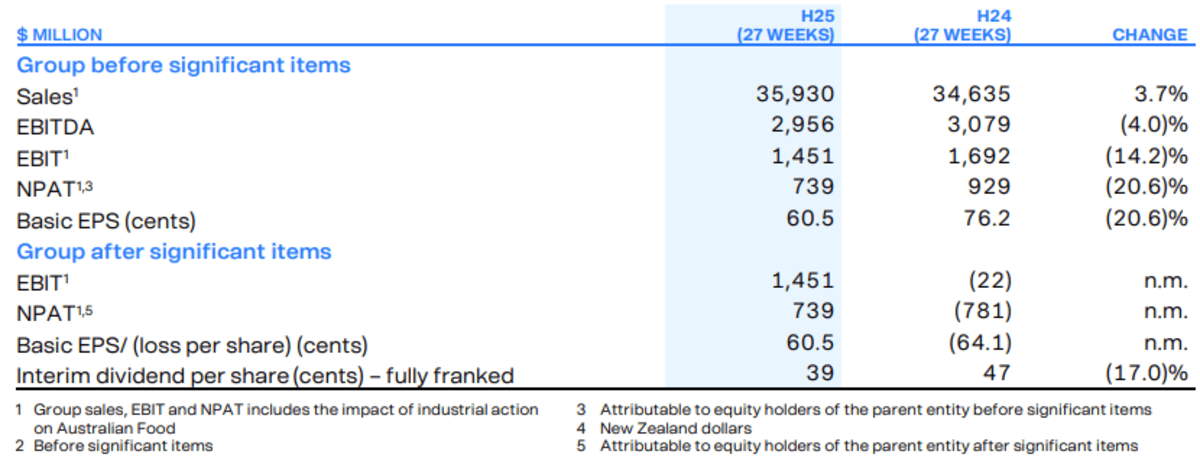

Woolworths has returned to a bottom line profit in the first half of the 2025 financial year despite a challenging operating environment which included strikes.

Australia’s largest retailer said net profit after tax in the half year to 5 January 2025 was A$741 million, compared with a $773 million loss in the previous corresponding period.

The prior period included a $1.492 billion goodwill impairment, a $209 million loss relating to Endeavour Group and a $13 million impairment relating to the transformation and rebranding of Countdown stores to Woolworths New Zealand.

Woolworths said earnings before interest and tax (EBIT) dropped 14.2% to $1.451 billion on sales which grew 3.7% to $35.9 billion.

The company said the decline in EBIT reflected 17 days of industrial action, value-seeking customer behaviour, supply chain commissioning and dual-running costs and a lower contribution from BIG W in a highly competitive discount retail segment.

Directors declared a fully franked 39 cents per share interim dividend, down from 47 cents a year earlier, to be paid on 23 April to shareholders on record on 6 March.

CEO Amanda Bardwell said customer “metrics” had begun to improve following a challenging half which was impacted by industrial action and ongoing cost-of-living pressures.

“We remain committed to providing value to our customers in an environment where household budgets remain under pressure and customers continue to shop around,” Bardwell said in an ASX announcement.

“Our priorities for 2025 are clear and we are already underway. We have an opportunity to further improve the shopping experience for our customers, we are taking steps to simplify our business, and are committed to unlocking the full potential of the Group.”

Woolworths (ASX: WOW) had closed on Tuesday at $31.56, up 31 cents (0.99%), capitalising the company at $38.55 billion.