Warner Bros. Discovery reported its fourth-quarter and full-year 2024 results, revealing a mixed performance.

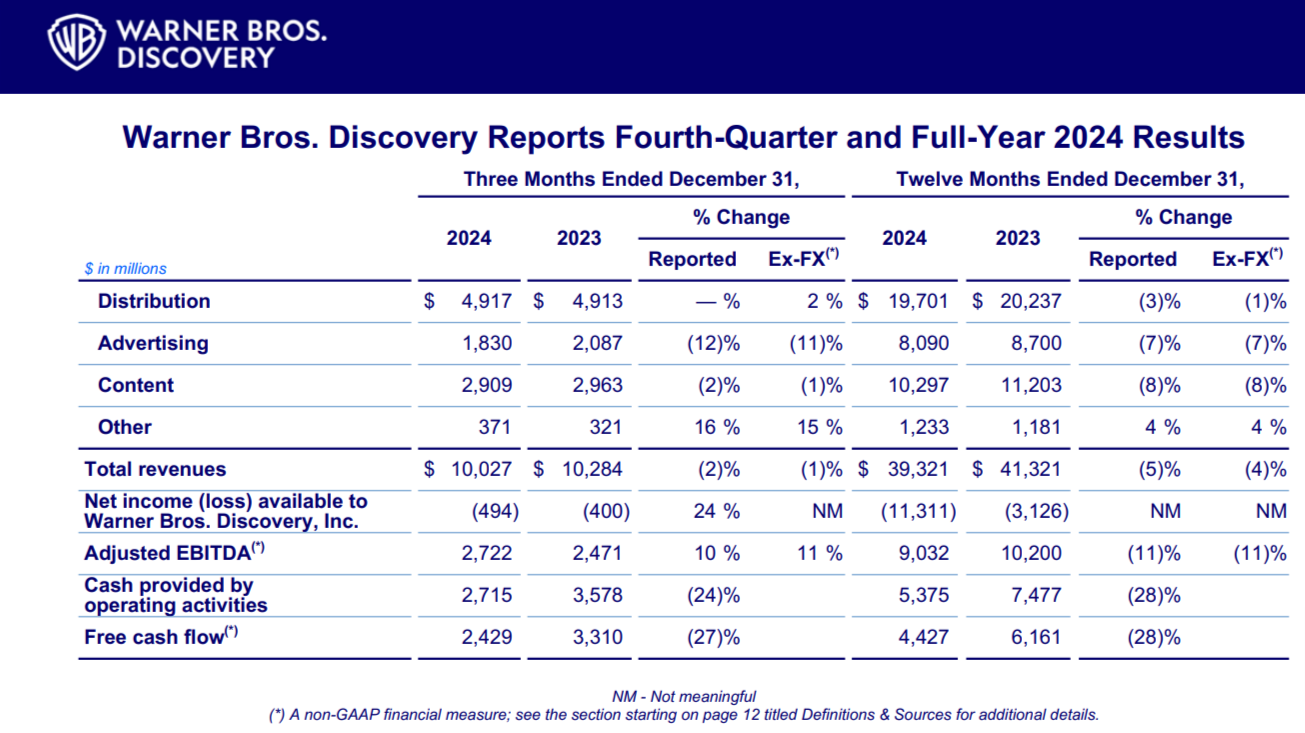

In Q4 2024, the company achieved total revenues of US$10 billion (A$16.044 billion), a slight 1% ex-FX decrease compared to the prior year quarter.

Distribution revenues saw a 2% ex-FX increase, driven by growth in global direct-to-consumer (DTC) subscribers, although this was partially offset by declines in domestic linear pay TV subscribers.

Advertising revenues, however, decreased by 11% ex-FX due to domestic linear audience declines and a soft advertising market. Content revenues remained relatively unchanged.

For the full year 2024, Warner Bros. Discovery reported total revenues of $39.3 billion, a 4% ex-FX decrease from the prior year. Distribution revenues decreased by 1% ex-FX, impacted by the exit from AT&T SportsNet and continued declines in domestic linear pay TV subscribers.

In a shareholder letter, the media and entertainment company said it has a “clear path” to hit 150 million global subscribers by the end of 2026.

Sky will launch Max in the United Kingdom and Ireland in the second quarter of 2026, and in Germany and Italy in the first quarter.

WB-owned Max, (aka HBO Max) is an American subscription video on-demand over-the-top streaming service.

“In this generational media disruption, only the global streamers will survive and prosper, and Max is just that,” CEO David Zaslav said on the company’s earnings call.

Advertising revenues fell by 7% ex-FX, with growth in domestic DTC ad-lite subscribers unable to offset domestic linear audiences declines and a weak advertising market. Content revenues also decreased by 8% ex-FX, attributed to Hogwarts Legacy and Barbie's strong performance in the prior year.

The company's net income for Q4 2024 was $0.5 billion, which included $1.9 billion of pre-tax acquisition-related amortisation of intangibles, content fair value step-up, and restructuring expenses.

Total Adjusted EBITDA for the quarter was $2.7 billion, an 11% ex-FX increase compared to the prior year quarter, primarily due to growth in the DTC and Studios segments.

Operating activities provided $2.7 billion, and free cash flow was $2.4 billion. The company ended the quarter with 116.9 million DTC subscribers, an increase of 6.4 million subscribers compared to Q3.

For the full year 2024, Warner Bros. Discovery's net income was $11.3 billion, including $7.5 billion of pre-tax acquisition-related amortisation of intangibles, content fair value step-up, and restructuring expenses, as well as a $9.1 billion non-cash goodwill impairment charge in the Networks segment.

Total Adjusted EBITDA for the year was $9 billion, an 11% ex-FX decrease compared to the prior year. Operating activities provided $5.4 billion, and free cash flow was $4.4 billion. The company ended the year with $34.6 billion net debt.

Shares of WBD rose nearly 10% in trading on Thursday (Friday AEDT). At the time of writing, the Warner Bros Discovery Inc (NASDAQ: WBD) stock price was US$11 - +0.50 (4.76%), with a market cap of approximately $26.98 billion.