Walmart has reported a 56% surge in consolidated net income for the second quarter of the 2026 financial year (Q2 FY26).

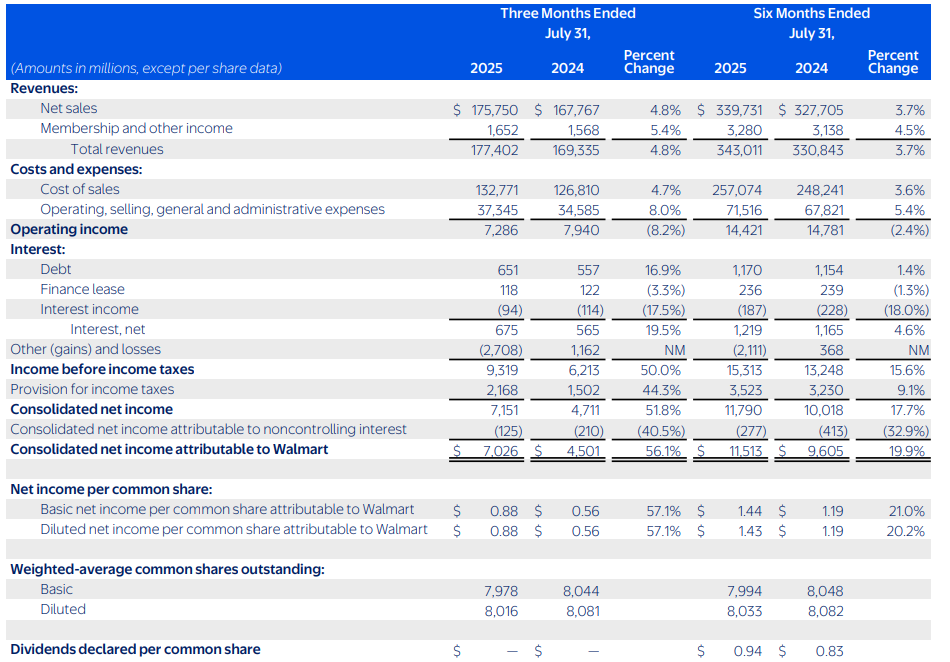

The United States-based global retailer said net income rose to US$7.206 billion (A$11.10 billion) in the three months ended 31 July 2025 from $4.501 billion in the previous corresponding period (pcp).

The main reason for the increase was the inclusion of a $2.708 billion gain on equity and other investments in Q2 compared with a $1.162 billion loss in the pcp.

Operating income, which strips out one-off items, fell 8.2% to $7.286 billion due mostly to legal and restructuring costs, but rose 4.8% on an adjusted basis, while revenue grew 4.8% to $177.402 billion.

Global ecommerce jumped 25% with growth across all segments.

Walmart upgraded Q3 net sales guidance to growth of 3.75% to 4.75% but left adjusted operating income guidance at growth of 3.5% to 5.5%.

President and CEO Doug McMillon said the 0.4% adjusted operating income growth in constant currency terms in Q2 was below expectations as it absorbed a 560 basis points headwind of general liability claims in the United States.

“We're still driving towards growing profit faster than sales this year, and that's reflected in our guidance,” he said on an earnings call.

He said Walmart was keeping prices as low as possible to manage the impact of tariffs.

Chief Financial Officer John David Rainer said the impact of tariffs would be less pronounced than previously anticipated with one third of Walmart’s sales coming from imported products.

Walmart Inc. (NYSE: WMT) shares closed $4.60 (4.49%) lower at $97.96 on Thursday, capitalising the company at $781.76 billion, as Q2 adjusted earnings per share of 68 cents came in below the average estimate of 74 cents.

Founded in 1962, Walmart is the world’s largest retailer by revenue and operates in 19 countries.