Another American investment bank has reaped the trading opportunities offered by volatile markets with Citigroup Inc announcing a 21% increase in quarterly earnings as higher revenue and lower expenses offset a higher credit cost.

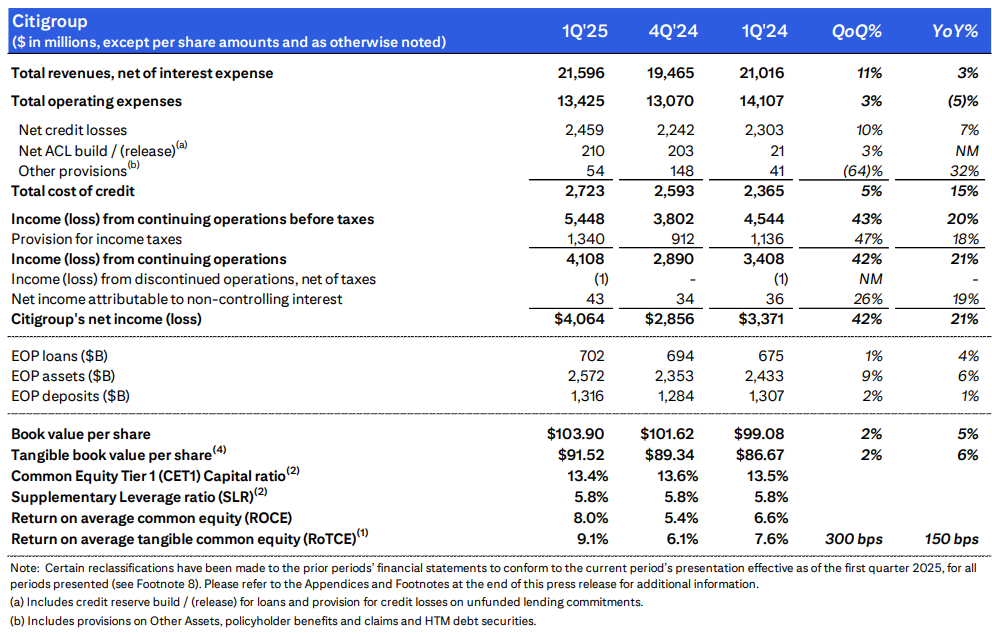

The banking and financial services company said net income for the first quarter of the 2025 financial year was US$4.064 billion (A$6.45 billion), compared with $3.371 billion in the previous corresponding quarter.

Diluted earnings per share (EPS) grew 24% to $1.96 on revenue which increased 3% to $21.6 billion.

Citigroup said revenue rose 12% from its markets division due to strong client activity and monetisation, 12% from banking as its mergers and acquisitions business almost doubled, 24% from wealth and 2% from United States personal banking (USPB).

It said market revenue growth was driven by increased client activity in fixed income and equity derivatives products and higher market volatility in fixed income.

The cost of credit rose 15% to $2.7 billion because of higher allowances for credit losses related to the deterioration in the macroeconomic outlook and higher net credit losses in card portfolios in USPB.

“With net income of $4.1 billion we delivered a strong quarter marked by continued momentum, positive operating leverage and improved returns in each of our five businesses,” CEO Jane Fraser said in a media release.

“When all is said and done, and longstanding trade imbalances and other structural shifts are behind us, the U.S. will still be the world’s leading economy, and the dollar will remain the reserve currency.”

This mirrored the experience of other U.S. banks including Goldman Sachs, which on Tuesday unveiled a 15% increase in net earnings for the first quarter of the 2025 financial year as its equities traders took advantage of volatile financial markets.

The results of JP Morgan Chase (JPM.N), Bank of America (BAC.N) and Morgan Stanley (MS.N) were also lifted by strong equities trading.

EPS exceeded LSEG estimates of $1.85 per share, according to Reuters.

Citigroup (NYSE: C) shares closed $1.18 (1.87%) higher at $64.33 on Wednesday (Thursday AEST).