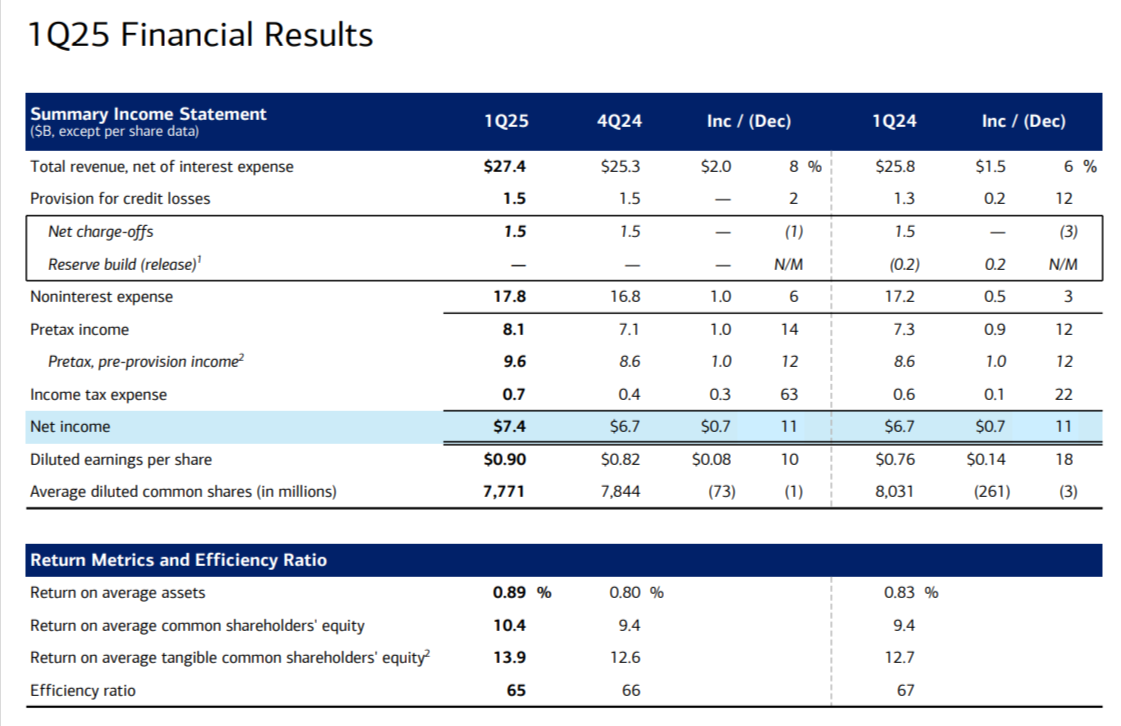

Bank of America (BoA) had a successful start to 2025, reporting a total profit of $7.4 billion (A$11.67 billion) for the first three months of the year.

This is higher compared with $6.7 billion in the same period last year.

The bank's revenue grew by 6%, reaching $27.4 billion, largely due to higher interest earned on loans and fees from its services.

Reuters reports BoA's headcount fell to 212,732 as of 31 March, compared with 213,193 in the previous quarter.

BoA's Chair and CEO Brian Moynihan noted that people and businesses manage their finances well despite potential economic challenges. The bank’s strong foundations in multiple areas continue to drive its growth.

Moynihan said: “We had a good first quarter, with earnings per share of $0.90 up from $0.76 last year. This reflected growth in net interest income and fee income, while sales and trading delivered its 12th consecutive quarter of year-over-year revenue growth. Our business clients have been performing well; and consumers have shown resilience, continuing to spend and maintaining healthy credit quality. Though we potentially face a changing economy in the future, we believe the disciplined investments we have made for high-quality growth, our diverse set of businesses, and the team’s relentless focus on Responsible Growth will remain a source of strength.”

Consumer Banking Success: Consumer banking focuses on regular people and small businesses. The segment made $2.5 billion in profit, with revenue increasing to $10.5 billion. Deposits (money held in accounts) were slightly lower than last year, but still much higher than pre-pandemic levels. People spend more using debit and credit cards, with $228 billion in card transactions. Over 250,000 newly opened checking accounts were opened, marking 25 consecutive growth quarters. Investments in this segment grew significantly, showing that people save and invest actively.

Global Wealth and Investment Management Growth: This part of the bank helps people with significant savings grow their wealth. It earned $1 billion in profit and increased its revenue by 8%. The value of bank assets (like stocks and investments) reached $4.2 trillion, a 5% increase from last year. Growth was driven by new client relationships and higher market values. Nearly nine out of 10 clients in this segment use digital tools, showing that tech plays a big role in managing wealth effectively.

Global Banking and Markets Success: Global banking earned $1.9 billion in profit, helped by strong growth in deposits and fees from banking services for businesses. Its loan balances for middle-sized businesses also grew by 6%. On the other hand, global markets saw a significant increase in income from sales and trading, hitting $5.7 billion. Trading revenue from areas like equities (company stocks) and fixed income (bonds) showed solid growth, highlighting strong market activity. Both segments demonstrated the bank’s ability to cater to businesses as well as investors.

Overall Financial Health: The bank is in great shape financially. It has $2 trillion in deposits and continues to grow its loan activities, offering more support to borrowers. It maintains strong capital reserves, which are essential for safety during economic uncertainties. Importantly, the bank returned $6.5 billion to its shareholders through dividends and share repurchases, signaling confidence in its performance. Its book value per share rose, meaning each piece of ownership in the bank is now worth more, showing increased trust and success.

At the time of writing, Bank of America's (NYSE: BAC) stock was trading at US$37.99. Bank of America's market cap stands at US$288.83 billion (A$455.43 billion).