Shares in Viva Energy Australia plunged after it was revealed that illegal tobacco sales behind organised crime gang firebombings cost it almost $100 million in the last six months.

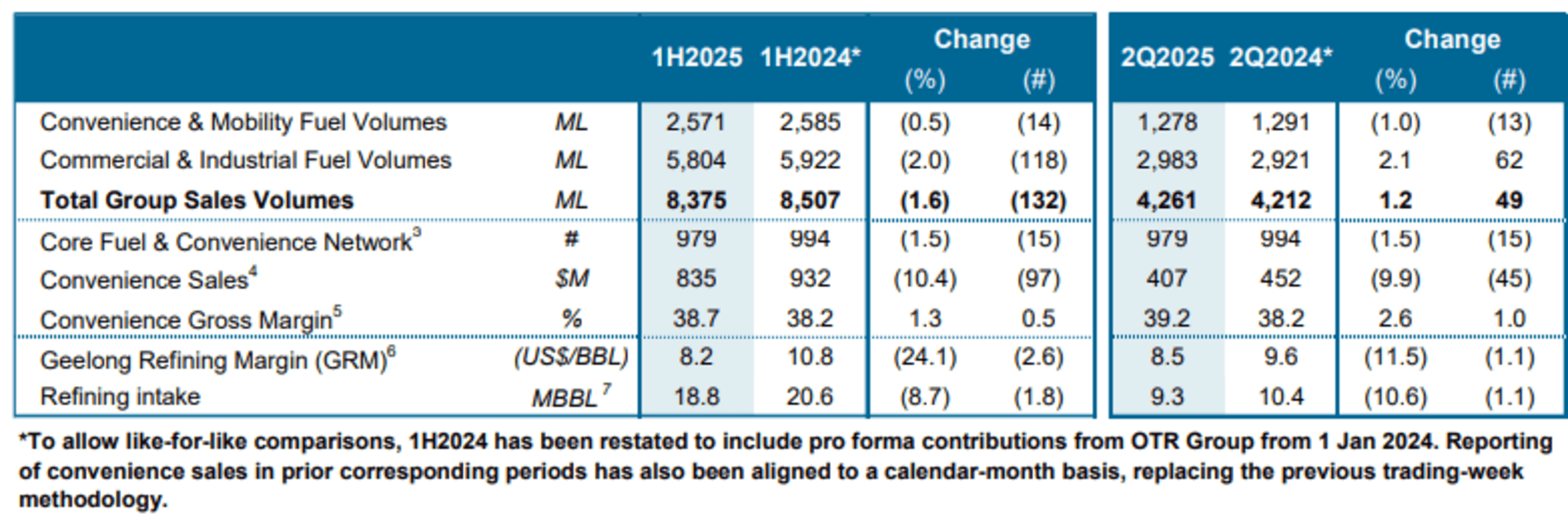

The company said sales from convenience stores at its service stations plunged $97 million to $835 million in the six months ended 30 June 2025.

“Convenience sales were down 10% compared with the same period last year, driven by a decline in tobacco sales which fell 27% due to the impact of new tobacco packaging laws taking effect and the continued growth in illicit tobacco trade,” Viva said in an ASX announcement.

Lower sales were partly offset by higher gross margins, which rose to 39.2% in the second quarter, due to changes in product mix, product range and supplier initiatives.

At the time of writing Viva shares were trading 22 cents (9.82%) lower at $1.98, capitalising the company at $3.19 billion, after trading between $1.93 and $2.08.

A wave of bombings and arson attacks in the last few years has been attributed to a violent underworld war over control of an illegal tobacco market created by high taxes on legal cigarettes.

Viva also said unaudited earnings before interest, tax, depreciation and amortisation (EBITDA) at replacement cost (RC) in the first half of 2025 were expected to be about $300 million with a positive contribution from its energy and infrastructure (E&I) business offset by corporate costs.

This compares with $451.7 million in the first half of the 2024 year ending 31 December at RC, which removes the distorting impact of oil price changes over time.

It said EBITDA from its convenience and mobility (C&M) and commercial and industrial (C&I) businesses was expected to be about $310 million, above the midpoint of the previous guidance range.

Convenience sales (ex-tobacco) fell 2% in the first half, although in the second quarter they were in line with the prior corresponding period (pcp), while C&M fuel sales declined 0.5% to 2.571 million litres with retail fuel margins strengthening in the second quarter.

Viva’s Geelong Refinery realised a refiner margin of US$8.20 a barrel, 24.1% below the pcp, on an intake of 18.8 million barrels, down 8.7%, due to an unplanned outage in January, minor turnaround activity and higher energy costs.