Azzet reports on three ASX stocks with market-moving updates to share today.

Viva Energy tumbles on 1H trading update

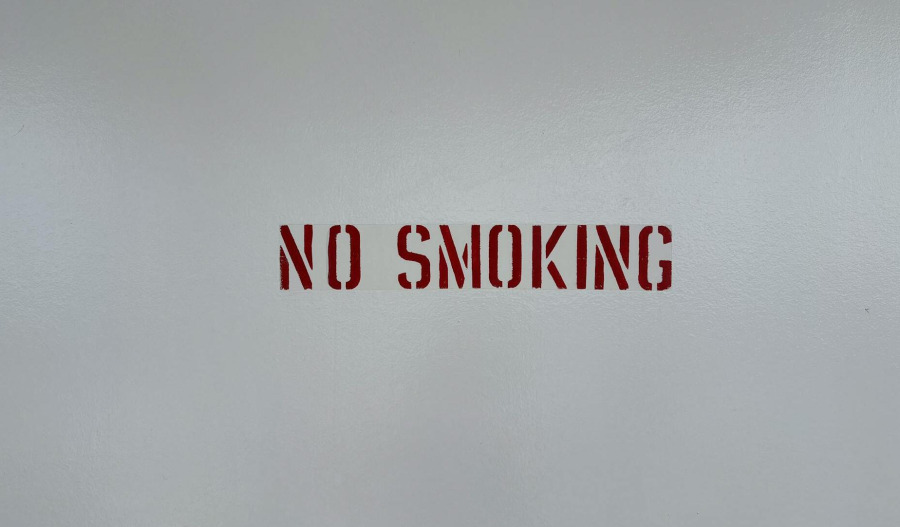

Shares in Viva Energy (ASX: VEA) were nudging a 10% fall at the open after the oil refiner and retailer reported a 10% slide in first-half convenience sales as new packaging laws and continued illicit trade saw tobacco sales tumble during the period.

Viva's convenience sales fell 10.4% year on year to $835 million with much of the decline being attributed to a 27% drop in tobacco sales, partly offset by higher gross margins. Convenience sales excluding tobacco were down 2% in the half, though flat in the June quarter.

However, this decline was partly offset by gross margins which improved to 39.2% in the quarter due to changes in the product mix and supplier deals.

The company expects to report earnings of around $300 million for the first half, with stronger fuel margins and cost reductions offsetting weaknesses in convenience sales and refining.

Earnings from its convenience & mobility and commercial & industrial businesses came in at around $310 million – above the midpoint of its prior guidance – with commercial & industrial earnings largely flat compared to the same period last year.

Refining earnings from its Geelong Refinery in Victoria were impacted by an unplanned outage in January, turnaround activity and higher energy costs.

Geelong’s refining margins averaged US$8.20 per barrel on an intake of 18.8 million barrels, down from US$10.80 a year earlier.

Management told the market that integration of the OTR Group was progressing, with the transitional services agreement with Coles completed in Q2 and nine new OTR stores opened.

A further 11 are under construction or conversion.

Back in April Macquarie downgraded Viva Energy and in a client note suggested that U.S. tariffs make it now more cautious about the country’s two refiners.

The broker dropped its 12-month share price target on Viva Energy by 39% from $2.80 to $1.70 per share.

Viva Energy was trading at $1.985 heading into lunch.

The stock has a market cap of around $3.2 billion; the share price is down 38% in one year and by around 13% in the last week.

The stock appears to be in a medium-term rally confirmed by multiple indicators.

Consensus is Moderate Buy.

Beonic rallies on watershed North African contract

Shares in little known ASX microcap Beonic Ltd (ASX: BEO) were trading 67% higher at noon after the AI-driven platform provider announced a contract with the North African Airport Authority to deploy its cutting-edge light detection and ranging (LiDAR) passenger flow technology across seven major international airports.

Beonic’s technology will help monitor real-time passenger movements and optimise operations, security, and travellers experience in terminals across seven airports.

It’s understood that Beonic’s ultra-precise people flow mapping and queue detection, enabling airport operators to optimise efficiency and reduce congestion.

While the total contract has a value of $15.2 million, Beonicʼs share is expected to come in at $10.6 million over the term of the contract.

The scope of work includes a 12-month installation period, followed by service and platform fees for up to 5.5 years.

While the contract is for an initial 2.5-year term, there is an option to extend it for a further three years.

The initial deployment includes a Technical Proof of Concept commencing at the (undisclosed) North African nation’s primary international gateway airport, a full rollout across all seven airports and is expected be rolled within 12 months.

Commenting on today’s update, Billy Tucker, CEO of Beonic told the market that this is a transformational contract for Beonic, not only due to its scale but also the timing ahead of a world-famous sporting event.

“With our advanced LiDAR capabilities and strong regional partnerships, we are well-positioned to expand our global leadership in passenger flow and queue management,” he said.

Tucker also noted that this seven-airport deployment further extends Beonicʼs global market-leading position for passenger flow management solutions in airports and is expected to contribute meaningfully to the company’s long-term annual recurring revenue (ARR).

Key international airport hubs already using Beonic’s technology include London Heathrow, JFK Terminal 4, Narita, Abu Dhabi and other major aviation centres.

Late May Beonic partnered with the Civil Aviation Authority of New Zealand (CAA) to deploy cutting-edge AI-driven passenger flow management technology across airports in the country, aiming to improve operational efficiency and enhance the passenger experience.

Last September the company raised $5.5 million in an oversubscribed placement and share purchase plan led by Canaccord Genuity and Alpine Capital.

At 1H FY25 operating cash outflows were $2.3 million and the group’s cash balance as at 31 December 2024 was $1.9 million.

Beonic Ltd has a market cap of $25 million; the share price is up 12.5% in one year and up 71% in the last month.

The stock’s shares appear to be in a long-term bearish trend confirmed by a falling 200-day moving average.

Consensus does not cover this stock.

Woodside lifts after disclosing operatorship of Bass Strait gas assets

Shares in Woodside Energy Group (ASX: WDS) were trading 1.5% higher at noon after the oil and gas giant revealed plans to assume operatorship of the Bass Strait gas assets.

Following an historic agreement with ExxonMobil Australia, Woodside will assume operatorship of the offshore Bass Strait production assets, the Longford Gas Plant, the Long Island Point gas liquids processing facility, and associated pipeline infrastructure.

As a result, Woodside is now responsible for asset planning and execution activities, pursuing a value maximisation strategy that targets further production and reliability improvements.

Marking a major shift in control of an east coast energy source, the strategic move is expected to combine Woodside’s existing global operating capabilities with ExxonMobil’s highly experienced Bass Strait workforce who will transfer to Woodside.

Management expects the operatorship of a larger group of assets in Australia to create economies of scale which are expected to realise over US$60 million in synergies for Woodside from the Bass Strait after deduction of transition and integration costs.

The agreement also creates flexibility to realise future development opportunities that meet Woodside’s capital allocation framework.

Woodside is understood to have identified four potential development wells that could deliver up to 200 petajoules of sale gas to the market.

Under the agreement, Woodside can solely develop these opportunities through the Bass Strait infrastructure subject to further technical maturation and a final investment decision. This potential production has been identified from within the existing contingent resource opportunity set.

Commenting on today’s update, Woodside EVP and COO Australia Liz Westcott told the market that the transfer of operatorship reinforces Woodside’s position as Australia’s leading energy company.

“… Woodside supports essential domestic energy needs in both Western Australia through the North West Shelf, Pluto and Macedon operations, and on the east coast through its equity participation in Bass Strait,” she said.

“Taking operatorship of Bass Strait demonstrates Woodside’s continued commitment to meeting Australia’s domestic energy demand while maximising the value of existing infrastructure.”

Meanwhile, ExxonMobil Australia Chair Simon Younger told the market that after operating the Gippsland Basin Joint Venture for more than 50 years, the company was proud to be handing over the reins and transitioning its highly experienced Bass Strait workforce to its valued partner Woodside.

Subject to conditions and regulatory approvals, completion is targeted for 2026.

Bass Strait assets include the Gippsland Basin Joint Venture (GBJV) and the Kipper Unit Joint Venture (KUJV).

Each of Woodside and ExxonMobil Australia hold a 50% participating interest in the GBJV and 32.5% participating interest in the KUJV.

Woodside Energy Group has a market cap of $50.4 billion; the share price is down 2% in one year and up 12% in the last month.

The stock appears to be in a medium-term rally confirmed by multiple indicators.

Consensus is Moderate Buy.

This article does not constitute financial or product advice. You should consider independent advice before making financial decisions.