Azzet reports on three ASX stocks with market-moving updates to share today.

Whitehaven Coal trades flat despite posting above expected FY25 guidance

Whitehaven Coal’s (ASX: WHC) strong quarterly update did little to excite the market this morning, with every sector (except energy and health care) trading lower at the open.

Following a strong June quarter, the country’s leading independent coal producer reported a 60% lift in full year run of mine (ROM) production to 39.1 million tonnes, driven by full-year ownership of Blackwater and Daunia mines.

While the group beat its FY guidance of $139/tonnes of coal and capex of $390 million, weaker coal prices – due to softer Chinese demand and trade pressures from U.S. tariffs - clearly impacted investor sentiment on the stock today with the share price trading fractionally lower at $7.025.

The company’s average realised coal price fell sharply to $189/tonne from $238 in the last year.

Commenting on today’s update, CEO Paul Flynn reminded investors that the miner had established a solid foundation for its Queensland operations, with FY25 outcomes meeting or exceeding guidance.

“Whitehaven is managing well through the current soft pricing environment. Our focus on cost management is reflected in the estimated $139/t cost of coal for FY25, which is better than our cost guidance for the year,” said Flynn.

“Whitehaven is in a strong financial position with net debt of $0.6bn at 30 June 2025 after paying the first deferred payment of US$500m to BMA in the June quarter.”

With Indian metallurgical coal demand from Australia continuing to be disrupted by discounted Chinese steel exports - while re-traded volumes in the seaborne metallurgical coal market also added to downward pricing pressure - Whitehaven will continue to focus on margin optimisation, cost management, prudent allocation of capital.

Looking forward, the company expects the structural shortfall in global metallurgical coal production, particularly the long-term depletion of HCC from Australian producers - combined with increased seaborne demand from India - to drive higher metallurgical coal prices over the long-term.

The company also long-term demand for seaborne high CV thermal coal together with a structural supply shortfall from underinvestment in new mines and depletion of existing supply, to underpin longer-term price support for high CV thermal coal.

Reflecting a combination of strong productivity outcomes and cost reduction initiatives during the year, the company expects to report better than guidance FY25 Group unit cost of coal of $139/tonne (excluding royalties).

Today’s highlights included:

Quarterly, ROM production of $10.6 million tonnes, up 15% on the March quarter.

Quarterly, Equity sales of 6 million tonnes.

Equity sales of 26.5Mt for the year, at the top end of guidance.

Quarterly, QLD produced 5.6 million tonnes of ROM.

Quarterly, New South Wales produced 4.9 million tonnes.

Whitehaven will present its FY25 financial results and FY26 guidance on 21 August.

While the coal market has been anything but stable in 2025, some brokers believe the company’s operational resilience and financial turnaround may position it as a contrarian play for investors willing to look past near-term volatility.

Due to the proceeds from the Blackwater Joint Venture sale and disciplined capital management, the company managed to shift its $1 billion net debt to $300 million net cash by mid-2025.

At current levels, the stock trades at a 12.5x forward P/E, below its five-year average of 15x, which suggests investors are pricing in near-term risks.

Back in May Macquarie, questioned if the company’s dividend could be under pressure due to negative EPS projections for 2H FY25.

Earlier in May, Goldman took off its buy rating on Whitehaven Coal shares and downgraded them to neutral with a $5.70 price target.

Whitehaven has a market cap of $5.8 billion; the share price is down around 10% for the year and is up 13% year to date.

The stock appears to be in a Medium-term rally confirmed by multiple indicators.

Consensus is Moderate Buy.

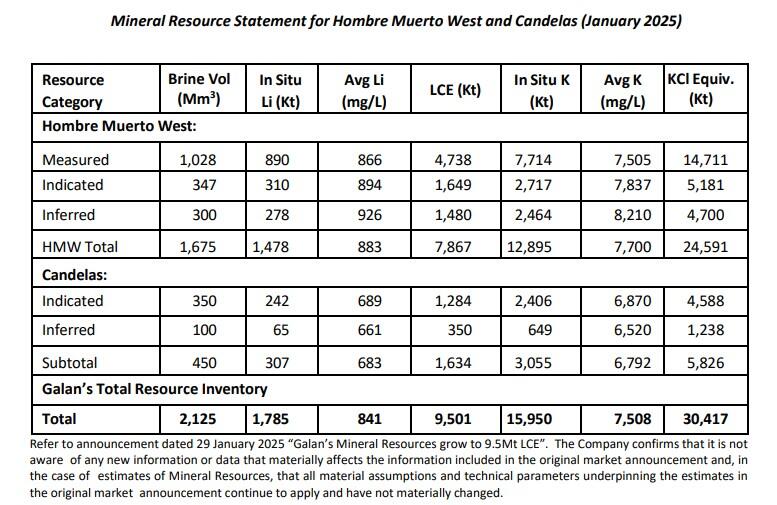

Galan Lithium rises after receiving approvals in Argentina

Shares in Galan Lithium (ASX:GLN) were up around 7% heading into lunch after the ASX-listed lithium explorer told the market its US$217 million lithium Hombre Muerto West (HMW) Project in Catamarca Province of Argentina has been approved under a new incentives program known as RIGI (Incentive Regime for Large Investments).

The HMW project is understood to be only the sixth project in Argentina - the world’s fourth-largest producer of lithium - to receive RIGI approval, and the second in the mining sector, following Rio Tinto’s Rincon project, bringing the total planned spending under the regime to $12.8 billion.

Commenting on today’s update, managing director, Juan Pablo (“JP”) Vargas de la Vega, told investors that the RIGI approval was a major milestone for Galan and strengthened HMW’s global competitive position as a future low-cost producer.

"The RIGI will provide a strategic advantage to Galan and will unlock meaningful long-term value for the people of Catamarca and our shareholders,” he said.

“It also signals strong alignment between Galan and the Argentine government’s broader vision of accelerating lithium production and economic development.”

The project will also benefit from reduced corporate income tax, fiscal stability for 30 years, preferential foreign exchange access, and other financial incentives, which are expected to position Galan competitively in the global lithium market.

As a multi-decade lithium brine project in Argentina, HMW is understood to have some compelling economics.

Last month, the miner secured a binding commitment for $20-million from existing shareholder, The Clean Elements Fund, to provide the final construction funding for its lithium project in Argentina.

The placement provided a final construction funding solution for Phase 1 (at 4,000 t/y of lithium carbonate equivalent) of the HMW project.

Galan Lithium has a market cap of $149 million; the share price is up around 10% in one year, and up 61% in the last month.

The stock appears to be in a strong bullish trend confirmed by multiple indicators.

Consensus does not cover this stock.

Icetana rallies on robust quarterly update

Shares in Icetana (ASX: ICE) were up around 17% to $0.076 in early afternoon trading after the micro-cap developer of AI-assisted video surveillance software reported its strongest quarterly growth in over four years.

Driven by customer renewals, new customer orders and a strategic partnership with SoftBank Robotics Group, the company reported a 10% increase in annual recurring revenue (ARR), reaching $1.9 million as of June 2025.

The company reported quarterly revenue of $490,000, up 13% on Q3 FY25, while AI received $1.25 million cash from customers, up from $178,000 quarter on quarter but down 5% year on year.

Icetana CEO Kevin Brown reminded investors that the company’s strong performance coincides with the signing of a transformational multi-year partnership with SoftBank Robotics, which establishes a platform for significant commercial growth, product innovation, and regional expansion across Japan and Asia-Pacific.

The four executed agreements, including a Subscription Agreement, a Global Partnership Agreement, a Distribution Agreement (Japan), and a Scope of Work for joint development, represent a total contract value exceeding $3.6 million, making this Icetana AI’s most significant strategic partnership to date.

Following on from this agreement, Icetana signed further (non-exclusive) distribution agreements with SoftBank Robotics Australia Pty Ltd (covering Australia and NZ) and SoftBank Robotics Singapore Pte Ltd (covering Singapore, South Korea, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Taiwan and Hong Kong).

Meantime, while the company’s sales and marketing initiatives in Q4 FY25 resulted in new orders, renewals and deployments, deployment of the $1.7 million Middle East safe city project sale - announced 19 March 2025 - has been delayed until Q2 FY26.

Other key metrics announced today included:

Gross margin reduced to 79% during the quarter due to a hardware sale.

Net operating cash outflow significantly decreased to $135,000.

Cash balance rose to $3.9 million.

Icetana has a market cap of $40 million; the share price is up 280% in one year and 347% year to date.

Despite the near-term weakness the stock is showing, it appears to be in a long term uptrend, confirmed by multiple indicators. Specifically, a 5-day moving average of the stock price is above the 50-day moving average, and the 200-day moving average is trending higher.

Consensus does not cover this stock.

This article does not constitute financial or product advice. You should consider independent advice before making financial decisions.