The glow of a blockbuster United States third-quarter earnings season is now fading into the background, and investors are beginning to reassess the resilience of the equity rally that has defined much of 2025.

Lofty valuations across major names - particularly among the so-called “Magnificent 7” technology giants - are prompting fresh caution as mixed economic signals and weakening consumer sentiment fuel debate about whether markets are entering a necessary cooling phase.

Volatility, too, is creeping higher, with levels hitting peaks last seen during President Donald Trump’s “Liberation Day” tariff announcements earlier this year, reviving anxiety about trade-related disruptions, supply-chain resilience, and the sustainability of corporate margins.

Against this backdrop, the latest earnings season has revealed several dominant themes, from diverging performance among mega-cap tech names to surprisingly robust results from consumer and financial companies navigating tariff and inflation pressures.

Tech titans lose steam after earnings

The market reaction to some of the most heavily traded stocks in the world has been far from uniform. NVIDIA, which has become the bellwether of global artificial intelligence investment, is down 2.6% since reporting results on 19 November.

Meta has fared far worse, sliding 14.7% since its 29 October release as investors reassessed its near-term AI monetisation strategy.

Alphabet, by contrast, rallied sharply and remains up 14.5% from its 30 October earnings announcement, buoyed by advertising resilience and strong cloud revenue.

This dispersion, particularly among the Mag 7 cohort, has offered one of the clearest indications yet that Wall Street’s expectations may finally be recalibrating after more than a year of unbroken enthusiasm for AI-related names.

AI: The theme that defined the cycle

If one trend dominated corporate commentary this season, it was artificial intelligence. BlackRock notes that AI continues to act as the “defining line between leaders and laggards”, particularly in sectors like Information Technology (IT), Utilities, and Industrials.

In IT, companies linked to the physical build-out of AI capacity - chipmakers, networking specialists, data-centre infrastructure providers - reported surging demand and large order books.

Utilities with exposure to nuclear, natural gas, and renewable energy saw similar inflows, reflecting the enormous energy footprint of AI data centres.

Industrial suppliers specialising in cooling systems, precision components, and advanced manufacturing technologies also pointed to significant orders tied to AI-driven capital expenditure.

Yet even within these outperforming sectors, BlackRock notes that dispersion is widening. Their analysis shows a 305% difference between the top and bottom performers in IT so far this year, illustrating that not all AI-exposed companies are equal, and that fundamental stock selection matters more than ever.

Broad strength across sectors, led by Health Care and Financials

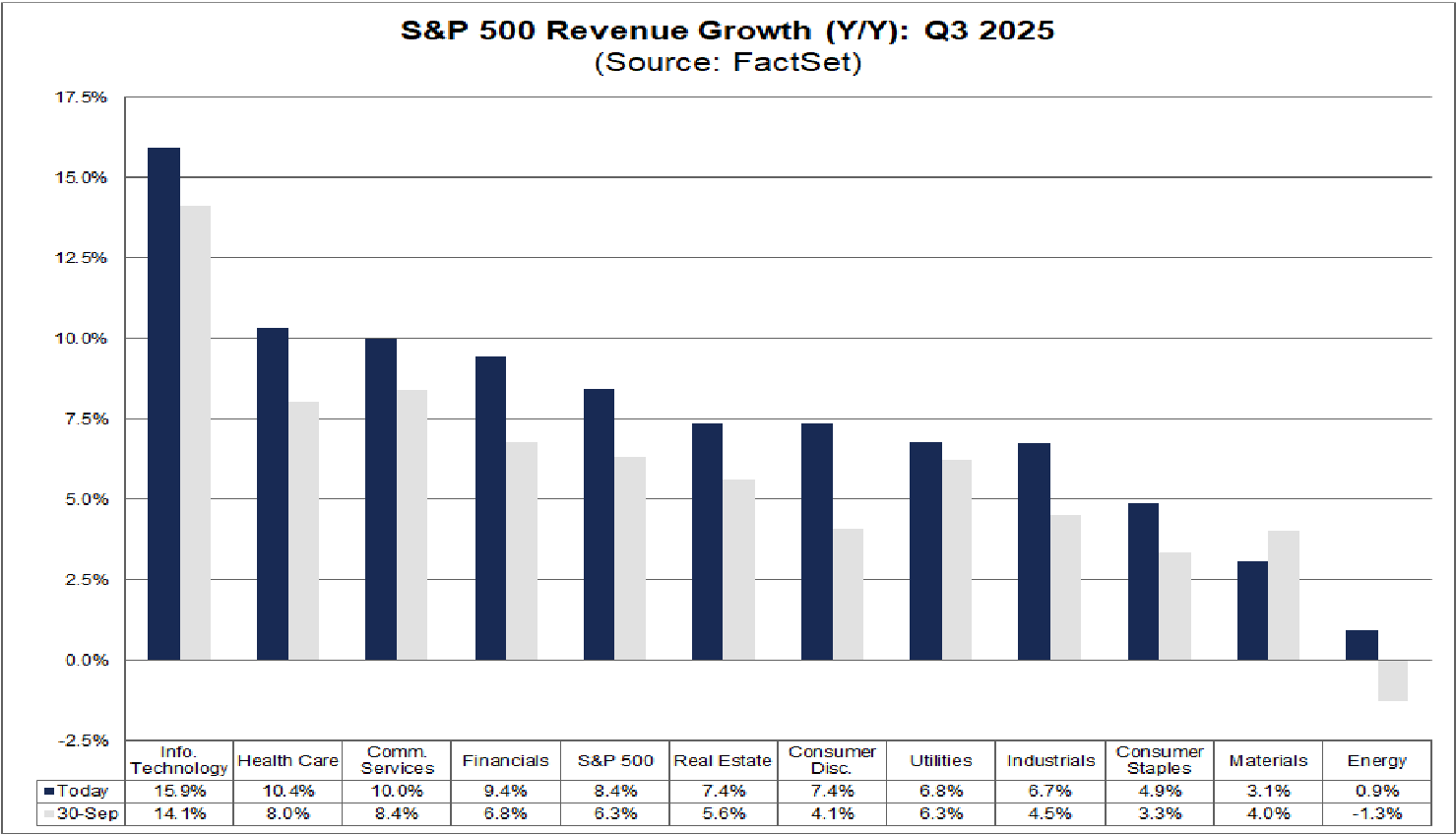

While big tech narratives dominated headlines, the broader corporate landscape delivered a far more balanced and surprisingly strong performance. FactSet data reveals that revenue growth expanded meaningfully across virtually every sector:

Health Care: The Quarter’s Silent Powerhouse

Health Care was the largest contributor to the overall improvement in S&P 500 revenue growth since 30 September.

Companies such as Cardinal Health, CVS Health, Centene, Cigna Group, and Eli Lilly sharply outpaced expectations, pushing the sector’s blended revenue growth rate from 8.0% to 10.4%.

These gains highlight strong pharmaceutical demand, improved insurance reimbursement conditions, and more stable post-pandemic operating environments.

Financials: A Return to Form

Financials matched Health Care as the second-largest driver of increased revenue growth, also contributing roughly 20% of the total improvement.

The magnitude of positive surprises - including Apollo Global Management, Prudential, Morgan Stanley, JPMorgan Chase, Goldman Sachs, and Citigroup - reflected a recovery in dealmaking, resilient credit conditions, and stabilising net interest income.

The sector’s blended revenue growth rate rose from 6.8% to 9.4%, marking one of its strongest quarterly expansions in two years.

Consumer Discretionary: Still Resilient, Despite Macro Headwinds

Consumer Discretionary followed closely, accounting for approximately 18% of the improvement in index-level revenue growth.

Strong quarterly performances from Ford, General Motors, Tesla, and Amazon lifted the sector’s blended revenue growth rate to 7.3%, up from 4.1%.

This outcome is especially notable given the challenging backdrop of slowing consumer sentiment, higher tariffs, and persistent inflation.

The strength of auto and e-commerce demand underscores the continuing bifurcation between household income brackets, with higher-income consumers proving more resilient.

Revenue and Earnings: The Best Showing Since 2022

Scope Markets notes that revenue growth for the S&P 500 came in at its highest level since the third quarter of 2022, led by Information Technology, Health Care, and Communication Services.

Only Materials posted underperformance, largely linked to commodity price volatility and weaker global industrial demand.

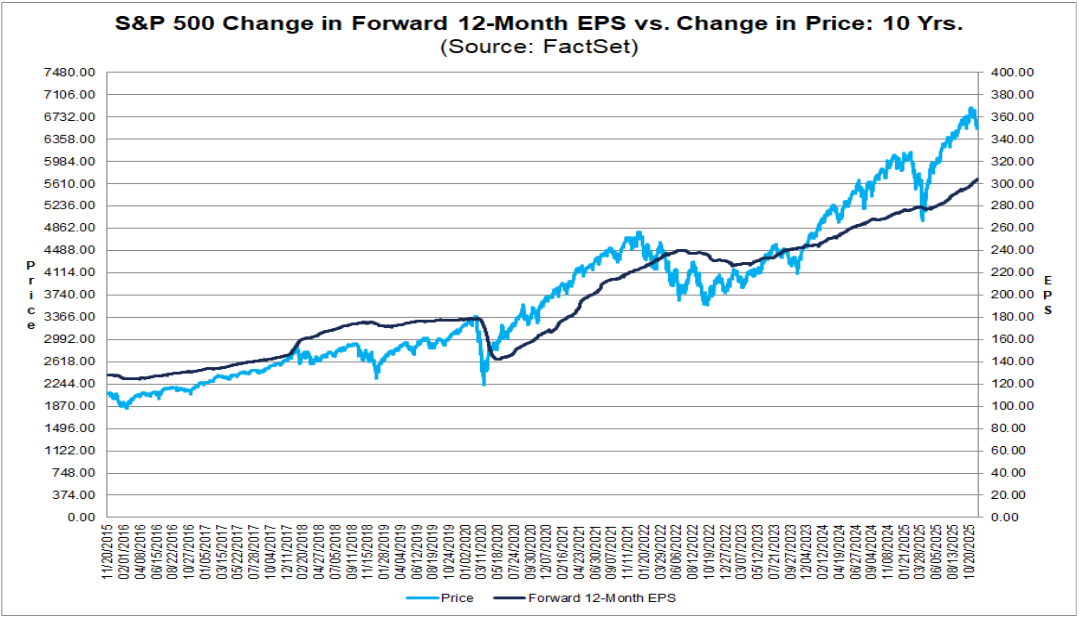

Earnings growth was even more impressive. Analysts had expected S&P 500 EPS growth of 7.9%, yet the actual blended rate came in at 13.4%, marking another quarter of substantial outperformance.

Forward 12-month EPS forecasts continue to rise, supporting the underlying fundamentals.

Yet Scope Markets warns that with valuations now stretched, a period of consolidation or profit-taking appears not only likely but healthy.

Mag 7 vs. The Rest: A Gap, but Narrower

BlackRock and FactSet both noted that while the Mag 7 cohort continues to outperform, the margin is narrowing.

The seven largest tech-centric names delivered earnings growth of 18.4% compared with 11.9% for the remaining 493 companies - more than double what analysts had forecast heading into the season, but still signalling gradual normalisation.

Investors should note that the price reaction to earnings beats has been unusually muted this season, while misses were punished more severely than usual.

This asymmetry underscores just how fully priced many of these mega-cap names have become.

Consumer and Retail Surprise to the Upside

Beyond the headline numbers, consumer-facing companies offered some of the most compelling storylines of the quarter.

Wayfair delivered a standout performance, with adjusted earnings per share of $0.70 - up 220% year-on-year - and revenue rising 8.1% to $3.1 billion.

The company’s adjusted EBITDA margin of 6.7% was its highest outside the pandemic period, while orders delivered grew more than 5% year-on-year.

American Express also posted a record quarter, with sales of $18.4 billion and a 19% rise in adjusted EPS.

Strong cardmember spending, new Platinum Card updates, and a 4% beat on net interest income contributed to the outperformance and allowed the company to raise its full-year guidance.

Companies such as Roku and Palantir delivered some of the quarter’s most dramatic beats. Roku tripled adjusted EPS and achieved positive operating income for the first time since 2021.

Palantir’s results were even more striking: record quarterly revenue of $1.2 billion, a 63% year-on-year increase, driven by a surge in U.S. commercial and government contracts. Total Contract Value exploded 340% year-on-year to $2.8 billion.

A market looking ahead, with caution

Despite the strength of earnings season, markets now find themselves at an inflection point. Forward-looking optimism remains anchored in the secular tailwinds of AI, resilient corporate balance sheets, and stabilising supply chains. Yet the risks are also becoming more pronounced.

Valuations across key indices remain near historic highs. Economic signals are mixed, with labour-market softening and weakening consumer sentiment raising questions about whether earnings momentum can persist into early 2025.

And while AI remains a multi-year structural theme, the recent pullback in many AI-exposed stocks suggests the market is finally becoming more discerning.

Still, the underlying message from corporate America is clear: earnings are strong, revenue growth is broad-based, and fundamentals remain supportive.

The question for investors is no longer whether the rally has justification, but whether expectations have become too aggressive.

As volatility rises and profit-taking emerges, the next stage of the market cycle may favour careful stock selection, balanced allocation, and a closer examination of which companies are best positioned to thrive in a more competitive, more nuanced, AI-driven landscape.