NVIDIA posted record revenue of US$57.01 billion for Q3 fiscal 2026 - a 62% surge from the prior year and 22% above the previous quarter's $46.7 billion.

The Street expected $54.9 billion, and the company cleared that by more than $2 billion.

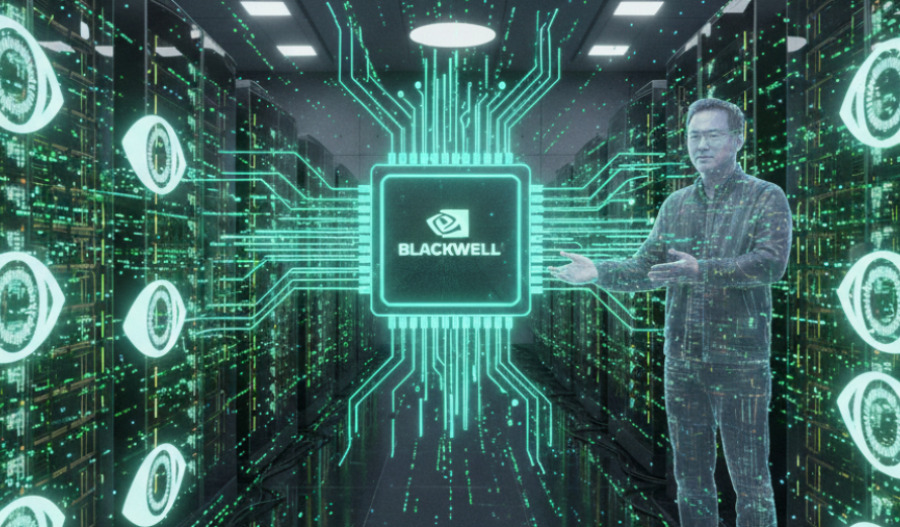

Data centre revenue hit $51.2 billion, up 66% year-on-year and now accounting for 90% of total sales, with the Blackwell architecture driving most of that momentum as the chipmaker delivers its fastest product ramp in history.

"Blackwell sales are off the charts, and cloud GPUs are sold out," NVIDIA founder and CEO Jensen Huang said.

"Compute demand keeps accelerating and compounding across training and inference - each growing exponentially.

"We've entered the virtuous cycle of AI. The AI ecosystem is scaling fast - with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once."

Shares popped more than 4% in after-hours trading following the release.

Q3 stats

Earnings per share landed at $1.30 adjusted, ahead of the $1.25 consensus estimate - a 60% leap from 81 cents a year ago.

Gross margins came in at 73.6% non-GAAP - down 1.4 percentage points from last year's 75%, but in line with guidance and up 0.9 points from Q2.

Net income reached $31.9 billion, a 65% year-on-year lift, while opex rose 38% to $4.2 billion non-GAAP as the company scaled production and R&D efforts.

Operating income clocked $37.8 billion, up 62% from the prior year.

The chipmaker returned $37 billion to shareholders over the first nine months of fiscal 2026 through buybacks and dividends, with $62.2 billion remaining under its repurchase authorisation.

Guidance tops expectations

Q4 revenue guidance of $65 billion topped the Street's $61.7 billion forecast, a 14% sequential increase.

Gross margins are expected to tick higher to 75% non-GAAP, suggesting improved manufacturing yields on Blackwell production.

The outlook comes after Huang revealed in October that the company had locked in $500 billion in combined orders for Blackwell and the forthcoming Rubin architecture through 2026.

Key deals and partnerships

The GPU maker signed a plethora of major agreements during Q3:

- OpenAI: Committed to deploying at least 10 gigawatts of NVIDIA systems for next-generation AI infrastructure.

- Anthropic: Will adopt 1 gigawatt of compute capacity using Grace Blackwell and Vera Rubin systems, with Microsoft investing up to $5 billion and the Jensen Huang-led outfit up to $10 billion in the AI lab, pushing its valuation to around $350 billion.

- Microsoft, Google Cloud, Oracle and xAI: Building out hundreds of thousands of NVIDIA GPUs for American AI infrastructure.

- Oracle and U.S. Department of Energy: Will deploy 100,000 Blackwell GPUs for the Solstice supercomputer, plus another 10,000 for Equinox.

- Intel: Collaborating to jointly develop multiple generations of custom data centre and PC products with NVLink.

- Uber: Partnering to scale the world's largest level 4-ready mobility network starting in 2027, targeting 100,000 vehicles.

- Nokia: Adding NVIDIA-powered AI-RAN products to Nokia's RAN portfolio for 5G-Advanced and 6G networks.

- Deutsche Telekom: Launching the world's first Industrial AI Cloud to power Germany's industrial transformation.

- South Korea: Working with the government and Hyundai Motor Group, Samsung Electronics, SK Group and NAVER Cloud to expand AI infrastructure with over 250,000 NVIDIA GPUs.

- United Kingdom: Investing £2 billion in the UK market, working with CoreWeave, Microsoft and Nscale to build AI infrastructure.

- Palantir Technologies: Building an integrated technology stack for operational AI.

- TSMC Arizona: Produced the first Blackwell wafer on U.S. soil.

One notable absence from Q3 results: any revenue or deals from China, with U.S. export restrictions eliminating H20 data centre chip sales to the Middle Kingdom - a $2-5 billion gap.

Huang has repeatedly warned that China poses a competitive threat in AI development, arguing the company should be permitted to sell its chips there.

The market

Shares in NVIDIA had rallied 2.9% heading into earnings, though they remain down about 12% from the October peak of $212.19 when the company briefly touched a $5 trillion market cap.

The pullback reflected concerns about AI spending sustainability and Michael Burry's recent short position on the stock.

Options pricing had suggested a potential $320 billion swing in market value post-earnings - what would have been the largest such move in company history - but the 4% after-hours rally suggests investors are satisfied.

Gaming revenue came in at $4.3 billion, up 30% year-on-year but flat sequentially, while professional visualisation notched $760 million, up 56% from last year, and automotive contributed $592 million, up 32%.

With hyperscaler capex exceeding $380 billion this year alone and the Santa Clara outfit capturing the bulk of AI infrastructure spend, the question is whether the market has already priced in the best-case scenario.