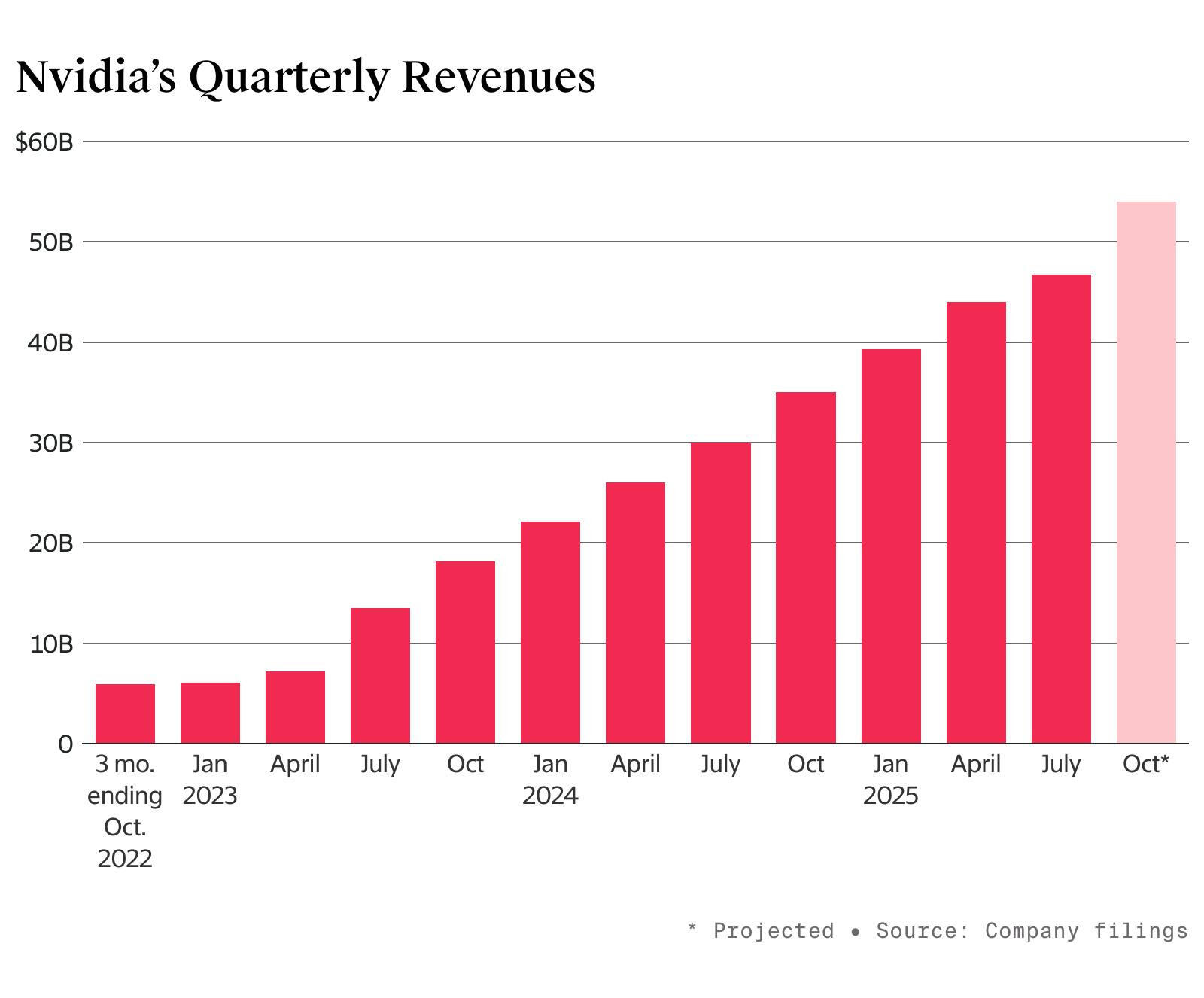

All eyes turn to CEO and co-founder Jensen Huang on Wednesday (Thursday AEDT) when NVIDIA reports third-quarter fiscal 2026 results. With a US$4.62 trillion market cap commanding 8% of the entire S&P 500, swings in the chipmaker's share price ripple across tech, utilities and industrials - making this the most anticipated earnings release of the season.

After weeks of debate about rising AI development costs and AMD and Broadcom making headway in the chip market, Huang gets his chance to remind everyone just how dominant NVIDIA remains. AMD reported $9.2 billion revenue last quarter - up 36% year-over-year, but still years behind NVIDIA's trajectory.

Amazon is deploying $125 billion this year on AI infrastructure spending. Meta's burning through $72 billion. Microsoft and Alphabet have each committed north of $80 billion.

Combined, Big Tech's infrastructure bet tops $380 billion so far this year - and NVIDIA is the primary beneficiary.

Expectations

- Wall Street expects third-quarter revenue of $54.59 billion, marking 55.6% year-over-year growth

- Consensus earnings per share sits at $1.23, up 51.9% from the year-ago quarter's 81 cents

- Goldman Sachs analyst James Schneider projects fiscal third and fourth quarter EPS of $1.28 and $1.49 respectively - both running 3-5% above Street estimates

- The bank lifted its price target to $240 from $210, implying 18% upside from current levels

- Morgan Stanley also raised its target to $220, maintaining its overweight rating

- Analyst Joseph Moore sees data centre revenue climbing toward $200 billion next year, up from a prior $175 billion estimate

NVIDIA's guidance is $54 billion for the quarter (+/-2%) - right in line with expectations rather than the explosive beats investors got used to. That marks a shift from quarters where the company routinely crushed forecasts by billions.

Blackwell's make-or-break moment

A key indicator is how NVIDIA's next-generation Blackwell architecture sales are going.

Management claims it delivered $11 billion in fourth-quarter fiscal 2025 revenue - the fastest product ramp in company history. For Q3 fiscal 2026, analysts expect Blackwell to contribute $8-12 billion, up from the prior quarter's $5-7 billion.

At NVIDIA's GTC event in Washington in late October, Huang surprised Wall Street when he revealed the company already had sales commitments for Blackwell and upcoming Rubin chips totalling $500 billion.

That's against fiscal 2025 revenue of $130 billion and analyst expectations of $207 billion for fiscal 2026. Most of those commitments will flow through 2026.

Goldman Sachs raised its data centre segment revenue estimates by 13% to account for what Schneider calls "positive revisions to hyperscaler capex and other intra-quarter datapoints". The segment is projected to generate 88-90% of total revenue.

NVIDIA CFO Colette Kress recently addressed investor concerns about efficient AI models like DeepSeek's R1 potentially limiting chip demand. Her counterpoint? Long-thinking, reasoning AI could require 100 times more compute per task compared to one-shot inference.

China

Here's what won't appear in Q3 results: any revenue from China. U.S. export restrictions have indirectly eliminated H20 data centre chip sales to the Middle Kingdom.

That's a $2-5 billion revenue gap, though analysts see potential upside if trade conditions improve.

What's remarkable? Despite the loss of that revenue, NVIDIA's maintaining 50%-plus growth despite losing that market entirely.

Huang's frequent warnings about the threat China poses in AI - meant to underline why NVIDIA should be allowed to sell its chips there - have spotlighted the scale of what's been left on the table.

The company's Q2 fiscal miss on data centre revenue - slight though it was - rattled markets despite beating overall estimates. The stock fell 4% in extended trading, breaking from the sharp post-earnings rallies of recent quarters.

Expect Huang to address China again on Wednesday's call, along with NVIDIA's recent spate of investments in potential customers - a topic that's drawn scrutiny around circular revenue.

Institution watchlist

Michael Burry's bearish bet through put options last quarter added intrigue, though most analysts dismiss it as a losing wager. NVIDIA has beaten consensus earnings estimates in 19 of the past 21 quarters, with an average surprise of 3.6%.

Options pricing suggests a 6.2% move post-earnings. That could translate to a 0.5% swing in the S&P 500 and 0.6% in the NASDAQ 100 - underscoring the company's outsized influence on broader markets.

The year-to-date picture shows shares up 39% despite a 13% correction from the 29 October peak of $212.19. Shares closed Friday at US$184.

And Huang's commentary on Wednesday evening U.S. time will likely matter more than the quarterly numbers themselves. Guidance for fiscal Q4 and colour on the $500 billion data centre revenue opportunity could determine whether NVIDIA extends its historic run or if the market's already priced in the best-case scenario.

The earnings call begins at 2pm Pacific time on 19 November. Markets will be listening…