United States stocks extended their rebound on Thursday (Friday AEDT) as easing geopolitical concerns helped markets recover from recent volatility tied to tariff threats over Greenland.

The Dow advanced 306.8 points or 0.6% to close at 49,384.0. The S&P 500 rose 37.8 points or 0.6% to finish at 6,913.4, while the Nasdaq Composite gained 211.2 points or 0.9% to settle at 23,436.0.

Despite the two-day rally, weekly performance remained mixed. The Dow was modestly higher for the week, while the S&P 500 was down 0.4% and the Nasdaq was lower by 0.3% week to date.

Market sentiment improved sharply on Wednesday after U.S. President Donald Trump said he would no longer impose new tariffs on imports from eight European nations that were due to begin on 1 February.

He also announced that a deal “framework” had been reached over Greenland.

Trump, who has been pushing for U.S. control of Greenland in recent weeks, said on Truth Social that he and NATO Secretary General Mark Rutte had “formed the framework of a future deal with respect to Greenland”.

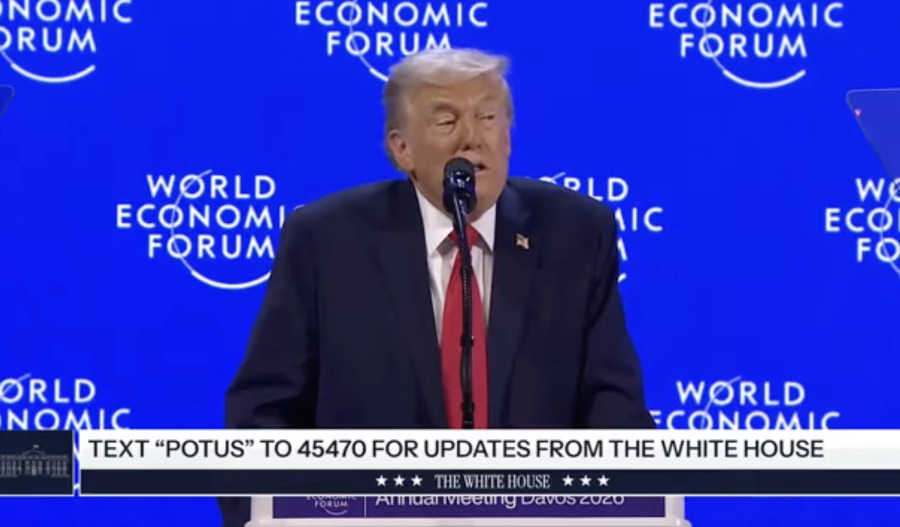

Stocks were already moving higher earlier in the day after Trump told the World Economic Forum in Davos that he would not seek to acquire Greenland by force.

All three major U.S. indexes jumped more than 1% on Wednesday, while the Russell 2000 index of small-cap stocks surged about 2% to a record close.

The rally marked a sharp reversal from Tuesday, when renewed tariff threats triggered a “sell America” trade that weighed on U.S. equities and the dollar while pushing Treasury yields higher.

While investors have welcomed the apparent easing in tensions, uncertainty remains. Danish Prime Minister Mette Frederiksen said on Thursday that Trump’s discussions with Rutte on Arctic security were “good and natural”, adding that Denmark was open to talks with the U.S. on its “Golden Dome” missile defence plan.

However, she reiterated that national sovereignty was not up for negotiation.

“The Kingdom of Denmark wishes to continue to engage in a constructive dialogue with allies on how we can strengthen security in the Arctic, including the United States' Golden Dome, provided that this is done with respect for our territorial integrity,” Frederiksen said.

Economic data also influenced markets. Fresh figures from the Bureau of Economic Analysis (BEA) showed the U.S. economy grew fWall Street extended its rebound as tariff fears linked to Greenland eased, lifting the Dow 300 points, while revised GDP and inflation data kept focus on the Fed outlook.aster than previously estimated in the third quarter, while corporate profits were revised higher.

Gross domestic product expanded at a 4.4% annualised rate, the fastest pace since the third quarter of 2023.

Inflation data, however, continued to point to lingering price pressures. The personal consumption expenditures price index, the Fed's preferred measure of inflation, rose 2.8% year on year in November, up from 2.7% in October.

Core PCE inflation, which excludes food and energy, was unchanged from the prior month, remaining above the Federal Reserve’s 2% target.

In bond markets, yields moved higher, with the 10-year Treasury yield up 0.1% to 4.251% and the 2-year yield rising 0.6% to 3.612%, reflecting expectations that interest rates may remain elevated for longer.