United States homebuilder confidence rose by just one point in November amid the government shutdown and a weak labour market.

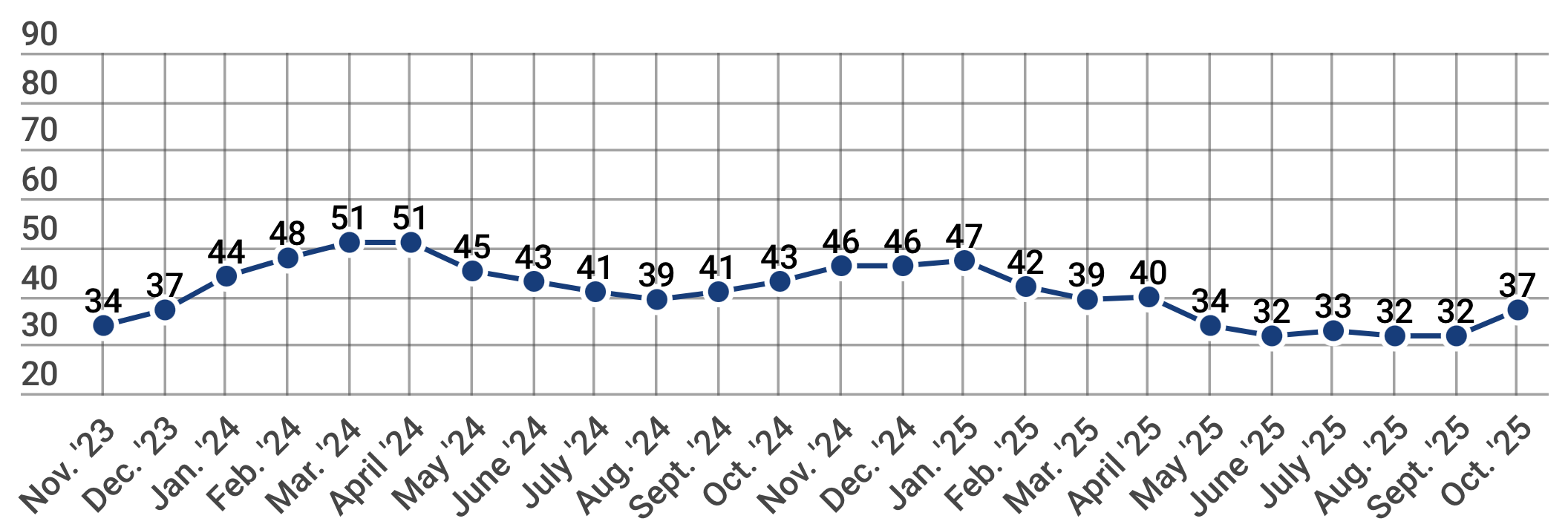

Builders’ confidence in the market for new single-family homes increased by one point to 38, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index. The index has been below 40 since May.

“While lower mortgage rates are a positive development for affordability conditions, many buyers remain hesitant because of the recent record-long government shutdown and concerns over job security and inflation,” said NAHB chairman Buddy Hughes. “More builders are using incentives to get deals closed, including lowering prices, but many potential buyers still remain on the fence.”

“We continue to see demand-side weakness as a softening labor market and stretched consumer finances are contributing to a difficult sales environment,” said NAHB chief economist Robert Dietz.

The current sales conditions index rose by two points to 41, but sales expectations for the next six months dropped by three points to 51. Traffic of prospective buyers

Around 41% of builders reported cutting prices in November, a record high in the post-pandemic period. The average price reduction remained at 6%.

The South saw the largest gain in its three-month average Housing Market Index score, rising three points to 34, while the Northeast increased two points to 48 and the West was up two points to 30. The Midwest’s score declined by one point to 41.

The U.S.’ longest ever government shutdown ended on 12 November, after 43 days. While the government’s economic data releases were largely suspended during the shutdown, U.S. job cuts surged 183% in October from the previous month, per a Challenger, Gray & Christmas report.

The Federal Reserve cut interest rates by 0.25% for the second time this year at the end of October. Interest rate traders are almost evenly split on whether the Fed will cut rates again on 10 December, according to CME FedWatch, though Fed Governor Christopher Waller backed another rate cut this week.

Related content