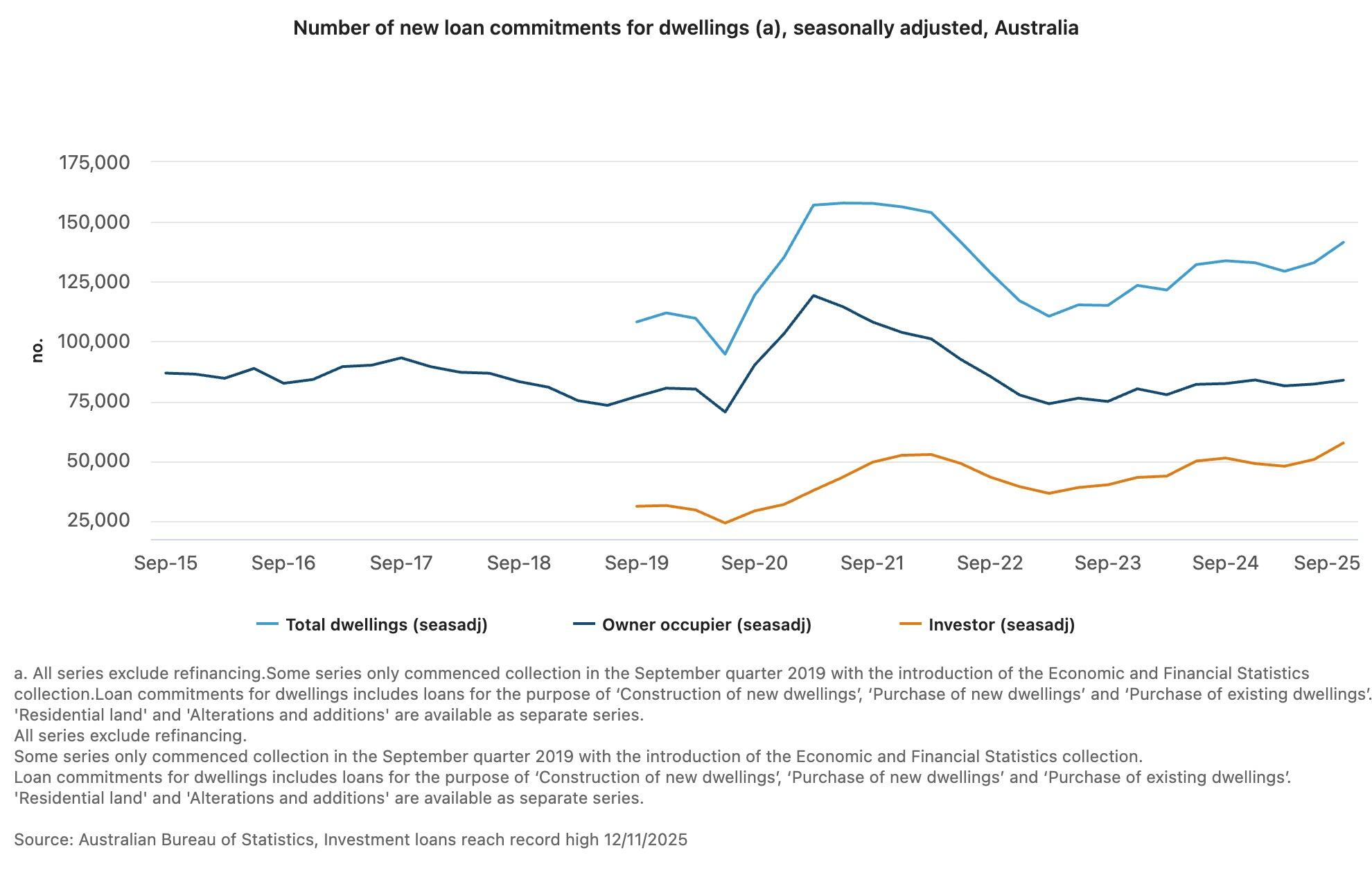

New data shows that investor loans reached record highs in the September quarter.

The data released by the Australian Bureau of Statistics (ABS) shows that the number of investment loans rose by 13.6% to 57,624.

ABS head of finance statistics, Mish Tan said this is the highest level of investment loans since the March quarter in 2022.

“Falling borrowing costs and low vacancy rates are favourable conditions for investors,” Tan said.

“Strength of lending for investment also pushed the total value of all new dwelling loans to a record high in September.”

While first home buyers grew in the September quarter by 2.3% from the previous three months, they fell by 0.23% year-over-year and accounted for 29,637 of all loans for the quarter.

Other owner-occupier loans increased 2% on a quarterly basis to 55,171.

Landlord loans have steadily grown to take up 40% of total new loans since March 2023 at a faster rate than owner-occupier loans.

The rapid rise in investor loans has sparked calls for the federal government to force banks to put the brakes on landlord lending.

The Reserve Bank recently noted that investor credit was growing at its fastest pace since 2015, having picked up even before the RBA cut interest rates three times this year.

In 2014, rapid rises in investor lending led the Australian Prudential Regulation Authority to warn banks that it would treat annual growth rates above 10% as a risk, forcing banks to cut back.

With the data showing investor credit rising at nearly double the rate, Greens senator Barbara Pocock to call for Apra intervention.

“We need to urgently rein in an overheated credit market for property investors,” she said.

House prices also surged 1.1% in October, the fastest rate in over two years.