The United States Department of War has secured a 10% stake in Trilogy Metals (NYSE: TMQ, TSX: TMQ) through a US$35.6 million investment targeting Alaska's Ambler Mining District.

Ambler's mineral wealth gives Washington direct exposure to copper, cobalt, zinc and lead deposits that have sat stranded for decades.

The transaction, announced yesterday, sees the Pentagon taking stakes in both Trilogy and its Ambler Metals JV partner, BHP (ASX: BHP) spinoff South32 (ASX: S32).

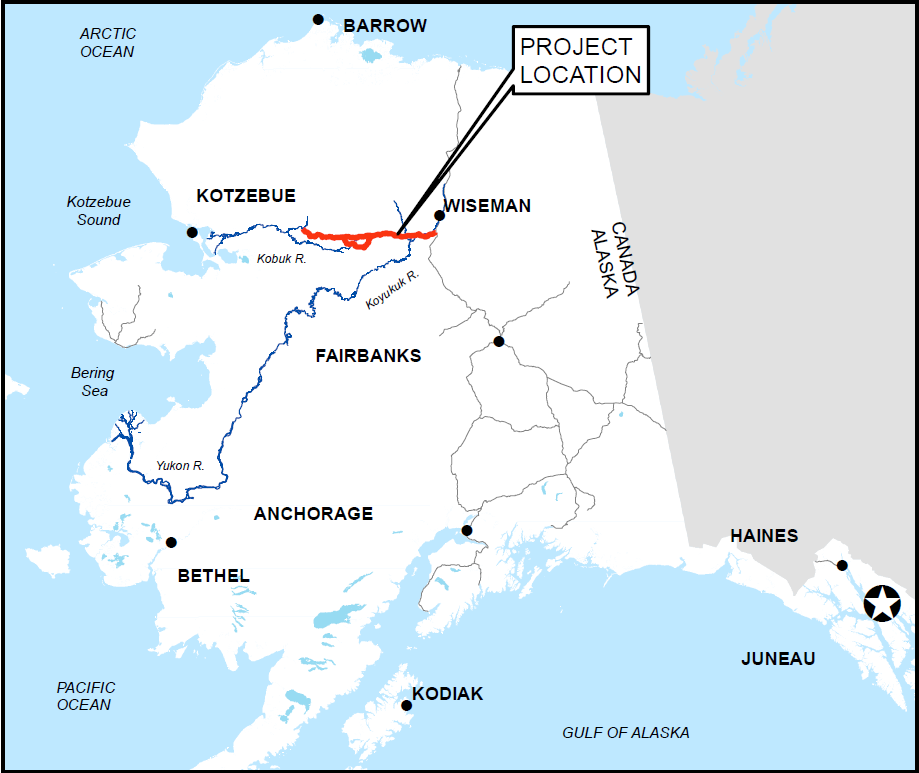

Funds are earmarked for exploration and development of the Upper Kobuk Mineral Projects within Ambler - home to some of the world's highest-grade copper deposits and other critical minerals.

"This is a significant milestone for Trilogy and for the development of a secure, domestic supply of critical minerals for America in Alaska,” Trilogy CEO Tony Giardini said.

The deal structure includes $17.8 million flowing directly to Trilogy for 8.2 million units at $2.17 per unit, with each unit carrying three-quarters of a 10-year warrant.

Another $17.8 million goes to South32 to purchase its existing Trilogy shares, plus a call option for an additional 6.1 million shares at $0.01 each.

Both the warrants and call option become exercisable once the controversial 211-mile Ambler Road gets built - and Trump just green-lit that too.

Paving the road to mineral wealth

On the same day as the investment announcement, President Trump issued an executive order granting permits for the Ambler Access Project, reversing the Biden administration's 2024 decision to kill the industrial road's development.

Without road access, the Arctic and Bornite deposits remain stranded 162 miles west of the Dalton Highway in one of Alaska's most remote regions.

The proposed road would unlock the entire Ambler Mining District - endowed with a purported $26 billion worth of mineral resources.

Trump's decision reflects what the White House called "a renewed federal commitment to responsible resource development in Alaska," positioning the road as critical infrastructure for ‘secure domestic supply chains of minerals essential to defence technologies and American manufacturing’.

It's also part of his United States sovereign wealth fund, which he announced would be created back in February.

The deal contemplates all parties - Trilogy, South32, the U.S. government and Alaska - working out a framework to finance and construct the road, with the Department of War committing to help facilitate funding in coordination with the state.

The deposits

Arctic, the more advanced of the two deposits, hosts 46.7Mt of probable reserves averaging a whopping 5% copper equivalent - one of the world's highest-grade copper deposits.

A 2023 feasibility study detailed plans for a 10,000-tonne-per-day open-pit operation producing 159 million pounds of copper, 199M/lb of zinc, 33M/lb of lead, plus gold and silver over a 13-year mine life.

Bornite, a carbonate-hosted copper-cobalt deposit 25km southwest, adds another 1.9 billion pounds of copper over a projected 17-year underground operation.

Together, the projects could sustain mining activities for more than 30 years.

Trilogy operates the JV through Ambler Metals LLC, formed in 2020 when Aussie miner S32 exercised its option for US$145 million.

The independently operated venture holds 100% of the Upper Kobuk Mineral Projects across roughly 191,000 hectares.

Trump's critical minerals blueprint

The Trilogy deal follows the Pentagon's July investment into rare earths miner MP Materials, where the Department of War took up to 15% via a $400 million equity stake backed by price floor guarantees.

Washington has also proposed equity positions in Lithium Americas for its Thacker Pass mine and held discussions with Critical Metals about Greenland's largest rare earths project.

The financial tools the Trump administration is employing are borrowed straight out of the private equity playbook, moving well beyond traditional government subsidies or loans.

The approach leverages the Office of Strategic Capital, established within the Department of War, to attract private capital into technologies critical to national security, and the Defense Production Act, which Trump invoked via executive order in March to accelerate domestic minerals production.

For Trilogy and South32, the deal brings more than just a payday - it has a stable and secure production pipeline to market.

The Department of War gets one board seat for three years and veto rights over debt exceeding $1 billion until 2029 and all parties have committed to fast-tracking mine permits through the FAST-41 process.

Trilogy's stock went galactic on the news of Uncle Sam's backing, the junior rocketing over 200% on the TSX.