United States stock futures traded narrowly higher on Monday night (Tuesday AEDT) after President Donald Trump approved a deal allowing Nvidia to sell its H200 chips to China.

By 10:35 am AEDT (11:35 pm GMT), Dow futures were flat, while futures for the S&P 500 and Nasdaq 100 each edged up 0.1%

Nvidia gained 2.2% in extended trading after Trump posted on Truth Social that the company would be allowed to ship its advanced H200 chips to “approved customers” in China and other markets, provided that 25% of the sales proceeds are paid to the U.S. government.

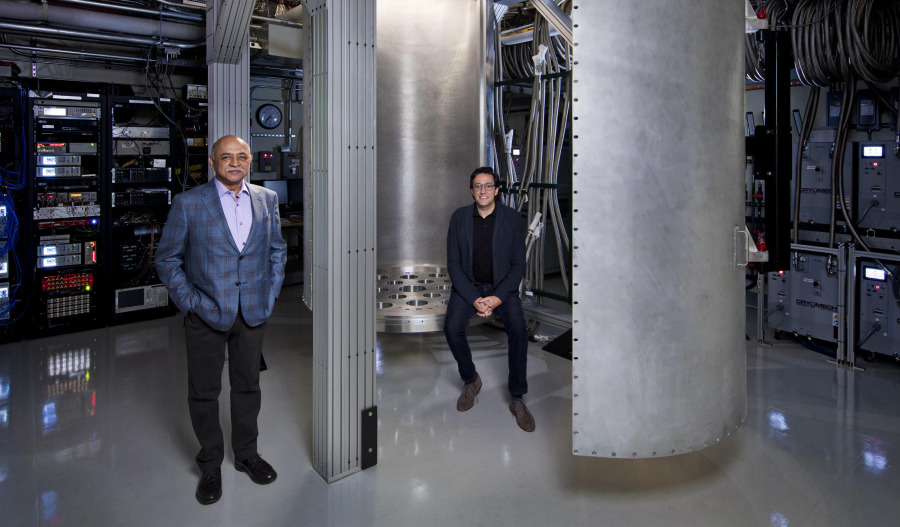

Trump said Chinese President Xi Jinping had “responded positively” to the arrangement. The move follows a meeting last week between Nvidia Chief Executive Jensen Huang and Trump, offering the chipmaker a breakthrough after months of tense trade negotiations and tightening export controls.

In the regular session on Monday, semiconductor and mega-cap tech stocks were among the market’s bright spots.

Broadcom rose nearly 3%, while Microsoft advanced around 2%, supported by a report from The Information suggesting the two companies are exploring the development of custom chips.

Despite the enthusiasm in the tech sector, all three major U.S. indices closed lower in the previous session.

The 10-year Treasury yield extended its climb, continuing to weigh on broader market sentiment as investors assess whether persistent inflation will complicate the Federal Reserve’s policy trajectory.

Attention now shifts to Wednesday’s meeting, the Fed’s final rate decision of the year. Markets are widely expecting a further quarter-point reduction in the key overnight lending rate - the third such move after cuts in September and October.

According to the CME Group FedWatch Tool, fed funds futures imply an 87.3% probability of a decrease, up from under 67% a month earlier.

Alongside the Fed’s decision, investors this week will monitor earnings from artificial intelligence and retail names, including Oracle, Broadcom, Costco and Lululemon.