United States consumer confidence dropped to a five-month low in October amid a stagnant job market and high inflation, according to the University of Michigan’s preliminary Surveys of Consumers report.

The report’s consumer sentiment index was 55.0 in October, down 22.0% year-over-year and down 0.2% from September.

“Improvements this month in current personal finances and year-ahead business conditions were offset by declines in expectations for future personal finances as well as current buying conditions for durables. Overall, consumers perceive very few changes in the outlook for the economy from last month,” said Surveys of Consumers director Joanne Hsu.

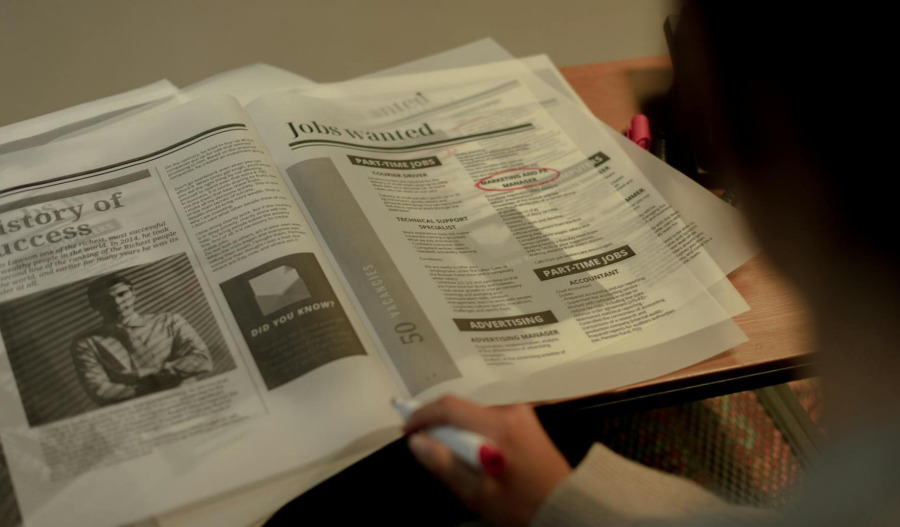

“Pocketbook issues like high prices and weakening job prospects remain at the forefront of consumers’ minds. At this time, consumers do not expect meaningful improvement in these factors.”

The consumer expectations index fell by 30.9% year-over-year to 51.2, and was down 1.0% from September. Its current economic conditions index was 61.0, falling 6.0% from one year ago, but rising 1.0% from September.

The consumer sentiment, consumer expectations, and current economic conditions indexes were all highest among Republicans and lowest among Democrats, with independents falling between.

Respondents’ five-year household finances outlooks also dropped to the lowest since at least July 2011, having declined every month since July. Around 63% of survey respondents said they expect the unemployment rate will increase over the next year.

Inflation expectations for the year ahead were 4.6%, declining slightly from 4.7% last month. Respondents’ long-term inflation predictions remained at 3.7%.

The ongoing government shutdown does not appear to have impacted consumers’ opinions on the economy thus far, said Hsu.

The release of the U.S. government’s economic and labour data has largely been suspended since the shutdown began on 1 October. The Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey said last month that while job openings rose, hiring rates declined.

Related content