While the third quarter of 2025 delivered strong performance across global asset markets, with the United States leading the way in economic growth, there’s mounting uncertainty over the durability of this expansion and what it means for investors.

At face value macroeconomic data continues to paint a solid picture, with jobless claims remaining low, core capital goods orders having increased, and second quarter GDP revised upward to an annualised rate of 3.8% - due largely to spending by U.S. consumers.

However, despite this momentum, U.S. labour markets remain soft which has created a disconnect between output and employment.

There’s also growing fear that while consumer spending has been propped up by wealth gains and lower saving rates, it will start falling away due to rising inflation and weakening labour income.

Adding to these concerns, the U.S. central bank’s monthly Survey of Consumer Expectations found that fewer U.S. consumers expect their households’ financial situations to be better off a year from now.

Outlook for shares

While shares remain strong, Shane Oliver chief economist with AMP believes the risk of a correction remains high given stretched valuations and numerous potential triggers around:

- Slowing U.S. jobs data.

- US tariffs and their impact.

- Public debt sustainability in the U.S., France, UK and Japan.

- Geopolitical risks around the possibility of escalating tensions between Russia and NATO countries.

- Uncertainty as to how much the Fed will cut rates and increased uncertainty around further rate cuts in Australia.

- The U.S. government shutdown.

However, AMP’s 6–12-month view remains positive for shares as Trump continues to pivot towards more market-friendly policies ahead of the mid-terms next year, the Fed cuts rates further, and other central banks, including Australia’s Reserve Bank (RBA) continue to cut, albeit to varying degrees.

Oliver reminds investors that the 20 [U.S. government] shutdowns over the last 50 years have resulted in minor economic and share market impact.

“But there is a rising risk that this shutdown may have a bigger than normal impact because the Trump Administration is threatening to lay off some of the roughly 600,000 furloughed Federal workers or not provide any back pay when they return to work,” Oliver noted.

The latter would mean a roughly 0.02 percentage point hit to annualised quarterly GDP for every week of the shutdown, according to Evercore ISI.

Meanwhile, the market consensus is for a 7.7% year-on-year (yoy) rise in earnings per share; however, based on past beats is likely to end up around 11.5%-plus yoy with growth led by tech stocks.

More Fed rate cuts

Meanwhile, all eyes appear to be on the U.S. labour market as a barometer for future Fed rate cuts.

The minutes from the last Fed meeting provided no hawkish surprise, with the Fed flagging two more rate cuts by year's end to manage risks around the softening U.S. jobs market.

However, if economic growth remains strong, tariff-related inflation risks stay high, and the U.S. labour market starts to strengthen again, then more rate cuts are less likely.

Assuming the U.S shutdown ends soon, delayed jobs data for September is expected to show a 40,000 rise in jobs with unemployment remaining at 4.3%.

However, recent data surprises – including strong consumer spending and jobless claims – appear to point to a further acceleration in growth and inflation, which may complicate the Fed’s dovish stance.

Credit outshines bonds

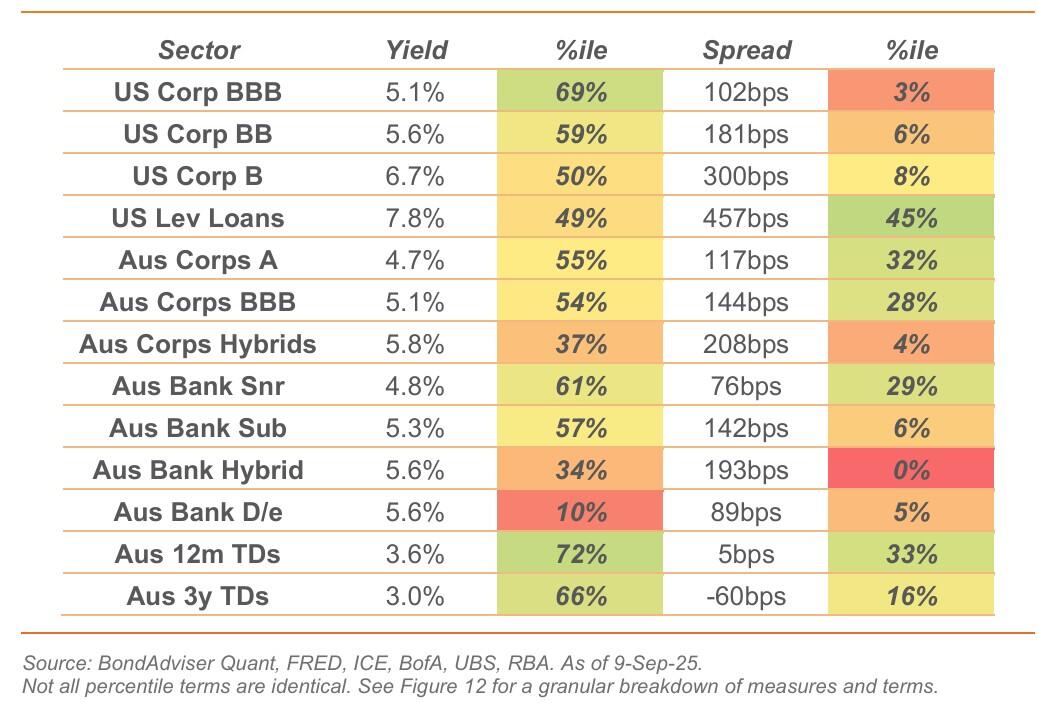

Meanwhile, on the bond front, corporate credit has continued to outperform sovereign bonds throughout 2025.

Strong corporate earnings, central banks supporting growth via policy easing, and inflation moderating have contributed to strong compression in credit risk premiums across global credit markets.

From a valuation perspective, Schroders portfolio manager and head of fixed income Australia, Kellie Wood, believes corporate credit currently appears expensive, especially high yield credit.

As central banks move policy rates back to more neutral levels, she expects less outperformance and recommends investing in credit assets for high-quality income in this environment.

“With credit valuations very stretched in the U.S., we continue to favour European and Australian investment grade assets, including residential mortgage-backed securities and higher yielding subordinated debt that are providing more attractive valuations and a supportive cycle,” said Wood.

Meanwhile, with local currency, emerging market debt continues to perform strongly. Wood maintains a constructive outlook for emerging market debt, supported by appealing real yields and a weaker U.S. dollar.

Inflation concerns

Meanwhile, Schroders has continued to reduce its interest rate risk vs the benchmark.

In Australia, the latest monthly inflation data surprised to the upside, with the details showing services inflation significantly higher than expected.

What this means for the RBA, adds Wood, is considerably less certainty that inflation has settled near 2.5% and highlights the likelihood that it will take a period of modestly restrictive policy for inflation to return to target.

“This also comes at a time when growth has been picking up, driven by domestic consumption off the back of recent interest rate cuts,” said Wood.

“Australian bond yields have been rising as the market anticipates less cuts will be required over the next year.”

US bonds

Meanwhile, U.S. bond yields moved lower at the start of the month as the Fed cut by 25bps, only to retrace higher into the end of the month.

Through mid-September, the market was pricing a cash rate of 2.85% over the next year.

While Schroders viewed this level as excessively priced and started to reduce U.S. interest rates, economic growth has since re-accelerated on the back of stronger consumption.

“Overall, we have moved short duration vs our benchmark, positioning for higher yields as markets are fully priced for policy easing and growth is now accelerating in the US, Australia and Europe,” said Wood.

“We are also short Japan interest rates as the Bank of Japan (BoJ) moves to hike policy rates in October, with inflation more embedded within the Japanese economy.”

Credit Valuations – Yield and Spread Percentiles