The Federal Reserve delivered a widely expected interest rate cut on Wednesday, 17 September, 2025, lowering its benchmark rate by 25 basis points to a range of 4.00% to 4.25%.

While the move was anticipated by markets, the surrounding circumstances made this meeting one of the most historic and politically charged in decades.

Newly confirmed Governor Stephen Miran, appointed by President Donald Trump just one day earlier, was the lone dissenter, pressing for a more aggressive half-point cut.

Meanwhile, Governor Lisa Cook participated in the deliberations despite ongoing legal battles over Trump’s attempt to remove her.

The meeting showcased not only diverging economic views inside the Fed but also underscored the growing political pressure on America’s central bank.

A Cut Expected, but Clouds Over the Path Ahead

Markets had largely priced in the Fed’s decision, with futures assigning more than a 90% probability to a quarter-point reduction. Yet the bigger question was what happens next.

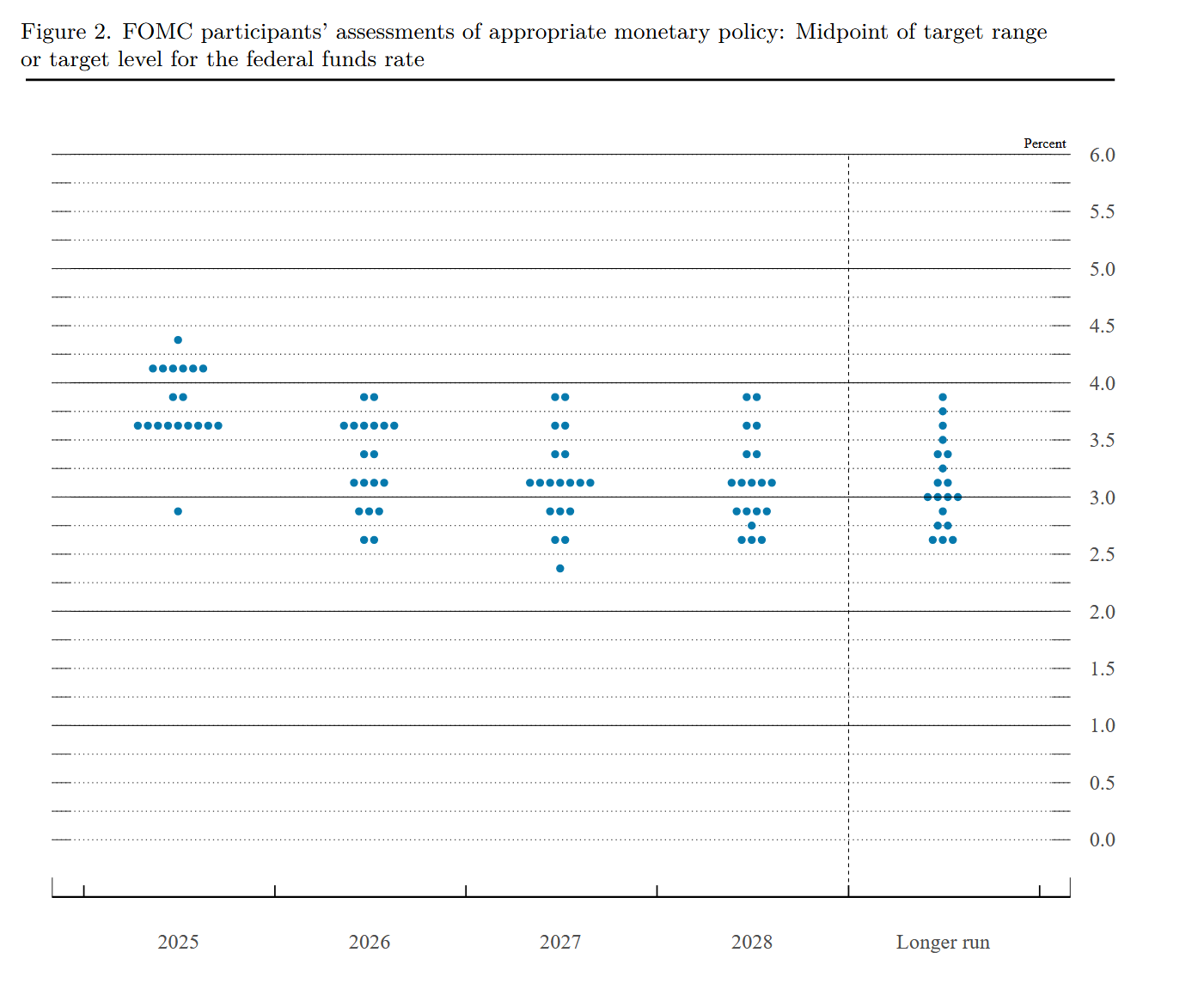

The Fed’s updated “dot plot” projections suggested two more cuts before the end of the year, bringing the policy rate closer to what officials view as a neutral level of 3%.

However, the path beyond remains murky. Some policymakers forecast only modest easing in 2026 and 2027, while others flagged as many as four cuts in a single year.

Chair Jerome Powell, speaking at his press conference, characterised the move as a “risk management cut”, designed to balance a weakening labour market against ongoing inflationary risks tied to Trump’s tariffs.

“The only way for any voter to really move things around is to be incredibly persuasive,” Powell said. “And the only way to do that in the context in which we work is to make really strong arguments based on the data and understanding of the economy. That’s really all that matters, and that’s how it’s going to work.”

His comments sought to project calm amid the turbulence, but markets were left jittery as Treasury yields fell on the short end but rose for longer maturities, raising concerns about stagflation risks.

Miran’s First Day — and First Dissent

Perhaps the most striking feature of the meeting was the role of Stephen Miran. Confirmed by the Senate in a razor-thin 48-47 vote late Monday night, Miran was sworn in Tuesday morning and sat down with his colleagues at 10:30 am for his very first FOMC session.

Within 24 hours, he had already marked himself as a dissenter, breaking with the committee by voting for a 50 basis point reduction.

Miran, who remains on unpaid leave from his role as chair of the White House Council of Economic Advisers, argued for a sharper move, aligning with Trump’s repeated calls for rates closer to 1%.

“It is unheard of in Federal Reserve history for an individual to maintain a position in the administration while not getting a paycheck for a few months and planning to step back into a position in the administration, which would seem to fly in the face of Miran's ability to be fully impartial and independent,” said Danielle DiMartino Booth, a former Fed advisor, speaking to Seeking Alpha. “You would think that he would have fully embraced the honor of becoming a governor at the Federal Reserve.”

Critics have argued that Miran’s presence undermines the Fed’s independence. Trump himself acknowledged the unusual circumstances, but praised his new appointee for “bringing fresh thinking” to the central bank.

Lisa Cook’s Precarious Position

If Miran’s swearing-in marked an unprecedented acceleration in Fed appointments, the participation of Lisa Cook added another layer of historic complexity.

Trump has repeatedly attempted to fire Cook, a Biden appointee whose confirmation in 2022 required then-Vice President Kamala Harris’s tie-breaking vote. Earlier this week, a federal appeals court blocked Trump’s dismissal order, allowing her to remain at the Fed while the case proceeds.

The White House has already pledged to appeal to the Supreme Court, potentially setting up a ruling that could redefine executive power over independent agencies.

DiMartino Booth noted the stakes: “If the Supreme Court decides to rule in favor of allowing President Trump to fire Lisa Cook for cause, that in and of itself will be very historical, to turn a Supreme Court ruling that dates back to the nineteen thirties that found against then President Roosevelt.”

For now, Cook was seated at the oval table, contributing fully to policy deliberations despite the political storm swirling around her.

Waller’s Call for Caution

Beyond the political drama, some of the most closely watched remarks came from Fed Governor Christopher Waller, who has been vocal about the need for measured cuts.

“I think we need to start cutting rates at the next meeting, and then we don't have to go in a locked sequence of steps,” Waller said in a recent CNBC interview. “We can kind of see where things are going, because people are still worried about tariff inflation ... Over the next three to six months, we could see multiple cuts coming in.”

Waller emphasised the need to lower the policy rate from its current range toward the estimated neutral level of 3%, but stressed that the pace should be guided by incoming data.

His stance was echoed by several colleagues who supported Wednesday’s move but expressed hesitation about committing to a fixed path for further easing.

Trump’s Shadow Over the Fed

President Trump’s influence loomed large over the meeting. He has repeatedly lambasted Powell for not cutting rates fast enough, arguing that borrowing costs should be slashed to bolster housing and lower government debt costs.

On Monday, Trump reiterated his demand in a Truth Social post: the FOMC “MUST CUT INTEREST RATES, NOW, AND BIGGER THAN [Powell] HAD IN MIND.”

Treasury Secretary Scott Bessent reinforced the administration’s stance in a CNBC interview, calling for a “fulsome” cut. “President Trump’s very sophisticated economically, and I think he has been right at almost every turn,” Bessent said. “The problem has been that the Fed has been behind the curve.”

The presence of Miran, combined with ongoing efforts to remove Cook and Trump’s plan to replace Powell when his term ends in 2026, signalled the White House’s growing influence over the central bank.

Minutes Highlight Policy Caution

The Fed’s meeting minutes, released two weeks after the historic meeting, noted: "In considering the outlook for monetary policy, almost all participants noted that, with the reduction in the target range for the federal funds rate at this meeting, the Committee was well positioned to respond in a timely way to potential economic developments.

“Participants expressed a range of views about the degree to which the current stance of monetary policy was restrictive and about the likely future path of policy.

“Most judged that it likely would be appropriate to ease policy further over the remainder of this year. Some participants noted that, by several measures, financial conditions suggested that monetary policy may not be particularly restrictive, which they judged as warranting a cautious approach in the consideration of future policy changes."

The minutes also noted that “the information available at the time of the meeting indicated that real gross domestic product (GDP) growth had moderated in the first half of the year. Although the unemployment rate continued to be low, the pace of employment increases had slowed, and labour market conditions had softened. Consumer price inflation remained somewhat elevated.”

Powell’s Balancing Act

Through it all, Powell sought to steady markets and maintain the Fed’s image of independence. At his press conference, he downplayed the political context and focused on economic fundamentals.

But the divisions inside the committee, the presence of a dissenting newcomer still tied to the White House, and the looming legal battle over Cook’s position left little doubt that this was not a typical Fed meeting.

As markets digest the path of rates ahead, the question remains: can the Fed maintain its independence and credibility in the face of mounting political pressure? Or has this meeting marked the start of a new era where central banking becomes another front in Washington’s partisan battles?