Ulta Beauty (NASDAQ: ULTA) has delivered a better than expected fourth quarter earnings report, but reduced its guidance, signalling a tricky 2025 ahead.

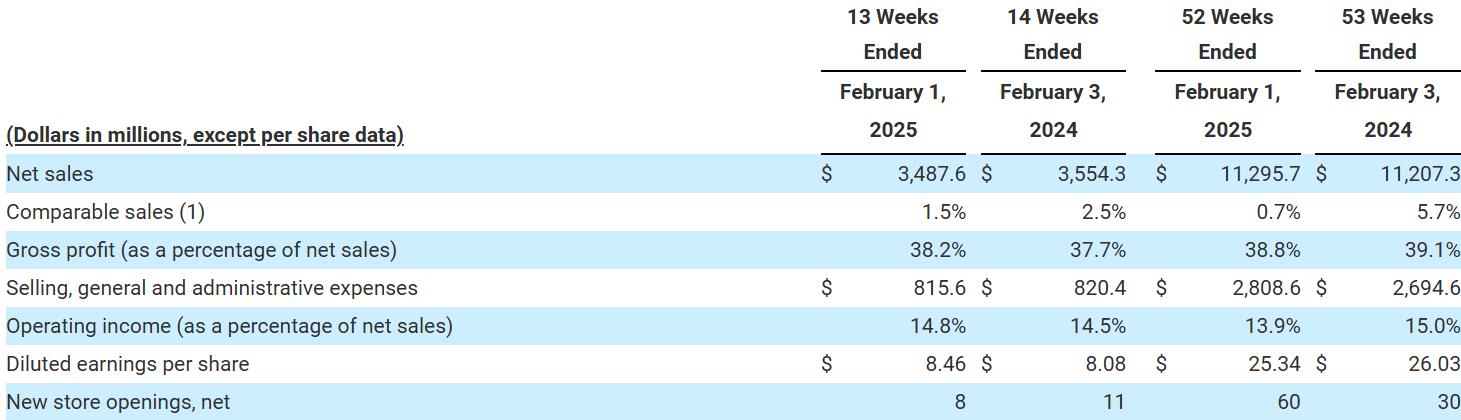

Despite Q4 landing across the busy holiday period, typically seeing customers spend more, net sales decreased 1.9% to US$3.5 billion compared to $3.6 billion in the previous period. However, comparable sales were up by 1.5%, beating expectations of 0.8% growth, according to StreetAccount.

Full-year earnings guidance was lower than expectations, expected to be between $22.50 and $22.90 instead of the predicted $23.47.

Earnings per share for the beauty retailer in Q4 beat expectations, coming in at US$8.46 ahead of the US$7.12 expected, and revenue also pulled ahead of the US$3.46 billion expected, finishing at US$3.49 billion.

The company’s reported net income for the three-month period that ended 1 February was US$393 million, or $8.46 per share, compared with $394 million, or $8.08 per share, a year earlier.

Back in January of this year, Ulta announced that veteran CEO Dave Kimbell would be replaced by its Chief Operating Officer Kecia Steelman, who says shes “incredibly optimistic about the future of Ulta Beauty".

"Fiscal 2025 will be a pivotal year as we make purposeful investments to fuel our future growth and move quickly to optimise our business. While it will take time to see the impact of these efforts, we are confident these investments will help reignite our momentum and unlock sustained growth and long-term value for our shareholders."

At the time of reporting (9:15 am AEDT), Ulta was sitting at US$314.47, and saw a fall of 4.48% at close but rose back by 6% in extended trading. The company's market capitalisation stands at $14.58 billion.