As the United States-China trade war and U.S. President Donald Trump’s insular policies continue to send markets into a spin, we take a snapshot of the major countries and sectors affected by the news.

But first, some background.

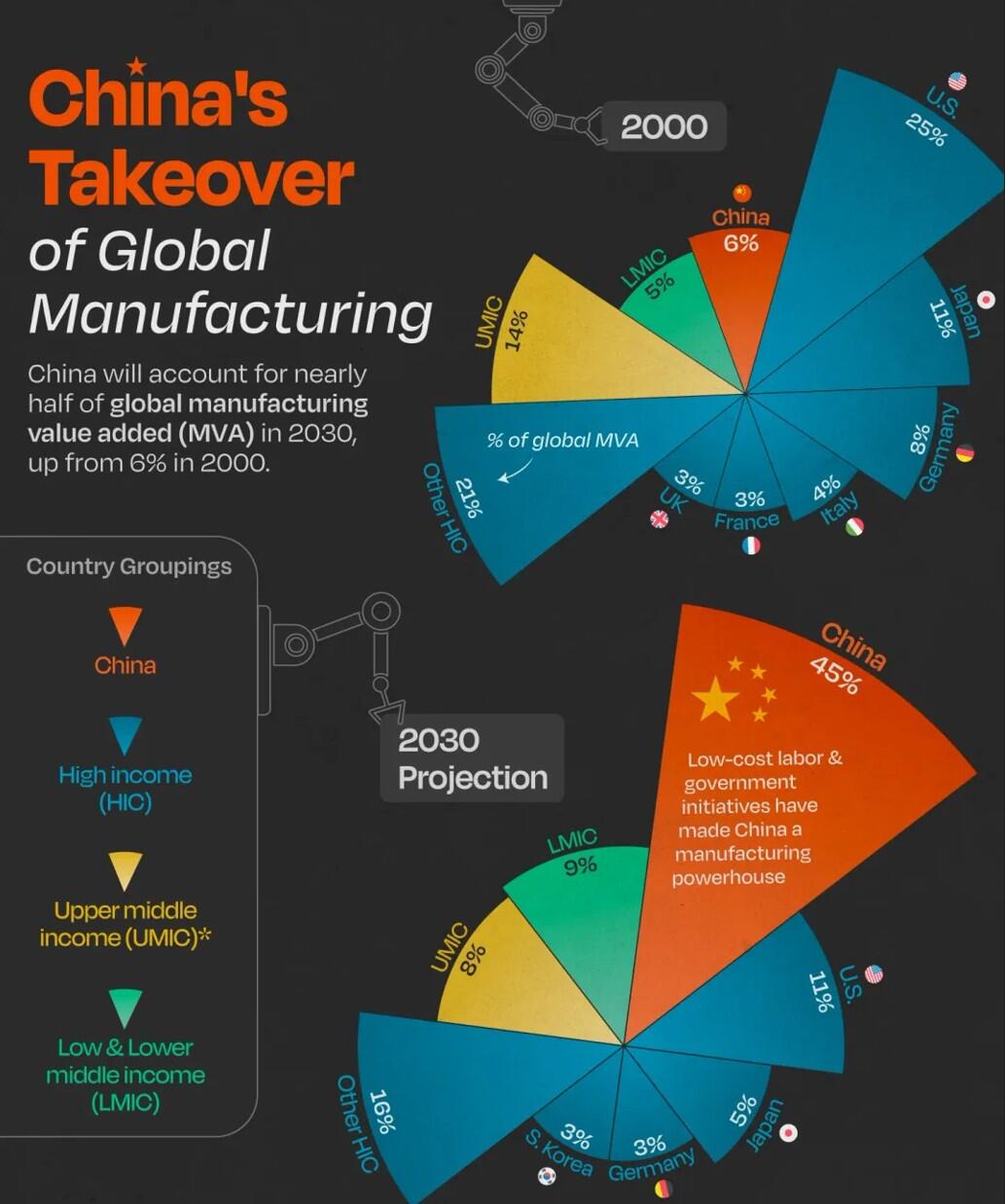

The macro effects of Trump’s “Tariffs 2.0” are designed to rekindle America as a manufacturing powerhouse. Why? Because 25 years ago the U.S. was number one in manufacturing - commanding a quarter of the global output pie - with China (6%) in fourth place behind Japan (11%) and Germany (8%).

Since then, low labour costs and government initiatives have seen China rocket into first place with no signs of stopping - tipped to account for 45% of global manufacturing value added (MVA) by 2030, according to the United Nations.

At current rates - and while they may change - the U.S. will drop to just 11% of global output.

Risky for business

Assessing Trump’s first round of tariffs - which saw levies to the tune of US$200 billion slapped on Chinese goods - the World Economic Forum’s (WEF) 2019 Global Risks Report declared that “the erosion of multilateral trading rules and agreements” represented one of the gravest threats to the world economy.

It ranks the risk of “state-on-state conflict” among the greatest concerns for businesses globally - including trade wars underway between global superpowers the U.S. and China.

For what it’s worth, Trump is taking on board the WEF’s 2025 recommendation of strengthening domestic economic resilience by incentivising domestic supply chains. However, he is creating the environment that needs this solution in the first place.

“In an environment where trade becomes more costly and cumbersome, emphasis needs to be placed on policies that strengthen the domestic economy, such as financial sector development or investment in education, health and infrastructure,” the WEF said.

“On the supply side, developing greater self-sufficiency in key strategic sectors such as energy, agriculture, and defense will increasingly become a critical aspect of resilience at the national level.”

Perhaps harshly, import taxes (tariffs) are the cause and demotivate U.S. companies to import goods.

The punitive taxes will cost them in the short term at a minimum to source supplies domestically or wear the higher costs of importing for lower realised profit margins.

And if they wish to, businesses will likely pass those costs onto consumers by increasing their prices.

Tariffs so far…

As U.S. tariffs ripple across the globe, trade between the U.S. and its largest trading partners - China, Canada, Mexico and the European Union are hit the hardest.

Latest tariff updates

Since then, Trump has announced a 25% increase on Canadian steel and aluminium imports to a 50% levy, another crushing blow for the sector's North American trade, yet backtracked on the move upon meeting with U.S. business leaders on Tuesday (Wednesday AEDT) - though not before getting the Canadian province of Ontario to pause its planned retaliatory surcharges on electricity sold across the border.

The effects are to be felt in Australia - America's closest ally - too, which will also be subjected to a 25% levy on steel and aluminium, with Trump commenting “if they want to be exempted, they should consider moving steel manufacturing here".

Australia's been accused of "aluminium dumping" by U.S. trade representative Peter Navarro, which Azzet's Mark Story covered.

Read more: No deal: Australia accused of dumping aluminium

And Superannuation growth options turned negative with -1.2% for February as markets tumbled across the board due to tariff uncertainty - as Azzet’s Garry West points out.

As the sixth biggest exporter to the U.S., Vietnam is heavily exposed to the levies. It is aiming to avoid being hit by upcoming repicrocal tariffs next month by signing a set of trade deals with the Trump administration this week.

Read more: Vietnam seeks to avoid US tariffs with new trade deals

With all this taking place, it's no wonder U.S. markets - even as tech tried to lead a rebound - dropped again at market close on Tuesday.